3 Reasons Why Global Stock Markets Could Come Under Pressure in the Coming Days

2023.02.14 08:18

- The unpredictable situation in Ukraine’s eastern border could pressure global equity markets

- The yield curve inversion in the U.S. is still indicating a high recession risk

- In the technical chart, if the Nasdaq 100 breaks key support levels, sellers could target last year’s lows

The start of 2023 has been generally positive for stock markets in both Europe and the U.S. The , and are up 10.98%, 14.28% and 7.76%, respectively over the last month and a half.

In recent days, we have seen a growing number of factors threatening to weigh on equities and broader risk assets.

Unfortunately, one of the most important and unpredictable variables is the development in Ukraine, where a large-scale Russian offensive is expected to be concentrated in the east of the country.

If the Russian army succeeds, equity markets are likely to react negatively, and news from Ukraine could once again become the focus of investors’ attention. Here are the three reasons global markets could suffer in the coming days:

1. U.S. Yield Curve Inversion Deepens

The is an indicator that should continue to attract investors’ attention, especially at a time when there is a risk of a significant economic slowdown.

We may now see a continuation of the inversion on the yield curve for bonds with maturities of 2-10 years.

Source: Bloomberg

This means that the risk of a recession in the U.S. remains high, despite recent positive labor market news and better-than-expected figures.

If GDP growth falls below zero, equity indices could suffer. In principle, the central bank should respond by cutting to stimulate lending and economic growth.

Still, in the current environment, all indications are that the Fed will not be in a position to pivot in the next few months.

2. U.S. Interest-Rate Target Is Raised Again

In late December/early January, as U.S. fell, market expectations of the target range for the federal funds rate, which was 4.75%-5% at the time, also fell.

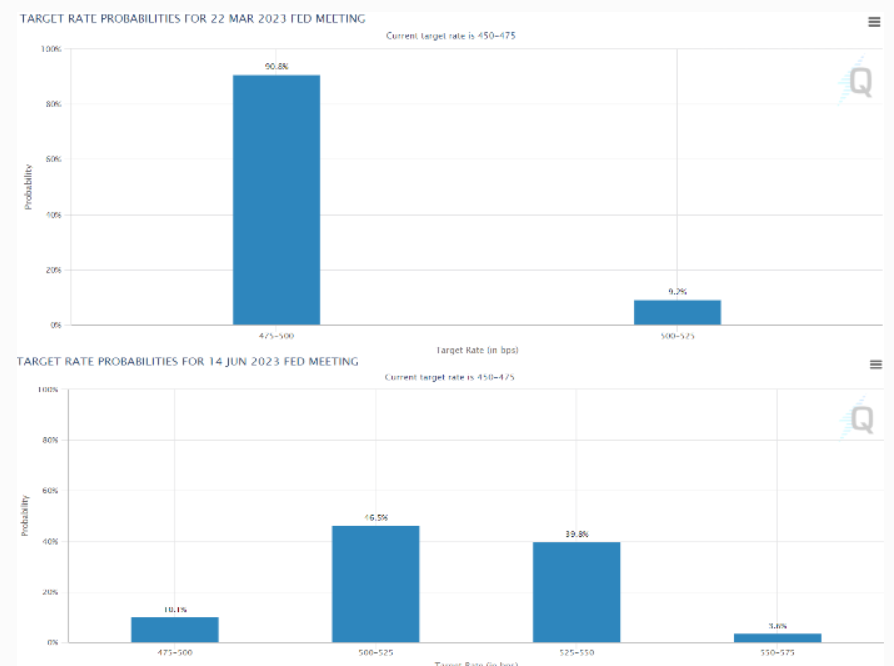

The most likely scenario now is further rate hikes, peaking in May in the 5-5.25% range, although this may not be the Fed’s last move.

Interest Rate Expectations in May and June

Interest Rate Expectations in May and June

Source: www.cmegroup.com

Looking at the same forecasts for June, we see that there is still a good probability of a rate hike of up to 5.5%, which is quite different from recent months and also exceeds the 2006 peak.

A higher interest rate environment carries not only the risk of recession or stock market declines, but also the possibility of so-called “black swan” events, i.e. unexpected events in the form of bankruptcies, such as the collapse of Lehman Brothers in 2008.

3. Bear Strength Prevails on the Nasdaq 100

The sellers have reached a local cluster of support levels in the 12,300 area due to the corrective movement seen on the Nasdaq 100 in recent days.

At the same time, this level is the first major test for the bears, which, if breached, should open the way for a continuation of the move south.

Nasdaq 100 Technical Analysis

In this scenario, the short to medium term target for sellers would be last year’s lows, which are already below 11,000.

The next few days will be important, with U.S. inflation data due on Wednesday.

Disclosure: The author doesn’t own any of the securities mentioned.