3 Rate-Sensitive Stocks Offering Up to 31% Upside as Fed Kicks Off Easing Cycle

2024.09.19 09:29

- The Fed delivered a supersized cut yesterday, with more on the way.

- Some stocks have historically benefited during the early stages of the rate-cutting cycle.

- In this article, we’ll discuss the top three stocks with the greatest upside potential.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The Fed a widely expected 50 basis point cut on Wednesday, aligning with investor expectations based on CME’s FedWatch tool, which had assigned a 65% probability to the move.

Along with the rate cut, the Fed at more easing ahead, signaling to investors that further easing could be on the horizon before year-end.

Current show a 29% chance of another 50 basis point cut in November, while a 71% likelihood points to a smaller, 25 basis point reduction.

In short, the market believes the Fed has kicked off a sustained easing cycle, pushing investors to rethink their portfolios and focus on rate-sensitive sectors to capitalize on new opportunities.

While lower rates tend to lift all stocks, some segments—such as dividend, consumer, and real estate stocks—are poised to outperform.

To help pinpoint the best options, we analyzed stocks that have historically delivered the strongest gains in the three months following the first rate cut of an easing cycle, dating back to 1984.

From the top 10 performers, we selected three with the most potential, according to InvestingPro Fair Value.

InvestingPro Fair Value combines established valuation models to offer clear insights into whether a stock is over- or undervalued, helping investors gauge its potential.

Let’s take a closer look at the top three stocks that we found.

1. Franklin Resources

- Median performance in the 3 months following the first rate cut of a Fed easing cycle: +13.7%.

Franklin Resources (NYSE:), better known by its brand name Franklin Templeton, is one of the world’s leading investment managers, offering a full range of financial services for individuals and professionals.

The stock hit a low of $18.94 on September 11, its lowest since 2020, and since then appears to have begun a rebound that took it back above $20 this week.

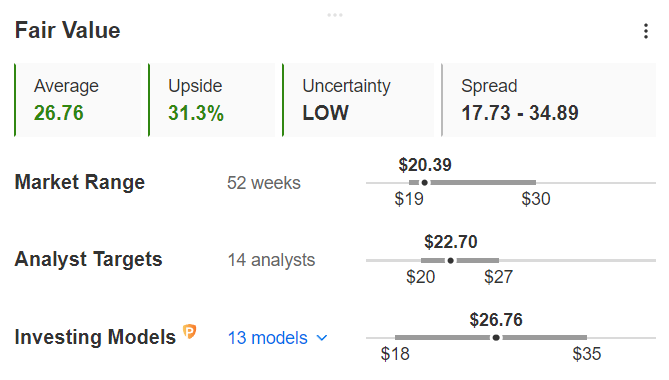

Now, InvestingPro’s Fair Value values the stock at $26.76, suggesting that it has a potential upside of over 31% from Wednesday’s closing price.

Source : InvestingPro

Analysts, though less optimistic, are averaging a $22.70 price target for Franklin Resources, 11% higher than the current price.

2. Kroger

- Median performance in the 3 months following the first rate cut of a Fed easing cycle: +16%.

Kroger (NYSE:) is one of America’s retail giants, owning and operating supermarkets, multi-department stores, and fulfillment centers across the country.

Last week, the company published better-than-expected quarterly results that led to a rally in its share price, and this trend could well continue.

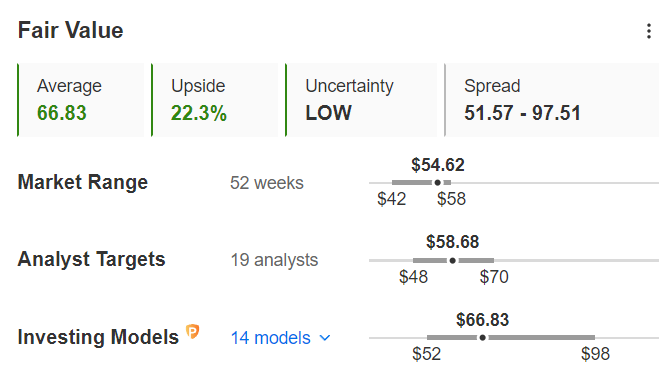

Indeed, Kroger’s InvestingPro Fair Value stands at $58.68, over 22% above the current share price.

Source : InvestingPro

Although more conservative, analysts also expect the stock to rise, with an average 12-month target of $58.68.

3. Textron

- Median performance in the 3 months following the first rate cut of a Fed easing cycle: +15.2%.

Textron (NYSE:) is a multi-sector company that leverages its global network of aerospace, defense, industrial, and financial companies to provide its customers with a variety of solutions and services.

The Company operates through six segments: Textron Aviation, Bell, Textron Systems, Industrial, Finance and Textron eAviation.

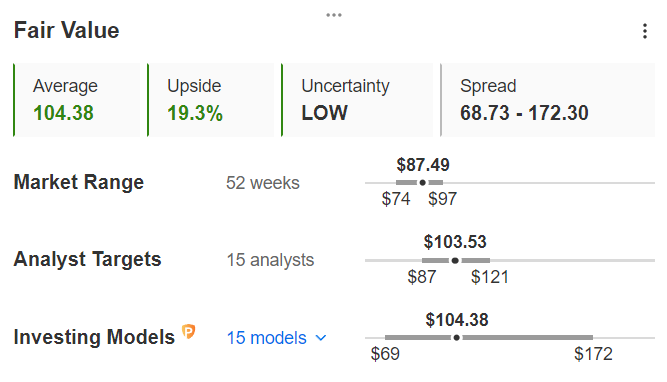

The trend of its shares has been uncertain for several months, between $80 and $95, but Fair Value forecasts that the stock will exceed $100 to reach $104.38 (i.e. 19.3% above the current price), which would constitute an all-time record.

Source : InvestingPro

Analysts have set a similar target of $103.53 on average.

Conclusion

Franklin Resources, Kroger, and Textron therefore deserve a prominent place on investors’ radar, not only because they are among the stocks that have historically benefited most from the Fed’s early easing cycles, but also because they are currently undervalued relative to their intrinsic value. However, many other opportunities may be better suited to your profile.

To identify them, InvestingPro tools can be of invaluable help, including :

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

So, what are you waiting for?

Subscribe now with an exclusive discount and unlock access to several market-beating features.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.