3 Cloud Software Leaders Set to Report Explosive Earnings in August

2023.08.02 06:26

- Wall Street’s second-quarter earnings season is more than halfway over, with about 275 of the S&P 500 companies having reported already.

- Several high-flying cloud-computing software companies are still due to post their respective results.

- As such, I believe investors should consider adding shares of Palantir, Datadog, and Workday to their portfolio ahead of earnings later this month.

- Looking for more actionable trade ideas? Check out our InvestingPro subscription plans!

We’re halfway into Wall Street’s second-quarter earnings season, with results pouring in from about 275 companies so far.

While most of the focus is on the mega-cap group of tech stocks, a variety of cloud-computing software companies, which have regained their footing in 2023 following a sector-wide selloff earlier this year, are still due to post their respective results.

So, here are three fast-growing cloud leaders to consider ahead of their quarterly reports in the days and weeks ahead. All three names are set to enjoy robust earnings and revenue growth thanks to surging demand for their innovative products and services.

1. Palantir

- Earnings Date: Monday, August 7

- EPS Growth Estimate: +600% Y-o-Y

- Revenue Growth Estimate: +13% Y-o-Y

Palantir Technologies (NYSE:) is scheduled to deliver its second-quarter earnings and revenue update after the U.S. market closes on Monday, August 7, and results are expected to get a boost from soaring demand for its new artificial intelligence platform.

The data analytics software maker’s generative AI platform – which it calls AIP – allows commercial and government sectors to use large language models based on their own private data sets.

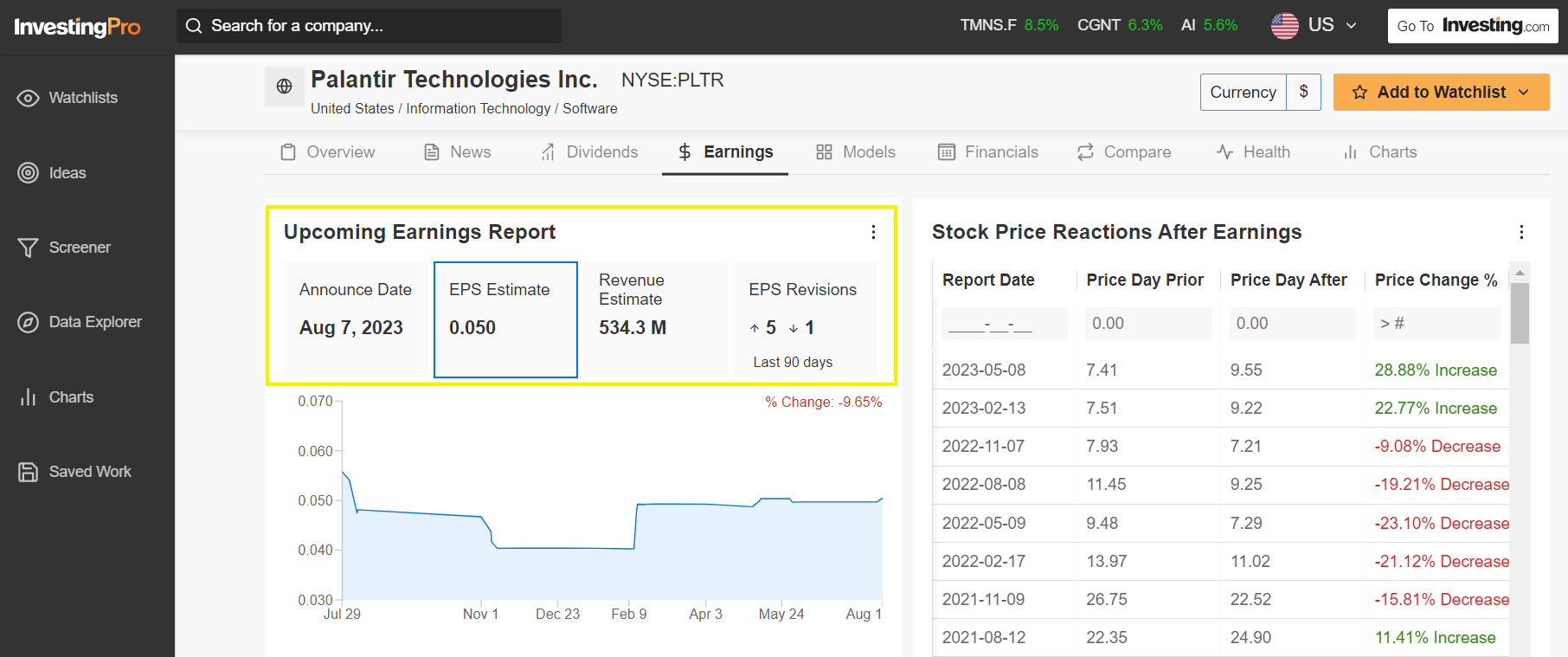

Analysts have become increasingly bullish ahead of the print, according to an InvestingPro survey: of the six analysts surveyed, five upwardly revised their earnings forecast in the last 90 days, while only one made a downward revision.

Source: InvestingPro

Source: InvestingPro

Consensus estimates call for Palantir to report a Q2 profit of $0.05 per share, compared to a loss of $0.01 in the same quarter a year earlier, as the enterprise software company reaps the benefits of ongoing cost-cutting measures. In February, it said it would cut 2% of its workforce.

Revenue is forecast to increase 13% from the year-ago period to $534.3 billion, which, if confirmed, would mark the highest quarterly sales total in Palantir’s history as it benefits from robust demand for its data analytics tools and services from both government and commercial clients.

As such, Palantir’s total customer count for the period will be eyed after surging 41% year-over-year in Q1 amid the current geopolitical environment.

The data-mining specialist reported revenue and for the first quarter that easily topped estimates and provided an upbeat outlook, sparking a 28.8% rally in its shares.

PLTR stock ended at $19.99 on Tuesday, the highest closing price since November 30, 2021. At current valuations, the Denver, Colorado-based big-data firm has a market cap of $42.3 billion.

PLTR stock ended at $19.99 on Tuesday, the highest closing price since November 30, 2021. At current valuations, the Denver, Colorado-based big-data firm has a market cap of $42.3 billion.

Shares have been on a tear in recent months, soaring 211% so far in 2023 thanks to excitement over the company’s promising AI initiatives and improved profitability outlook.

Notwithstanding the recent turnaround, Palantir remains over 50% below the January 2021 all-time high of $45.

2. Datadog

- Earnings Date: Tuesday, August 8

- EPS Growth Estimate: +16.7% Y-o-Y

- Revenue Growth Estimate: +23.4% Y-o-Y

Datadog (NASDAQ:), which provides a security monitoring and analytics platform for software developers and information technology departments, has seen its stock jump 56.4% year-to-date, rising alongside much of the tech sector.

The SaaS company is anticipated to deliver upbeat profit and sales growth when it reports second-quarter financial results on Tuesday, August 8, reflecting strong demand for its IT monitoring and analytics tools from large enterprises.

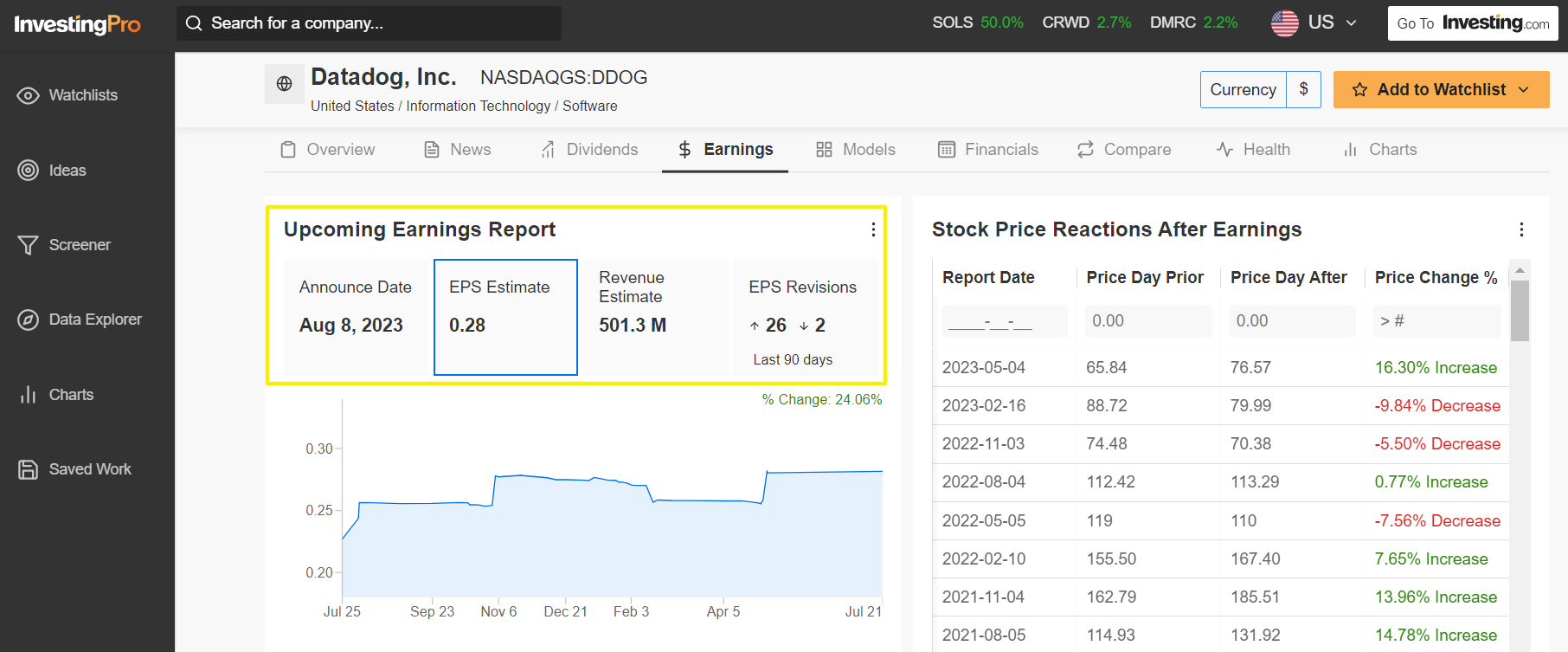

An InvestingPro survey of analyst earnings revisions points to growing optimism ahead of the earnings release, with analysts raising their EPS estimates 26 times in the last 90 days, compared to just two downward revisions. The upward revisions follow a strong result in early May that sent shares surging upward.

Additionally, Wall Street remains optimistic on DDOG, as per an Investing.com survey, which revealed that 27 analysts have a Buy-equivalent rating on the stock vs. 10 Hold-equivalent ratings and 0 Sell-equivalent ratings.

Datadog Upcoming EarningsSource: InvestingPro

Datadog Upcoming EarningsSource: InvestingPro

Consensus estimates call for the security-monitoring platform provider to report earnings per share of $0.28 for the June quarter, increasing 16.7% from a profit of $0.24 in the year-ago period.

Meanwhile, sales are expected to grow 23.4% annually to $501.3 million amid robust demand for its cloud observability solutions across the enterprise segment.

The security-software maker said that it had 2,910 customers with annual recurring revenue (ARR) of $100,000 or more as of the end of March, up 29% from the year-ago period.

Datadog reported first-quarter financial results that crushed Wall Street’s earnings and revenue estimates on May 4. It also provided an upbeat outlook, triggering a 16% rally in its stock.

DDOG rose to a fresh 52-week high of $118.02 on July 25; it finished Tuesday’s session at $114.95. The New York-based software company has a market valuation of $37 billion as of yesterday’s closing price.

DDOG rose to a fresh 52-week high of $118.02 on July 25; it finished Tuesday’s session at $114.95. The New York-based software company has a market valuation of $37 billion as of yesterday’s closing price.

It should be noted that even after the strong gains recorded this year, shares are still 42% below the record peak of $199.68 reached in November 2021.

3. Workday

- Earnings Date: Thursday, August 31

- EPS Growth Estimate: +51.8% Y-o-Y

- Revenue Growth Estimate: +15% Y-o-Y

Workday (NASDAQ:), which offers enterprise-level software solutions for financial management and human resources, such as payroll tools, has enjoyed a powerful rebound since seeing its stock slump to a bear market low of around $128 last November.

Shares of the human resources software maker have run 43.3% higher in 2023, far outpacing the comparable returns of major industry peers, such as Automatic Data Processing (NASDAQ:) (+4%), Paycom (NYSE:) (+19.5%), and Paylocity (NASDAQ:) (+16.6%), over the same timeframe.

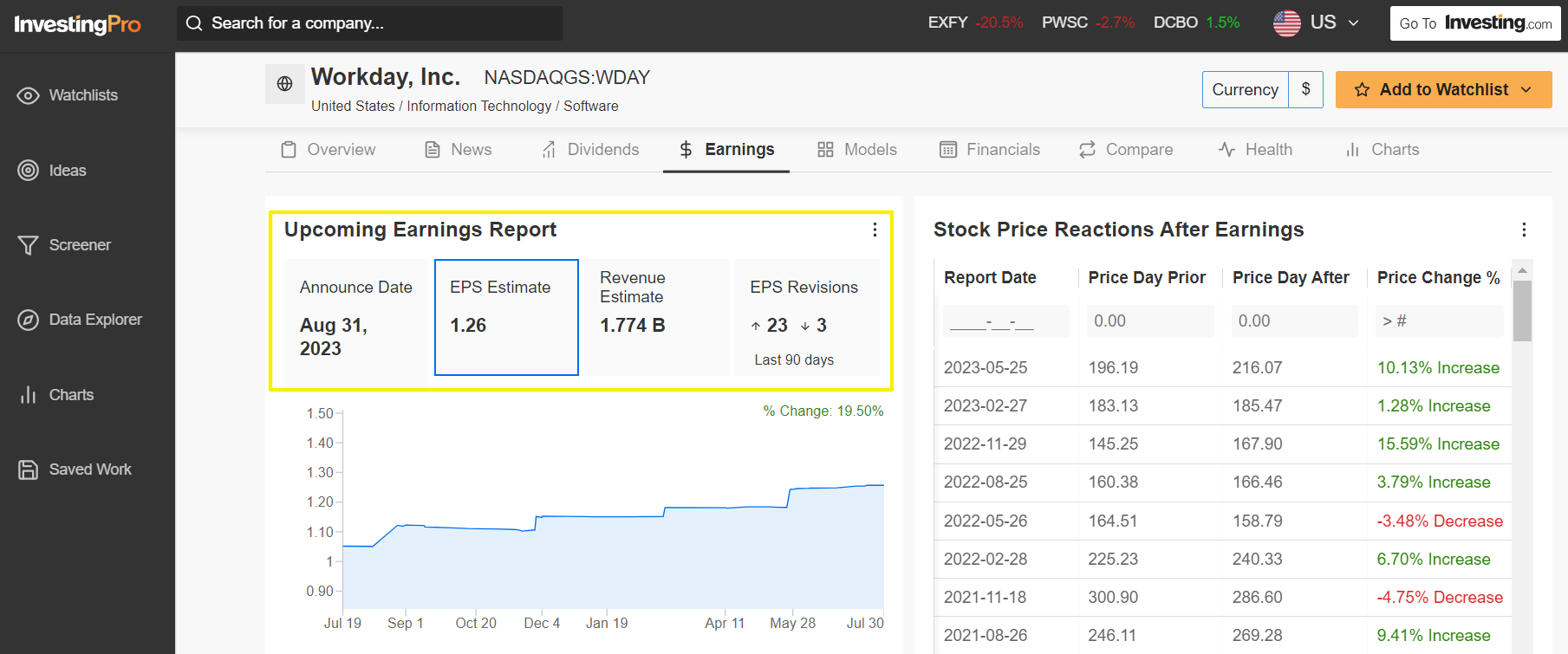

Workday is not expected to report earnings until August 31. However, sell-side confidence is brimming. Earnings estimates have been revised upward 23 times in the last 90 days, according to an InvestingPro survey, compared to just three downward revisions, as Wall Street grows increasingly bullish on the finance/HR software specialist.

Workday Upcoming EarningsSource: InvestingPro

Workday Upcoming EarningsSource: InvestingPro

The Pleasanton, California-based software company is projected to earn $1.26 a share in the second quarter, rising 51.8% from the year-ago period, due to the positive impact of ongoing operational restructuring actions and cost-cutting measures.

Meanwhile, revenue is anticipated to increase 15% year-on-year to $1.77 billion, benefiting from solid demand for its cloud-based human capital management and financial management software solutions.

If that is, in fact, the reality, it would mark the best quarter in Workday’s 18-year history, a testament to the strength and resilience of its underlying business as well as strong execution across the company.

Workday easily surpassed expectations on both the top and bottom lines in the , sending shares higher by 10.1% on May 25.

WDAY stock ended Tuesday’s session at $239.80, the highest level since April 5, 2022. At current valuations, the human capital management company has a market cap of $62.4 billion.

WDAY stock ended Tuesday’s session at $239.80, the highest level since April 5, 2022. At current valuations, the human capital management company has a market cap of $62.4 billion.

Despite the recent rally, shares remain 22% below their November 2021 all-time high of $307.81.

***

Find All the Info you Need on InvestingPro!

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average, S&P 500, and the Nasdaq 100 via the SPDR Dow ETF (DIA), SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Sector through XLK. I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.