3 Contrarian Picks for Trump 2.0 (Yields up to 7.5%)

2024.12.17 07:53

At times like these, I’m reminded of a quote from Howard Marks, the most successful value investor you’ve likely never heard of. (Warren Buffett is a fan.)

Marks’s monthly “Oaktree Memos” are well worth a read. And in his insightful book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor, he wrote:

“What’s clear to the broad consensus of investors is almost always wrong.”

This quote has been on my mind lately because everyone is convinced that Trump 2.0 will lead to higher inflation.

I’m sure you can see where I’m going: Higher inflation begets higher interest rates. And since bond prices and interest rates move in opposite directions, the new administration will be bad for bonds.

Hence, the mini-selloff in fixed income since the election.

My take? This is a short-term overreaction. The narrative against bonds is assumed. When this happens, markets tend to move in the opposite direction of conventional wisdom.

Which means we should bet with bonds—at least in the near term. When the rally comes, it will surprise everyone but us!

We looked at three bond-focused CEFs that are smart near-term buys (yielding up to 10.2%) in last Wednesday’s article.

Today we’re going to look next door to bonds, to our favorite “bond proxies”:

Utility stocks.

“Utes” also tend to fall when rates rise, as they compete with Treasuries, CDs and the like for more-conservative investors. That puts them in the sights of us contrarians today, too.

So let’s talk about three options. One is a timely buy now, while two others are solid additions to your “watch list” and ripe for picking up on the next dip.

We’ll start with the biggest bargain on the board: Virginia-based Dominion Energy (NYSE:).

This Unloved Utility Is “Booted Up” for 2025 Gains

Virginia is important here: The state is ground zero for the data-center boom that’s supporting AI’s growth. That’s a big reason why the company has projected a doubling of demand for its power by 2039.

That said, we’re mainly looking to the stock as a contrarian play on the higher-inflation narrative surrounding Trump 2.0.

These days, Dominion sports 4.5 million electricity and gas customers across 13 states, from North Carolina to Utah.

Income investors look to “Big D” for the stock’s 4.9% yield, more than four times the 1.2% the typical stock pays. Still, the income crowd hasn’t fully warmed back up to the stock after management cut its payout in 2020.

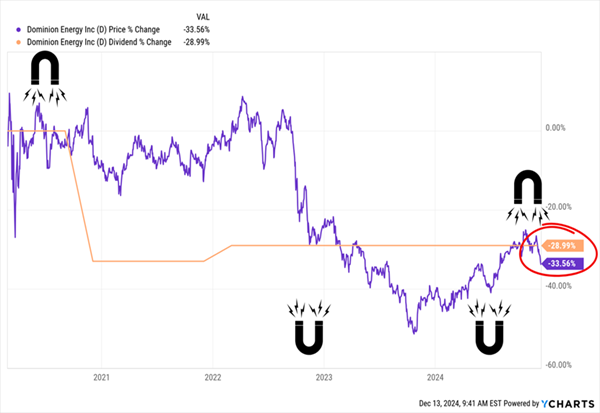

The share price levitated for a while, as you can see in the chart below. But the “Dividend Magnet”—or the tendency of a stock to follow its payout (higher or lower)—eventually kicked in here.

Dominion’s “Lagging” Stock Sets It Up for Gains

Now, the selloff looks overdone—especially with Dominion having been caught up in the pullback that’s hit utility stocks generally since the election. And with the stock now falling behind the payout growth, it looks ripe for more upside.

Why the 2020 dividend cut? Too much debt, of course. Dominion had embarked on an acquisition binge in the name of growth. Which, ironically, backfired.

The result was a rare payout slash from a utility—an income investor’s worst nightmare. That’s why first-level investors keep Dominion in the doghouse today. Which intrigues us here at Contrarian Outlook. Did we hear doghouse?

“Measure Twice, Cut Once”

With dividend cuts, it’s key to bear in mind that chief financial officers are like carpenters. It’s best if they measure twice and cut only once. As a result, the safest dividend is often the one recently cut.

Unless management is a complete clown show (which Dominion’s is certainly not), the last thing they want is to be forced back into that particular dentist’s chair! And let’s bear in mind that the ongoing (even if more gradual) move to lower interest rates will cut D’s borrowing costs, too.

As I mentioned, Dominion yields 4.9%, above its five-year average of 4.5%. That’s another good entry point for us, especially with the “higher-inflation” narrative gripping so many investors’ thinking today.

And Put These 2 High-Yield CEFs On Your Watch List

So Dominion, with its 4.9% yield is a great place to start in the utility space. And we can add to our income (and potential upside) when we buy a basket of utility stocks through closed-end funds (CEFs), for three reasons:

- CEFs boast outsized yields, to the tune of 8%, on average, as I write this.

- Many CEFs, including the two utility funds in our Contrarian Income Report portfolio, pay dividends monthly, and …

- CEFs often trade at different levels than the value of their portfolios, and often at a discount. These discounts to net asset value (NAV) translate to gains for us as they narrow (and even become premiums).

Our two utility CEFs—the Cohen & Steers Infrastructure Fund (NYSE:) and Reaves Utility Income Fund (NYSE:)—are good examples. UTF yields 7.5%, and UTG pays 6.9% as I write this. And both pay dividends monthly, too.

UTF puts a heavy weight toward electrical utilities, at 35% of the portfolio. Dominion is one of its top-10 holdings, along with NextEra Energy (NYSE:) and Southern Co. (NYSE:).

But as the name says, it also stretches beyond into other types of infrastructure, like cell towers, through holdings like American Tower (NYSE:) and Crown Castle (NYSE:). And pipelines through top holding TC Energy (NYSE:).

UTG, meantime, is more focused on the electricity side of things including top-10 holdings Talen Energy (NASDAQ:) and Vistra Energy Corp (NYSE:) of Texas; Maryland-based Constellation Energy (NASDAQ:); and Louisiana-based Entergy (NYSE:).

Like Dominion, both funds have dipped in recent weeks, along with utilities as a whole. But the decline hasn’t been quite big enough for us to tip them from holds to buys, with UTG at just a 1.8% discount and UTF trading for a 1% premium.

So where does that leave us? With D as a smart buy now and UTF and UTG sitting on our watch lists, ready for us to buy when the next window opens. I’ll let you know exactly when that day comes in Contrarian Income Report.

This “Perfect” Trump 2.0 Buy Yields an Incredible 11% (and Pays Monthly)

This leads me straight to the other big dividend I want to tell you about today. I see it as nothing less than a perfect contrarian buy for the new administration.

It’s another CEF, like UTF and UTG. But this one holds the best corporate bonds for the next four years. It’s cheap now, and “hard-wired” for upside as Jay Powell continues to lower rates (and yes, rates will keep moving lower, as we just discussed).

I’ve saved the best for last here: The dividend. As I write, this amazing fund yields 11%. And yes, it also pays dividends every month.

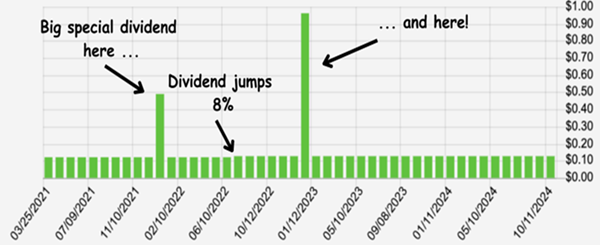

It gets better. Because this is an 11% dividend that GROWS—and management regularly drops special dividends too.

Check out the big extra payouts they’ve dropped in the last few years, and the dividend hike they delivered smack in the middle of the “dumpster fire” year that was 2022:

A Dividend Hike Plus 2 Big “Specials”

Dividend deals like this—11% yields, monthly payouts and dividends that grow—are incredibly rare, and this one won’t stay cheap as the current fear over rates and inflation wanes.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”