2025’s Biggest Portfolio Question: Stick With US Stocks or Rotate Away?

2024.12.23 10:32

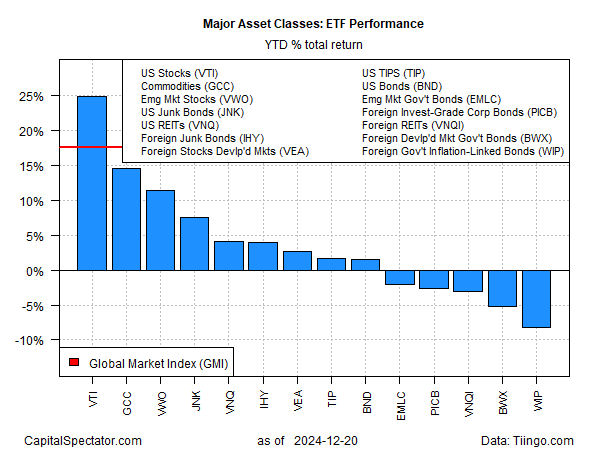

American shares are poised for another year of leading global markets by a hefty margin, based on a set of ETFs through Friday’s close (Dec. 20). , US stocks in 2024 will likely take the performance crown with a red-hot gain for a second straight calendar year.

With just days left in the trading year, American equities () are posting a 24.9% total return for 2024. The next-best performance is commodities () via a 14.6% rise.

This year’s losers are confined to various flavors of foreign bonds. The deepest loss year to date: inflation-indexed government bonds ex-US () — the proxy ETF is down 8.2%.

The Global Market Index (GMI) is heading for another strong increase in 2024. So far this year, GMI is up 17.5%, virtually matching its sharp rise in 2023. GMI is an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios.

The lopsided results in favor of American shares in 2024 – again – are a reminder that portfolio strategy success, or failure, has once more relied heavily on asset allocation. For passive or active managers, one decision above all else has been crucial: How much to hold in US stocks.

After two straight years of winning by a wide margin, portfolio strategists are faced with a familiar choice that could once more be decisive: Will US stocks deliver a third straight year of unusually potent results?

The debate is furious and the stakes are high, as is the uncertainty. Unsurprisingly, warnings that the US stock market is a bubble are widespread, in part because valuation is high. The CAPE ratio (cyclically adjusted price-to-earnings ratio), for example, is near 38, which is close to a 145-year high. The elevated reading suggests that expected returns are relatively low, perhaps even negative, depending on the modeling and ex ante time horizon.

Yet there are optimists who see US-led outperformance continuing for a third year. “We expect the bull market in global equities will likely continue in 2025, with the U.S. again likely to outperform the rest of the world,” says Arun Bharath, chief investment officer at Bel Air Investment Advisors in Los Angeles.

Another bull who’s been mostly right in recent years has turned somewhat cautious lately. “We’re used to the market going straight up for so many months, and there’s going to be more volatility from here,” predicts Ed Yardeni, the president of market advisory firm Yardeni Research and former chief investment strategist at Deutsche Bank’s U.S. equities division. Yet “the reality is the economy is doing fine, which is bullish.”

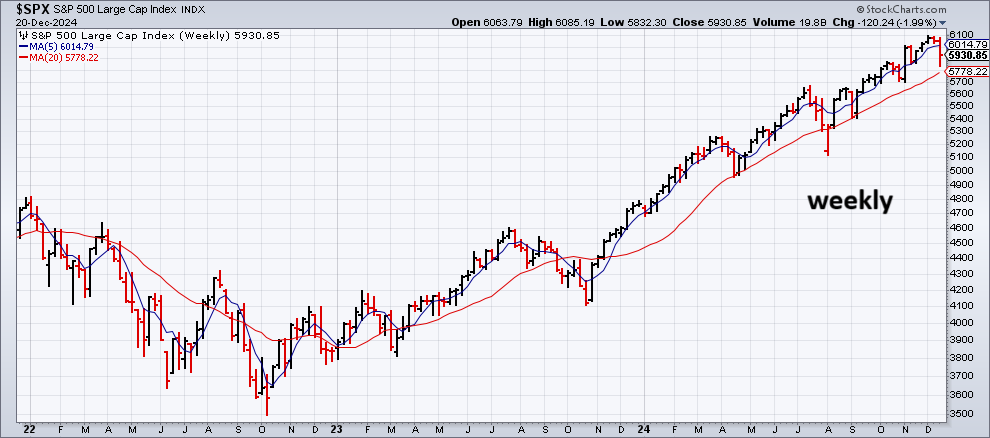

Perhaps, but there’s an argument for using Mr. Market’s signaling as the best (or least worst) option for evaluating market risk. As one starting point, consider the weekly trend for the .

Even after last week’s sharp correction, it’s not obvious that the bull trend has snapped. Meantime, the year ahead promises (threatens?) plenty of change, starting with a Trump 2.0 policy agenda. Strategists are debating if the outlook is a net positive or negative given the political shift that’s coming. The crowd’s view, for now, is that the bull run remains intact. That will change at some point, of course. When it does, the shift will be relatively clear by way of a downside bias in the S&P.

Alas, no one can pick market tops or bottoms in advance, which leaves investors with a key binary decision for portfolio design in 2025: Do you want to be early or late to the next trend shift? Each side of this coin has its own pros and cons. Pick your poison.

For now, the market’s implied recommendation is that the bull run remains intact. The key challenge in the days and weeks ahead is deciding if that outlook is still valid.