3 Picks to Level Up Your Portfolio With Variety, Quality, and Growth Potential

2024.09.17 07:52

- The time could be ripe to rebalance your portfolio amid the ongoing uncertainty surrounding the Fed.

- Diversification is a must during volatile times.

- Today, we’ll take a look at three stocks that could add quality and variety to your portfolio.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The is set to kick off a new rate cut cycle this week, creating an opportunity to rebalance your portfolio. As rates begin to fall, it’s crucial to identify stocks that are not only reasonably priced but also have strong growth potential.

Today, we’ll highlight three stocks to consider for your portfolio: Microsoft (NASDAQ:), Highpeak (NASDAQ:), and Equinor (NYSE:).

Microsoft, with its solid track record, represents a more stable choice, while Highpeak Energy and EQNR offer higher risk but potentially higher rewards.

Each stock brings unique strengths to the table, making them valuable additions to a well-diversified portfolio with medium-term growth prospects.

1. Microsoft

Microsoft has been a popular choice among investors due to its brand strength, innovative artificial intelligence strategies, strong financial performance, and strategic acquisitions.

The tech behemoth will report next on October 22. The market expects revenue and earnings to grow by 13.8% and 11.6%, respectively, in 2024 and earnings to continue to grow by 16.1% in 2025.

In the fourth quarter of fiscal 2024, the company reported that Azure AI serves more than 60,000 customers. During the quarter, revenue was up double digits and it had a cash balance of $75.5 billion, with long-term debt of $42.6 billion.

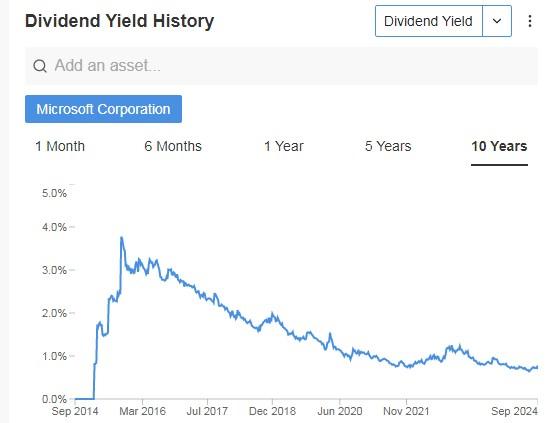

Source: InvestingPro

Microsoft paid $8.4 billion to shareholders through dividends and share repurchases. The company pays a yield of 0.72%, lower than the tech sector average of 1.3%.

Source: InvestingPro

The acquisition of Activision Blizzard (NASDAQ:), which closed in 2023, has expanded its gaming portfolio and is expected to boost long-term profitability.

Now that gaming is becoming a larger component of digital entertainment, Microsoft is well positioned to capture a larger share of this expanding market.

Microsoft’s stock is somewhat expensive and trades at 30 times forward earnings by 2025. However, given its leadership in cloud computing, artificial intelligence innovation and gaming, the stock is a good long-term investment.

Therefore, Microsoft stands out as a good investment due to its diverse revenue streams, strong financials, strategic initiatives in key growth markets, and steady dividend payments.

The tech titan’s stock has 39 ratings, of which 38 are buy, 1 is hold and none are sell.

The potential assigned by the market consensus is at $502.43.

Source: InvestingPro

2. Highpeak Energy

It is an energy company engaged in the acquisition, development and production of oil, and natural gas liquids reserves.

On November 11, it will present its accounts for the quarter. At the moment it maintains positive free cash flow for the fourth consecutive quarter, highlighting its operational prowess and financial discipline.

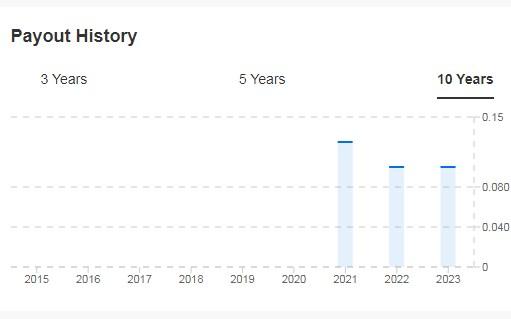

Source: InvestingPro

The company increased its quarterly dividend by 60% and now offers $0.04 per share, bringing the annual dividend to $0.16 for a yield of 1.10%.

They also have a $75 million share repurchase plan in place, showing they are confident in their financial future.

Source: InvestingPro

Their CEO, Jack Hightower, recently purchased more than $2 million worth of company stock, specifically he picked up two share packages on August 29 and September 3, a total of nearly 187,000 with a purchase price of between $15.45 and $15.47 per share.

Its valuation is 3.15 times its enterprise value, so it is very well priced, considering that the average for the energy sector is 5.78 times.

It enjoys excellent financial health with a score of 4 out of 5.

Source: InvestingPro

The stock is trading 26.2% below its fundamental price target of $18.23. The market sees potential at $23.50.

Source: InvestingPro

3. Equinor

Equinor is an energy company that focuses on oil and gas exploration and production. It is one of the few companies in the sector with an AA rating.

The International Energy Agency believes that world electricity demand will increase this year at its fastest pace since 2007 and gas demand will also increase.

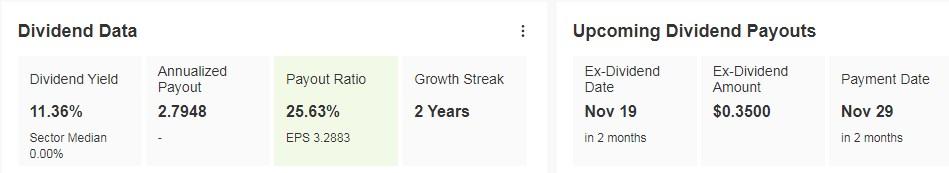

The company pays a quarterly dividend of $0.35 per share, or $1.40 on an annualized basis.

That translates into a significantly more attractive dividend yield than the energy sector average. It will pay out $0.35 per share on Nov. 19, and you must own shares before Nov. 19 to be eligible to receive it.

Source: InvestingPro

In the second quarter, revenues increased 12% year-over-year to $25.5 billion. It will report its next quarterly accounts on October 24. Revenue expectations for this quarter are for a 0.4% increase from $24.642 billion to $24.745 billion.

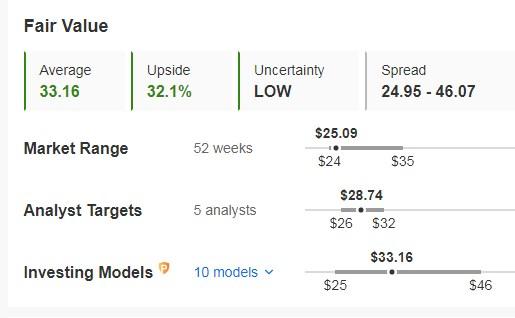

Source: InvestingPro

Its shares are undervalued, in fact, its fair value or price for fundamentals is at $33.16, or 32.1% above its trading price at the close of the week. The market sees potential at almost $29.

Source: InvestingPro

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.