2 Surging Dividends to Buy for Trump 2.0

2024.11.19 09:49

Trump’s win cements what we’ve been saying for months: You can forget about a hard landing or a soft landing—This economy is headed for no landing at all.

In the last few weeks, I’ve started to see the mainstream media pick up on our thinking here. Nice to see they’re finally catching up!

We’ve got two “refined” trades on Trump 2.0 below (ranked in order of appeal). They’re both growing their dividends, and they’ve both been unfairly left behind in this year’s rally.

Before we get to them, let’s take a look at the post-election state of play so we can get a grip on exactly how we’re going to move ahead here.

Election Results Back Up Our “No-Landing” Argument

Truth is, this economy has been heading toward a no-landing scenario for months. And let me be clear and say that this would’ve been the case no matter the election result.

Look, you and I both know government spending is out of control, with the Congressional Budget Office projecting Uncle Sam will spend nearly $2 trillion more than he’ll take in this year.

That extra $2 trillion is more than enough to keep an economy rolling! It is also likely that this monetary inflation will bleed over into .

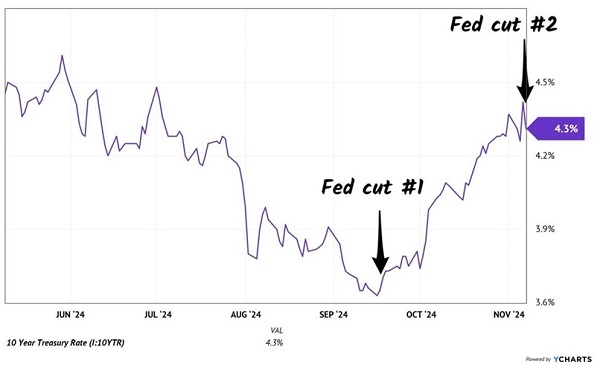

I’m not the only one saying that, by the way. Witness the return of the “bond vigilantes,” who’ve put Jay Powell on notice that inflation is NOT dead: They’ve bid down the , sending its benchmark yield up from 3.6% in mid-September, when Jay first cut rates, to around 4.3% as I write this.

10-Year Treasury, Powell in a Bar Brawl Over Rates

Jay didn’t back down—he’s now dropped two rate cuts and is likely to cut one more time before the year ends. Who will win out here? Given the deficit (which you and I both know won’t be tamed anytime soon), I’m going with the vigilantes on this one.

Of course, the return of inflation is not great news for consumers. But the “growth-with-inflation” world we’re moving into is great for the two refinery stocks we’re going to delve into next.

Refiners in the Sweet Spot

Refiners are nicely positioned here for a few reasons, starting with the fact that continued economic growth means continued strong demand for their main products: gasoline, diesel and other petrochemicals.

Before you ask, yes, the energy transition is something to bear in mind here. Goldman Sachs Group (NYSE:), for example, released a report in June calling for gasoline demand to peak around 2028. (Of course, you and I both know that peak oil and gas have been incorrectly predicted for decades, so do take that with a grain of salt.)

But even if that call does come true, Goldman sees demand for petrochemicals used in the production of things like plastics, as well as diesel fuel (since heavy trucks are harder to electrify) and other specialized petrochemicals as likely to offset it.

Speaking of driving, here’s something else that most folks overlook: Refiners produce asphalt, and this is another growth market, with infrastructure spending likely to keep growing across the world. According to research firm SNS Insider, asphalt demand will grow at a 5.1% compound annual clip between 2024 and 2032. Not bad!

That’s the outlook on the demand side. And the picture looks promising on the cost side, too, with the Trump administration focusing on increasing US production. Higher output would weigh on the price of oil, refineries’ main feedstock. And bear in mind that oil is already pretty cheap as it is, at around $68 a barrel as I write this.

2 Refiners to Buy Now (Ranked)

The mainstream crowd often overlooks, or completely misunderstands, refiners, either confusing them with oil and gas producers or focusing only on gasoline, even though, as mentioned, these companies produce a wide range of chemicals.

That’s too bad because they’re missing out on stocks with some pretty sweet dividend growth, like Phillips 66 (NYSE:), my fav refiner of the two we’ll discuss today. The firm has hiked dividends 130% over the last decade, with the only pause coming during the pandemic:

1. PSX’s Share Price Takes Aim at Its Payout

As you can see, the firm’s share price has struggled to keep up with the surging payout, but it always closes the gap. That makes our strategy simple: Buy when there’s a divergence—as there is now—and ride along as the price reels in the dividend.

And here’s another indication that PSX is overlooked: Even though it’s rallied in the wake of the election, with pretty much everything else, it’s still flat this year, even with its dividend (current yield: 3.5%) included. This at a time when the S&P 500 has returned around 27%:

PSX Still Overlooked, Despite Trump Rally

The kicker is that management is all-in when it comes to rewarding shareholders. In addition to its strong payout growth, PSX is a big repurchaser of its stock—having taken some 24% of its outstanding shares off the market in the last decade.

That’s a nice setup for us because it leaves fewer shares on which PSX must pay dividends, juicing future payout growth. It also enhances things like earnings per share and free cash flow per share, putting a lift under share prices.

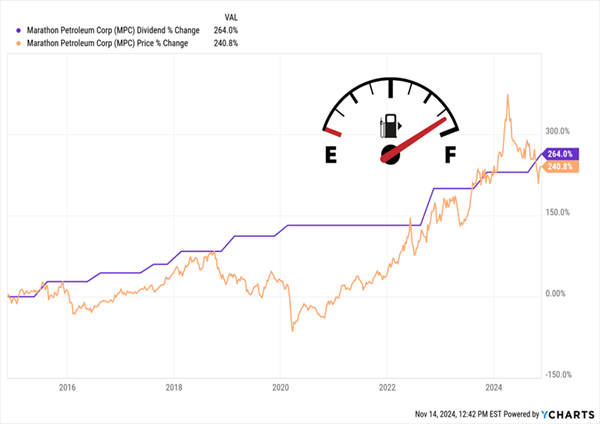

2. Marathon Petroleum: Low Dividend Yield Offset By Sterling Payout Growth

Marathon Petroleum Corp (NYSE:) is the second-biggest refiner in America by market cap, behind PSX. Investors overlook it for all the same reasons they miss out on PSX, and I’ll add one more: Its current yield is lower, at around 2.3%.

But the first-level crowd overlooks the fact that this low current yield is more than offset by MPC’s payout growth, with the dividend up a sterling 264% in the last decade. And as we can see below, MPC does have a powerful Dividend Magnet: Its payout has pulled its share price higher at every turn over the last decade:

MPC’s Dividend Fuels Its Share Price

Dividend hikes are, hands-down, the No. 1 predictor of share price growth with MPC. And we can expect that payout growth to continue, with dividends accounting for a light 22% of MPC’s last 12 months of free cash flow (FCF).

Now before I tell you why MPC is my second-favorite of these two, let me first say that refiners do tend to rally together. Regulators aren’t approving more refineries, and the big players already own the “beachfront properties.”

It’s just that with MPC, the share price has already caught up to the dividend, robbing us of any potential “slingshot” effect like we have with PSX’s lagging payout.

Moreover, unlike PSX, MPC has already returned about 9% this year, compared to a flat performance for PSX. That tells me that PSX is better positioned for a year-end (and then some) rally here.

5 More “Dividend Magnets” to Buy as Trump and Powell Face Off

As we just saw, payout growth drives share prices higher—and it’s set to keep doing just that for these two strong refiners (with PSX pegged for the biggest upside due to its “lagging” payout).

But we do not need to stop with these two. I’ve got a portfolio of 5 stocks for you that each have fully powered “Dividend Magnets.” And these 5 winners have the soaring cash flow to keep their payouts popping.

No matter what happens with interest rates. Or politics. Or geopolitical events.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”