2022 Was a Classic Grinding Bear Market for Both Stocks and Bonds

2023.01.04 11:43

[ad_1]

2022 is a wrap. Below are the returns for the calendar year.

2022 Major Equity Index Returns:

2022 Bond ETF Returns:

- iShares 20+ Year Treasury Bond ETF (NASDAQ:): -31%

- iShares Core U.S. Aggregate Bond ETF (NYSE:): -13%

- iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:): -11%

2022 was a classic grinding bear market. What made it unique is that bonds, which typically perform well in this environment, performed poorly. So, using bonds as a hedge against stock market losses isn’t working.

Market technicals continue to suggest further market losses going into next year. There are signals that are characteristic of a bear market bottom and ensuing market advance (bull market), and we have not seen any of them yet.

Risk-On or Risk-Off

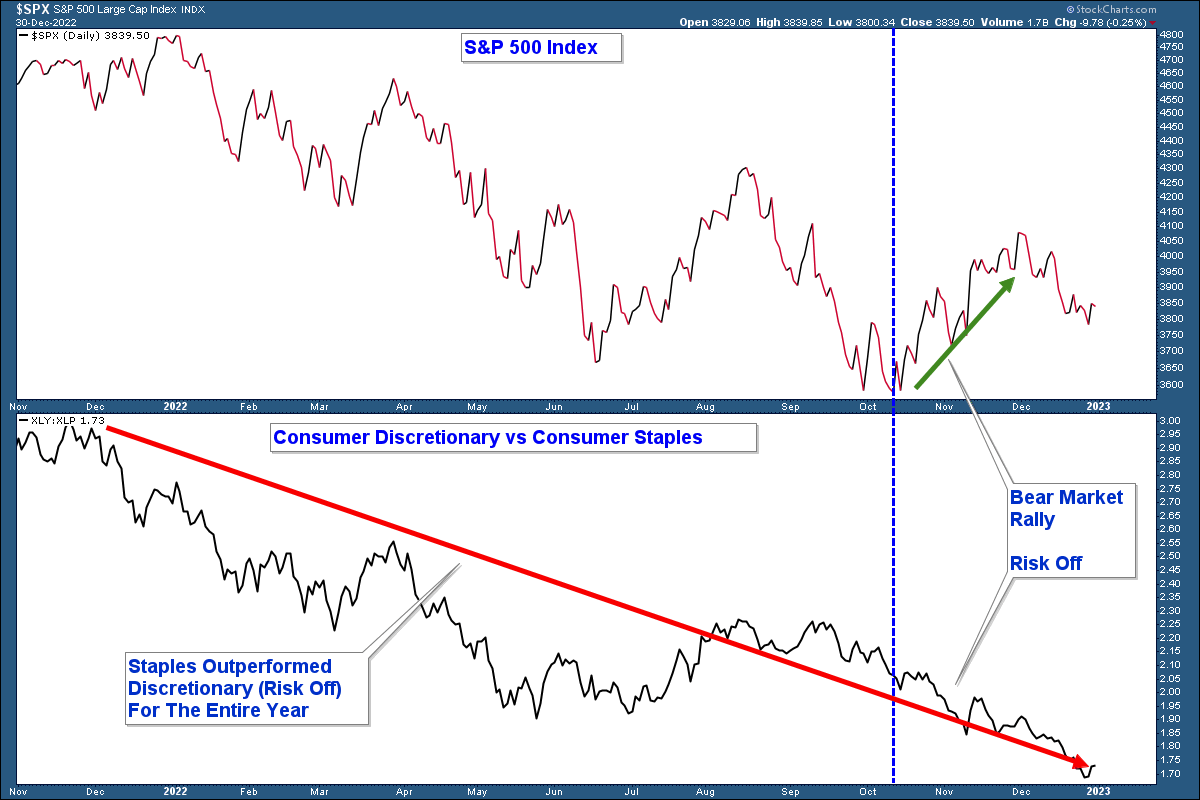

One sign of a bullish market is a risk-on environment. In the chart below is the S&P 500 Index in the top panel and a relative strength chart of Consumer Discretionary (risk-on) verse Consumer Staples (risk-off) in the lower panel.

When the relative strength line is rising it indicates that Consumer Discretionary is outperforming which would signal a risk-on environment and would be a bullish factor for the market.

The line has fallen all year. That weakness has continued through the recent advance off the October lows (blue horizontal line) which suggests that the advance is likely to fail.

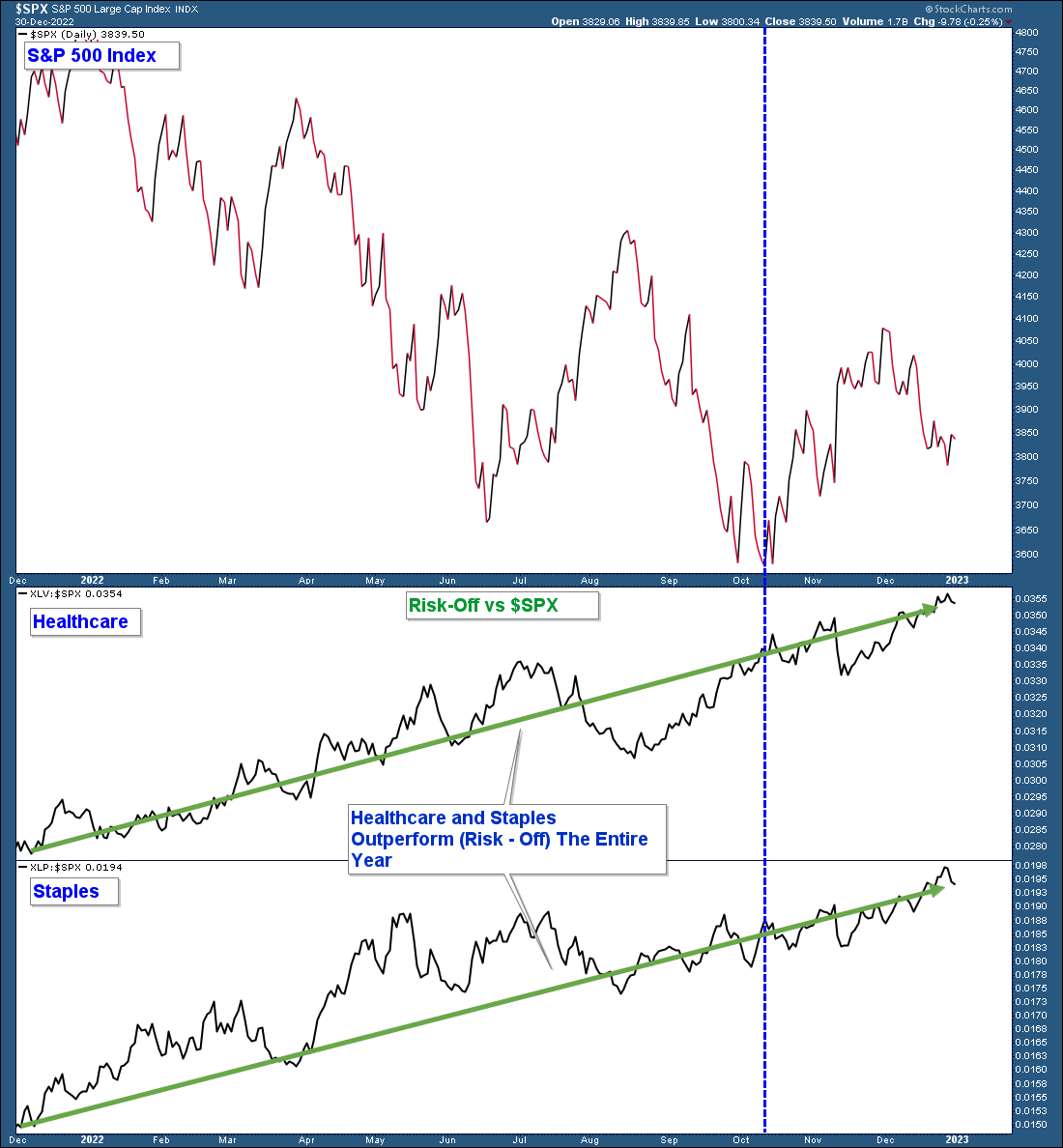

What is performing well relative to the S&P 500 Index? Healthcare and Staples, are both risk-off sectors. This is further confirmation of a weak market environment.

Capitulation Common at Bear Market Bottoms

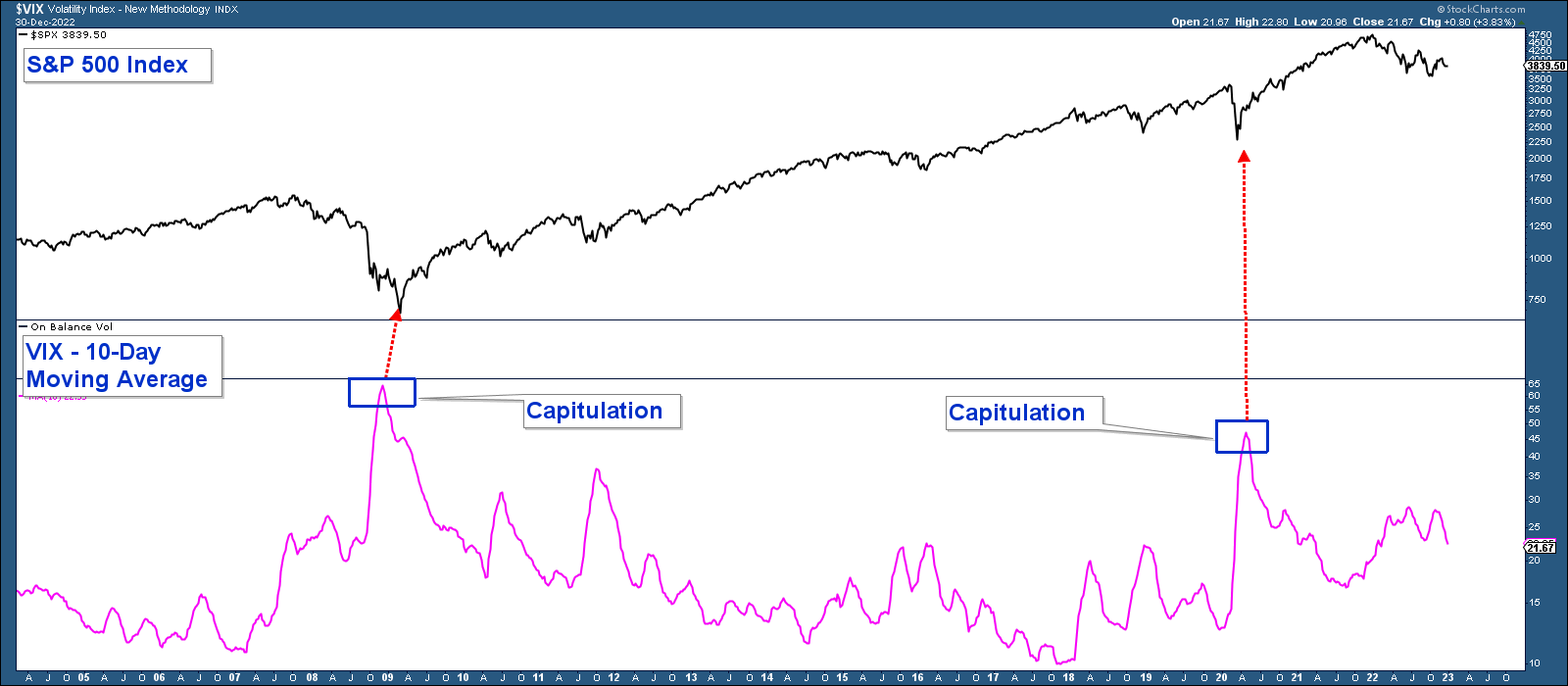

In our July 2022 Market Update, I wrote about how bear markets typically end when investors capitulate which is most commonly gauged using the .

Typically, the VIX will rise to elevated levels at market bottoms which is a reflection of investors rushing to sell in mass. This is referred to as capitulation, and we are not there yet.

Below is a chart of the S&P 500 in the upper panel and the 10-day moving average of the VIX in the lower panel. Notice how the VIX topped out this year at about 28 which is nowhere close to the elevated levels seen at the last two bear market bottoms (47 in 2020 and 64 in 2009).

Economic Conditions Projected to Deteriorate In 2023

In our December 2022 Update, I wrote about how economic conditions were going to worsen next year (recession likely) and how that would negatively impact the stock market. Here is an expert from that update but with this year’s S&P 500 return updated.

“The odds of entering a recession next year are very high. Historically, the most significant drops in the stock market occur during economic recessions. For example, the 2000 and 2007 recessionary bear markets saw the S&P 500 fall 50% – 55%. The S&P 500 is down about 19% year-to-date thus there is a lot of downside risk from here.”

[ad_2]