3 Beaten-Down Stocks Poised for Rebound in 2024

2023.11.29 06:41

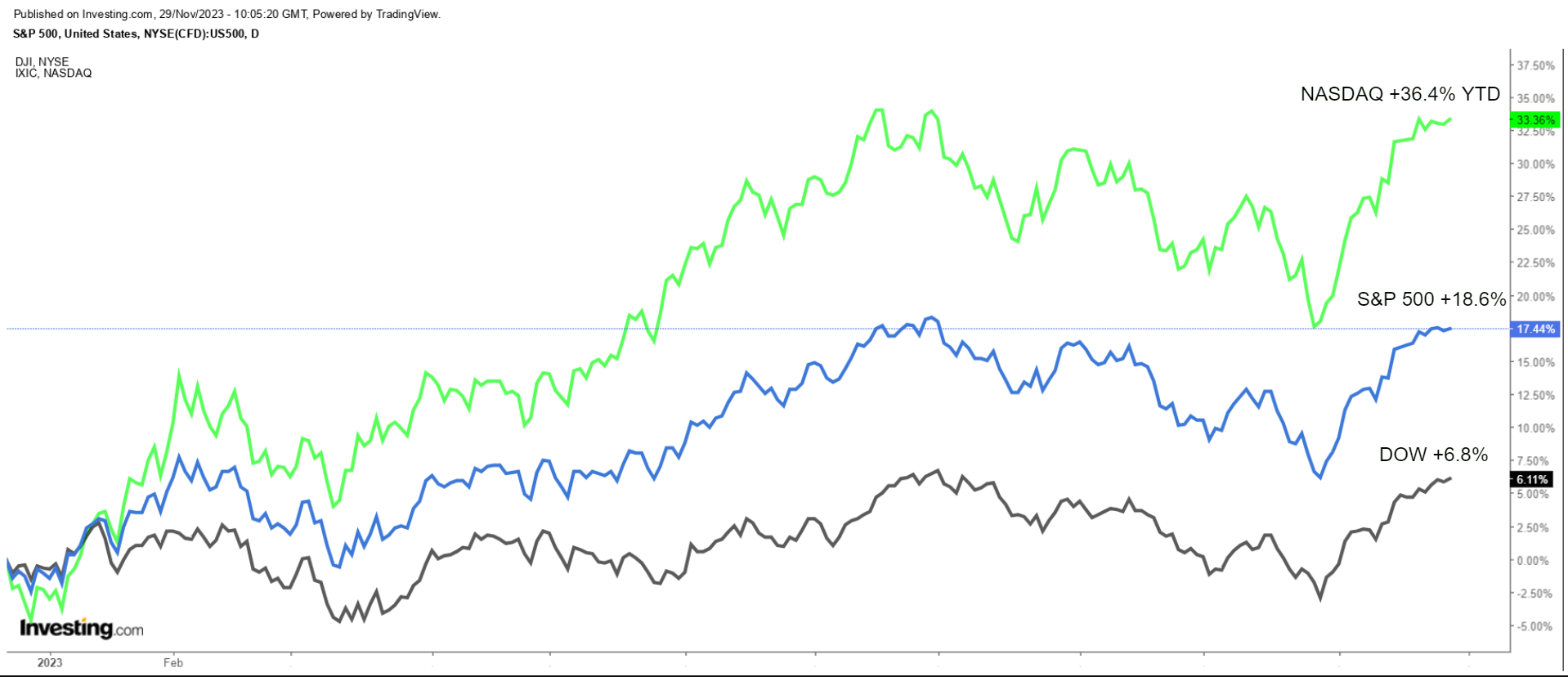

- Wall Street is on track to end 2023 on a solid note.

- Growing optimism that Fed interest rates and U.S. inflation have peaked, combined with hopes for a soft-landing will continue to impact sentiment in 2024.

- As such, investors should consider buying Charles Schwab, PayPal, and Dollar General as the trio of beaten-down stocks are poised to rebound.

- Missed out on Black Friday? Secure your up to 60% discount on InvestingPro subscriptions with our extended Cyber Monday sale.

Stocks on Wall Street are on track to close out 2023 on a solid note with investors growing increasingly optimistic that that the Federal Reserve may be done raising rates amid cooling inflation and as the economy holds up better than expected.

The tech-heavy has led the year-to-date charge higher, rising 36.4%, while the benchmark and the blue-chip are up 18.6% and 6.8% respectively for the year.

With Fed policy, , and soft-landing prospects likely to remain front and center for investors in 2024, I recommend buying shares of these three beaten-down companies thanks to their improving fundamentals and reasonable valuations.

1. Charles Schwab

- Year-To-Date Performance: -33%

- Market Cap: $101.7 Billion

As one of the nation’s most interest-rate-sensitive financial institutions, Charles Schwab (NYSE:) found itself caught up in concerns over the health of its balance sheet and the specter of rising interest rates. Shares of the online stock brokerage – which are hovering near their lowest level since November 2020 – have lost 33% year-to-date due to worries about the strength of the banking sector.

Charles Schwab Daily Chart

Charles Schwab Daily Chart

However, a closer examination suggests these fears might be exaggerated. Schwab’s proactive measures to navigate through higher interest rates to maximize profitability, coupled with its impressive track record of customer acquisition, paint a promising picture for a potential rebound in 2024.

Although the financial services company faces headwinds due to the challenging operating environment, its successful integration of the TD Ameritrade merger significantly expanded its customer base. The Westlake, Texas-based discount broker had 34.6 million active brokerage accounts as of the end of October, 5.2 million corporate retirement plan participants, 1.8 million banking accounts, and $7.65 trillion in total client assets.

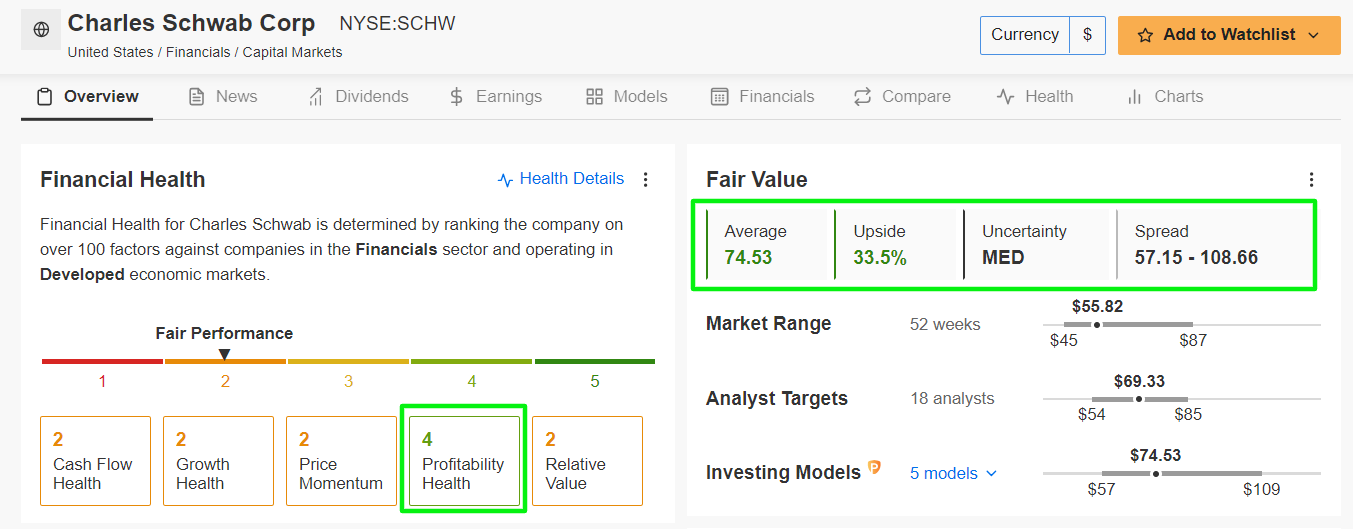

While missteps with low-interest-rate loans and the negative impact from higher borrowing costs have cast shadows, Schwab stock’s current valuation seems disconnected from its intrinsic strength. For investors willing to wager on the eventual subsiding of these headwinds, Schwab’s undervalued status becomes an enticing option.

As InvestingPro points out, SCHW stock is currently trading at a bargain valuation. Shares could see an increase of 33.5% from last night’s closing price of $55.82, which would bring them closer to their ‘Fair Value’ of $74.53.

Charles Schwab InvestingPro

Charles Schwab InvestingPro

Source: InvestingPro

At its current valuation, Charles Schwab – which stands about 42% below its all-time peak of $96.24 reached in February 2022 – has a market cap of $101.7 billion, making it the sixth largest U.S. banking institution.

2. PayPal

- Year-To-Date Performance: -17.9%

- Market Cap: $63 Billion

PayPal (NASDAQ:) has faced significant headwinds this year amid increased competition in the digital payments industry from the likes of Apple (NASDAQ:), Google (NASDAQ:), Amazon (NASDAQ:), and Block. Shares of the San Jose, California-based fintech leader, which are languishing near their lowest level since mid-2017, have considerably underperformed the broader market in 2023, losing almost 18% year-to-date.

Yet, beneath the surface, PayPal exhibits resilient strengths and characteristics. The mobile payments processing company’s revenues, profits, and total payment volume have all continued to grow despite the uncertain macroeconomic environment. In addition, the company’s shift toward embracing newer revenue streams, including the surge in buy-now-pay-later (BNPL) options, offers a major diversification advantage.

Despite recent turmoil, PayPal shares are poised to recover under the leadership of new CEO Alex Chriss, who came over from Intuit (NASDAQ:), as the digital payments giant steers towards an era of operational efficiency and streamlined growth.

Indeed, PayPal’s recently third-quarter financial update was well received by Wall Street. Adjusted earnings per share increased 20% year-over-year to $1.30, while sales rose 8% annually to $7.41 billion. In an encouraging sign, total payment volume, a key performance indicator for the business, jumped 15% to $387.7 billion.

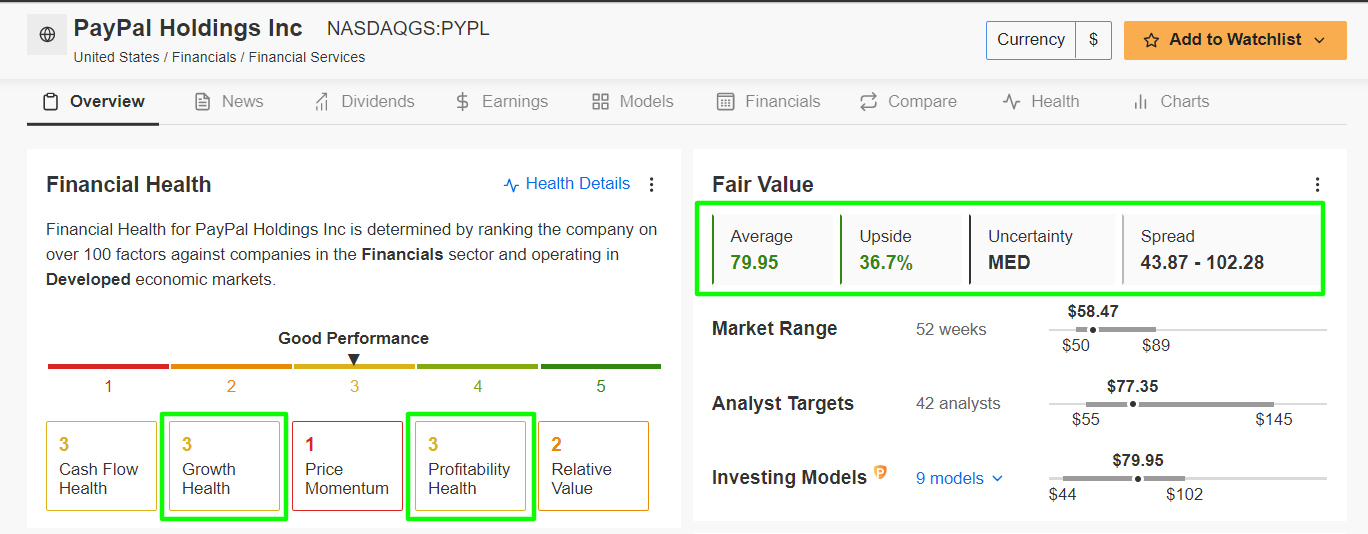

It should be noted that PYPL stock is extremely cheap at the moment according to InvestingPro, and could see an increase of 36.7% from Tuesday’s closing price of $58.47. That would bring shares closer to their Fair Value of $79.95.

Source: InvestingPro

At current valuations, PayPal, which is roughly 80% below its July 2021 record high of $310.16, has a market cap of $63 billion.

3. Dollar General

- Year-To-Date Performance: -48.2%

- Market Cap: $28 Billion

As a stalwart in the retail space, Dollar General (NYSE:) has faced significant obstacles this year stemming from worries about slowing consumer spending and lingering inflationary pressures. Shares of the discount retailer – which recently slumped to their lowest since December 2018 – have lagged the year-to-date performance of the S&P 500 by a wide margin in 2023, tumbling roughly 48%.

Yet, its recession-proof status as a discount retailer with a wide footprint across rural and suburban areas remains an invaluable asset amid the current backdrop. As bargain-hunting consumers seek value amid economic uncertainties, Dollar General stands poised to benefit. The Goodlettsville, Tennessee-based discount retail chain’s strategic initiatives, such as expanding its fresh produce offerings and investing in digital capabilities, aim to bolster its competitive edge.

Additionally, Dollar General’s continuous efforts to return more cash to shareholders in the form of higher dividend payouts make it an even likelier candidate to outperform in the months ahead. The company recently increased its quarterly cash dividend for the fifth year in a row to $0.59 per share. This represents an annualized dividend of $2.36 and a yield of around 1.9%.

Dollar General’s proven ability to navigate through challenging times and maintain its market position signifies resilience that could translate into a turnaround story in 2024.

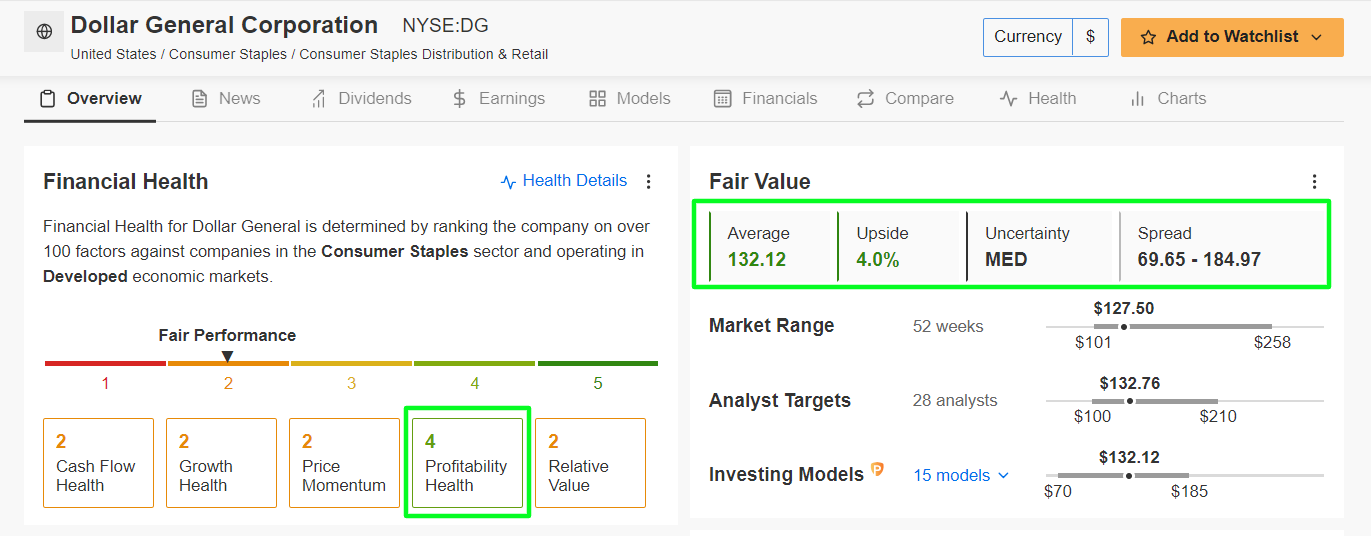

Indeed, shares appear to be a tad undervalued, as per the quantitative model in InvestingPro, which points to a potential upside of 4.0% from current levels to $132.12. Meanwhile, Wall Street remains bullish on the discount retailer’s long-term growth prospects, with 30 out of 32 analysts surveyed by Investing.com rating DG stock as either a ‘buy’ or a ‘hold’.

Dollar General InvestingPro

Dollar General InvestingPro

Source: InvestingPro

At its current share price of $127.50, Dollar General has a market cap of $28 billion, making it the largest U.S. dollar store and one of the biggest discount retailers in the country.

You can easily determine whether these companies are suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

You can sign up now with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Claim Your Discount Now!

***

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.