2 Undervalued Retail Stocks That Could Skyrocket in the Months Ahead

2023.02.15 10:15

- The retail sector has outperformed the broader market by a wide margin thus far in 2023.

- Despite the gloomy macroeconomic outlook, I remain positive on several retailers.

- As such, I recommend buying shares of TJX Companies and Academy Sports and Outdoors.

The final group of companies scheduled to report fourth quarter financial results this season are the major U.S. retailers, which are perhaps the most sensitive to shifting economic conditions and consumer spending.

The sector has held up relatively well compared to the broader market in recent months despite worries over a possible recession as well as ongoing supply chain issues, and persistently high raw material costs.

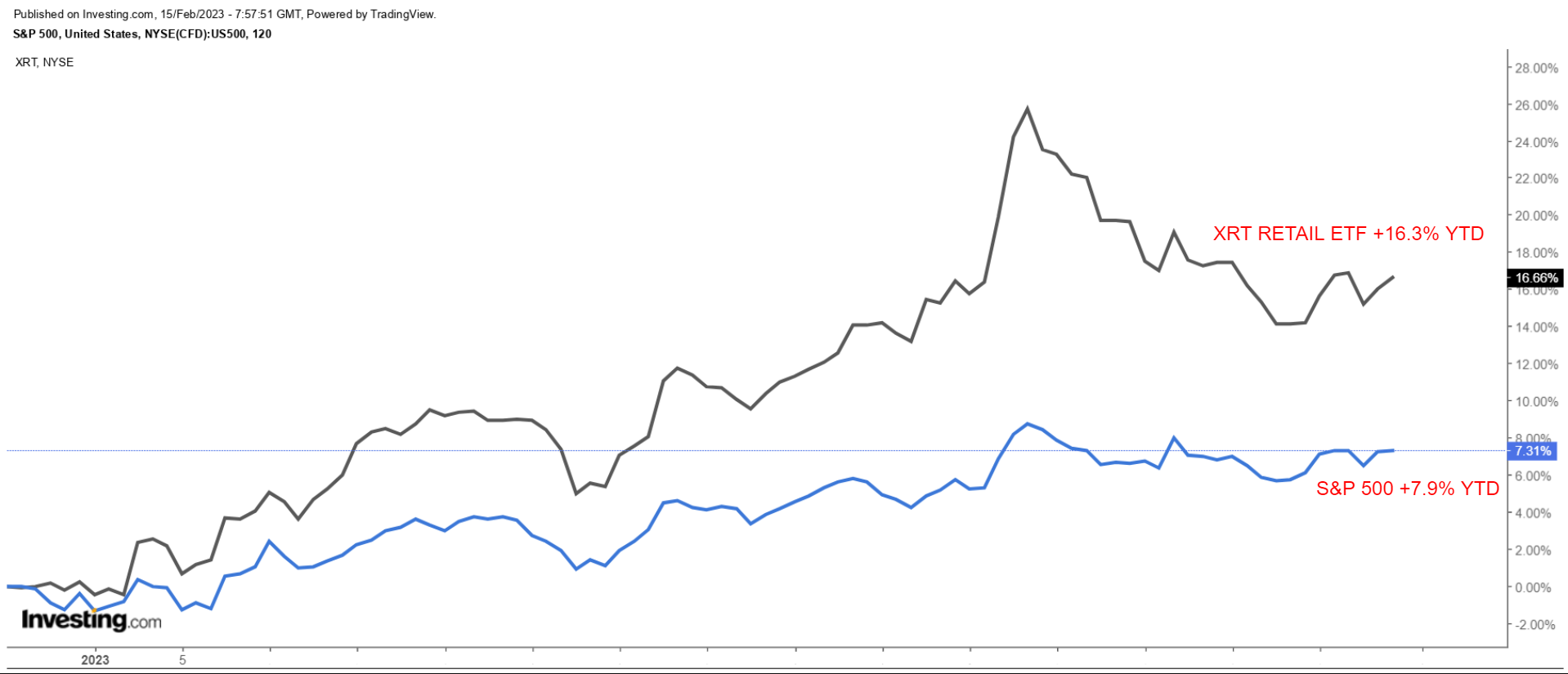

The retail industry’s main ETF — the SPDR S&P Retail ETF (NYSE:) — has rallied around 16% since the start of 2023, more than doubling the ’s near 8% gain over the same period.

XRT vs. S&P 500 YTD Price Performance

XRT vs. S&P 500 YTD Price Performance

With that in mind, I believe that shares of TJX Companies (NYSE:) and Academy Sports Outdoors (NASDAQ:) are smart buys despite their recent uptrend, as their upcoming earnings are anticipated to show solid profit and sales growth and only a modest impact from inflation.

TJX Companies

- Year-To-Date Performance: +1.4%

- Market Cap: $93.4 Billion

TJX Companies, best known for its T.J. Maxx, Marshalls, and HomeGoods stores, remains one of the best names to own in the retail space, thanks to its off-price business model which has enabled it to weather the current economic environment better than most of its peers.

While most retail stocks have struggled in the face of a gloomy macroeconomic outlook, TJX has thrived amid the existing climate as it benefits from ongoing changes in consumer behavior due to lingering inflationary pressures that is causing disposable income to shrink.

The price-conscious clothing and home decor chain — which operates nearly 4,800 stores in nine countries, including the U.S., Canada, UK, Ireland, Germany, the Netherlands, Austria, Poland, and Australia — provides a wide range of well-known designer brands at a steep discount, offering cash-strapped consumers a “treasure hunt” shopping experience.

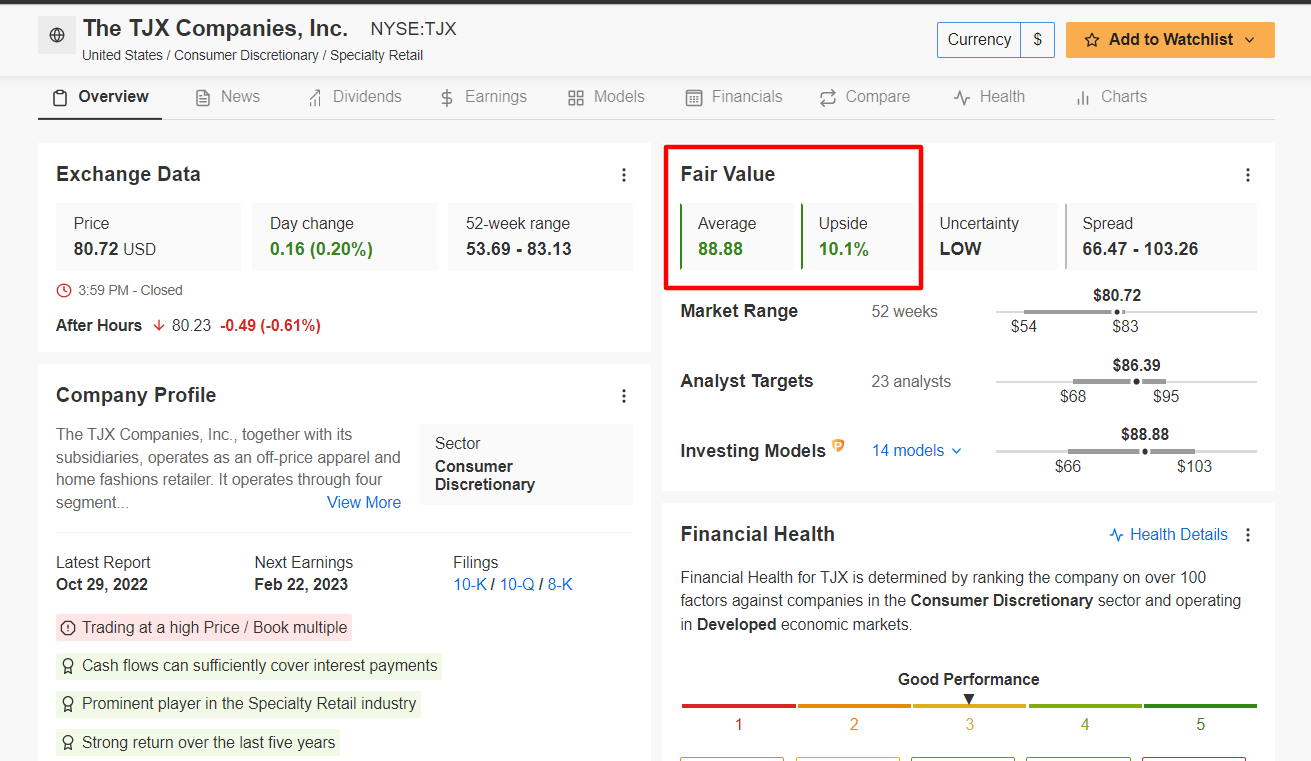

TJX stock closed Tuesday’s session at $80.72, within sight of its record high of $83.13 reached on Jan. 9.

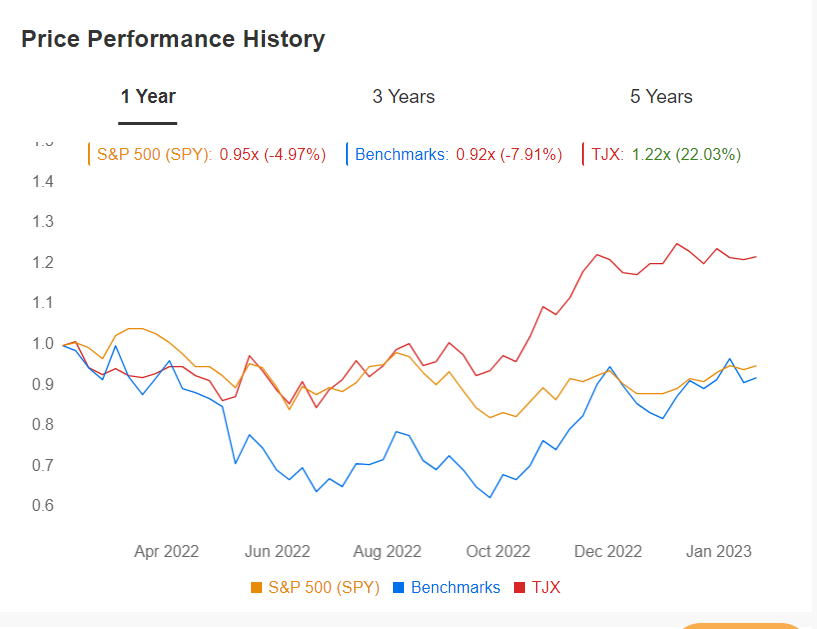

At current levels, the Framingham, Mass.-based company has a market cap of $93.4 billion. Shares are up 18.7% over the last 12 months, compared with a decline of 6% for the S&P 500 and an 11% drop for the Retail Select Sector SPDR ETF.

TJX Price Performance vs. Benchmarks

TJX Price Performance vs. Benchmarks

Source: InvestingPro

Unsurprisingly, Wall Street has a long-term bullish view on TJX, as per an Investing.com survey, which revealed that all 25 analysts covering the stock rated it as either a ‘buy’ or ‘hold’. Among those surveyed, shares had an upside potential of 7.1% from Tuesday’s closing price. Similarly, the average fair value for TJX’s stock on InvestingPro according to a number of valuation models implies over 10% upside from the current market value over the next 12 months.

Source: InvestingPro

The next major upside catalyst is expected to arrive when TJX reports fourth quarter financial results ahead of the U.S. market open on Wednesday, Feb. 22.

Consensus estimates call for the discount retailer to post , according to Investing.com, rising 14.1% from EPS of $0.78 in the year-ago period. Despite several macro challenges, TJX’s Q4 revenue is forecast to inch up 1.6% year-over-year to about $14.1 billion as consumers migrate to off-price chains in search of cost-saving deals.

If that is in fact reality, it would mark TJX’s fourth consecutive quarter of accelerating profit and sales. This speaks to the consistency and fundamental strength of the bargain retailer’s treasure-hunt shopping experience through many types of retail and economic environments.

Looking ahead, it is my belief that TJX’s management will provide upbeat guidance for the current quarter as it continues to navigate through the challenging environment better than its major competitors, such as Ross Stores (NASDAQ:), Burlington Stores (NYSE:), Kohl’s (NYSE:), Bed Bath & Beyond (NASDAQ:), and Target (NYSE:).

Academy Sports and Outdoors

- Year-To-Date Performance: +10.7%

- Market Cap: $4.5 Billion

Academy Sports and Outdoors is one of the top retail stocks to own for the months ahead in my opinion as it remains well-placed to achieve ongoing growth amid the current operating backdrop.

The athletic gear retailer, which operates 268 stores located across 18 states mostly in the U.S. Southeast and Midwest, has thrived amid robust demand for sports and recreation clothing and equipment despite a choppy macro backdrop. Besides selling sports apparel, footwear, and exercise gear, the popular chain also offers a wide selection of products and equipment for the outdoors, such as hunting, fishing, boating, and kayaking.

In addition to its strong fundamentals, Academy Sports remains committed to returning capital to shareholders through a combination of share buybacks and dividends. The thriving sporting goods store chain has repurchased ten million of its shares in the past nine months for $389.4 million and has approximately $400 million remaining under its buyback program. The company also pays out a quarterly cash dividend of $0.075 per share, which amounts to $0.30/share on an annualized basis.

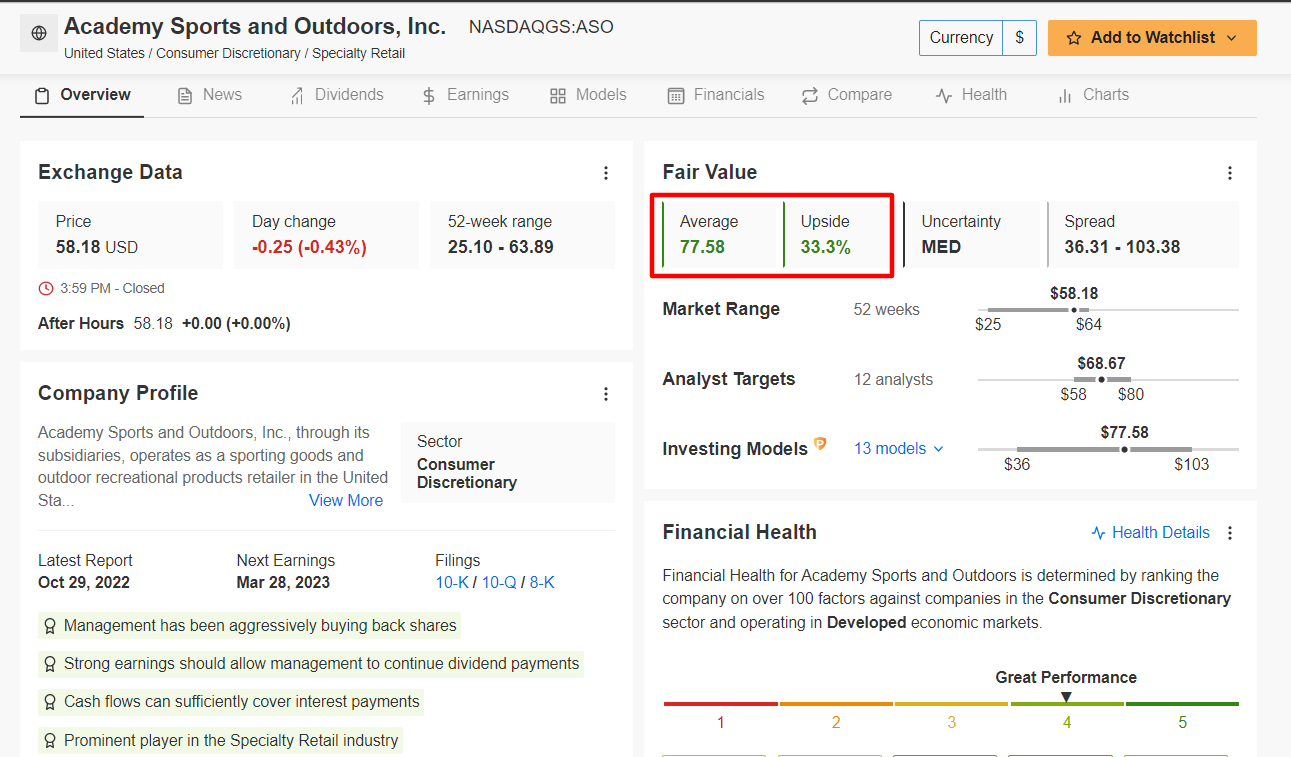

ASO stock ended at $58.18 yesterday, a tad below its all-time high of $63.89 scaled on Feb. 3. At current levels, the Katy, Texas-based company has a market cap of around $4.5 billion.

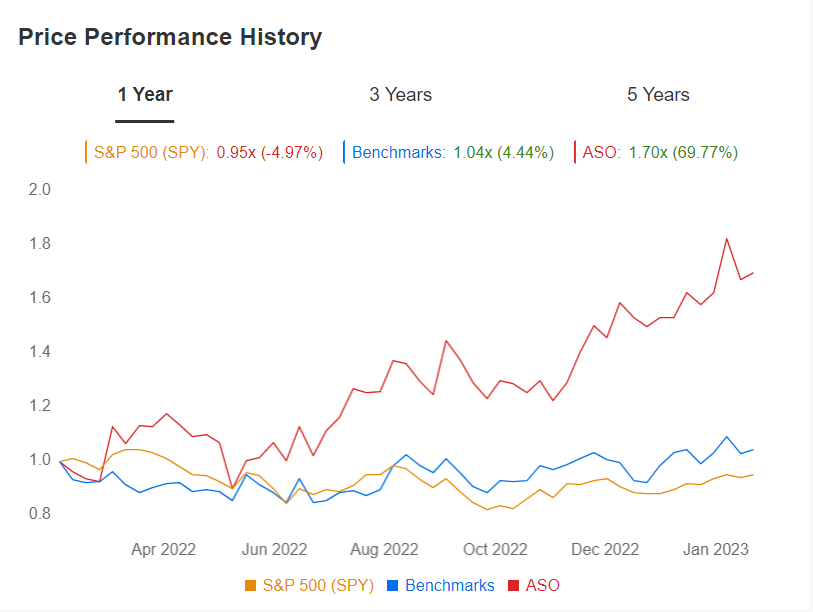

Year-on-year, ASO stock has gained a whopping 69.5%, making it one of the biggest retail industry winners of the last 12 months. Shares have easily outpaced the y-o-y performance of its major competitors, such as Dick’s Sporting Goods (NYSE:) (+17.6%), Hibbett Sports (NASDAQ:) (+26%), and Sportsman’s Warehouse (NASDAQ:) (-16%).

ASO Price Performance Vs. Benchmarks

ASO Price Performance Vs. Benchmarks

Source: InvestingPro

Academy Sports and Outdoors has not formally confirmed its next earnings release date, however the company is tentatively slated to deliver its fourth quarter update ahead of the U.S. market open on Tuesday, March 28.

An InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the report, with analysts raising their EPS estimates 11 times in the last 90 days, compared to zero downward revisions. The upbeat outlook follows a strong earnings result in early December that sent shares surging upward.

ASO Earnings Expectations

ASO Earnings Expectations

Source: InvestingPro

Consensus estimates call for the sporting goods retailer to report , rising about 17% from EPS of $1.57 in the year-ago period. The company has either beaten or matched Wall Street’s profit expectations in every quarter since going public in October 2020. Meanwhile, Academy’s Q4 revenue is forecast to total $1.81 billion, reflecting strong consumer demand across all its product categories.

As such, I expect management will maintain its upbeat view regarding its outlook for the rest of the year as the sporting goods retailer benefits from favorable consumer trends and customer demand.

Source: InvestingPro

As could be expected, shares remain a favorite on Wall Street, with 11 out of 12 analysts surveyed by Investing.com rating ASO stock a ‘buy’. The average analyst price target is around $69, representing an upside of almost 19% from current levels. Even more promising, the quantitative models in InvestingPro point to a gain of 33.3% in ASO over the next 12 months, bringing shares closer to their fair value of $77.58.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.