3 Most Upgraded Stocks in Q2

2023.06.21 07:44

- Microsoft scores the top spot in Q2 for upgrades and price target revisions.

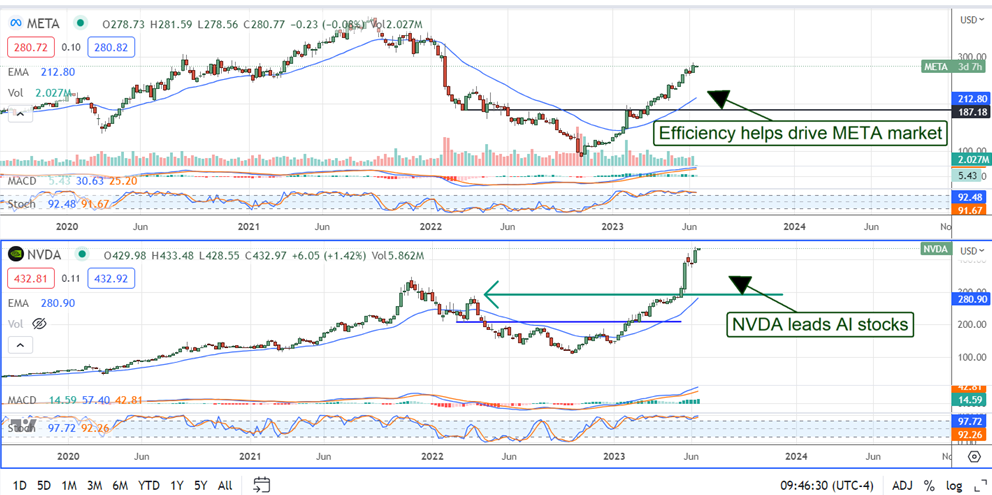

- Meta Platforms falls from 1st to 2nd but is still a heavily upgraded name.

- NVIDIA remains in 3rd spot and is a winner in the eyes of the analysts.

The Q2 earnings reporting season is about to be unleashed, making now an excellent time to look at which stocks the analysts are paying attention to. Among the many ways to find this information is Marketbeat’s list of the Most Upgraded Stocks. This list tracks upgrades and upward price target revisions and can be a telling indicator of where market money is flowing. While the names at the top of the list are the same as in Q1, the order is changing, and some exciting names are popping up below the top 3 spots that bear watching.

Microsoft Takes The Lead, Is Most Upgraded Stock In Q2

Microsoft (NASDAQ:) was the 2nd Most Upgraded stock coming out of the Q1 reporting season due to its position in the Cloud and potential dominance within the world of AI. The analysts have continued to shower praise on the company and have put it firmly in 1st position outpacing Meta Platforms (NASDAQ:) by 8 revisions. Microsoft has been upgraded or had its price target raised 54 times in the last 3 months pegging its consensus rating at Moderate Buy. The 54 is significant for the volume of analysts covering and upgrading the stock and because some analysts have upped their data more than once.

The price target is a cause for concern in the near term. The price target is trending higher since , it’s up more than 15% since last quarter, but it is still trailing the price action. The consensus of $333.23 is about 2.5% below the price action, which is trying to break out to a new high. That may come when the company reports earnings for Q2, which is scheduled for July 27th. The analysts expect revenue to grow about 7%, consistent with Q1. Solid guidance and anything to do with AI could be the catalyst to get the consensus target above the all-time high and this market to break out.

Meta Platforms: Still Getting Upgrades

Meta Platforms fell from the top spot, but this cloud-based consumer-oriented AI-powered company still gets upgrades, price target increases, and newly initiated coverage. The company has received 46 revisions in the last 3 months from 50 analysts, up 13 from last year. Some companies in the AI craze don’t have 13 analysts covering them, so that is saying something. The price target is trending higher, but, like with Microsoft; it is trailing the price action by a wider margin.

Meta is slated to report earnings the day after Microsoft and to post about 8% of top-line growth. Again, the company may provide market-beating results due to its internal efforts at efficiency and the rise of AI. Regardless, news about AI may be enough to invigorate the market and extend the rally to a new high.

NVIDIA: Still In 3rd

NVIDIA (NASDAQ:)is still sitting in 3rd spot. The company has garnered 44 revisions in the last month to remain solidly in its position. The analysts rate this stock a Moderate Buy with a price target trending higher but lagging the market. The caveat is that the price target is up 40% in the last month, 40% YOY and the freshest targets imply a double-digit upside. NVIDIA reports on August 23rd and may shock the market with another strong report.

Advanced Micro Devices (NASDAQ:) and Adobe Systems (NASDAQ:) are in the 4th and 5th spots. These companies have emerged as serious competition for NVIDIA (in the case of AMD) and a substantial part of the AI infrastructure (in the case of ADBE).

Original Post