2 Stocks to Bolster Your Portfolio as September Rate Cut Appears Imminent

2024.08.01 06:00

- Fed left rates unchanged yesterday, but the path ahead remains data-dependent.

- While the markets appear to be almost certain about a September cut, it’s good to prepare for any eventuality.

- In this piece, we’ll take a look at 2 stocks that you can add to your portfolio ahead of September.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

The Federal Reserve yesterday as widely expected, but offered little clarity on the timeline for potential cuts.

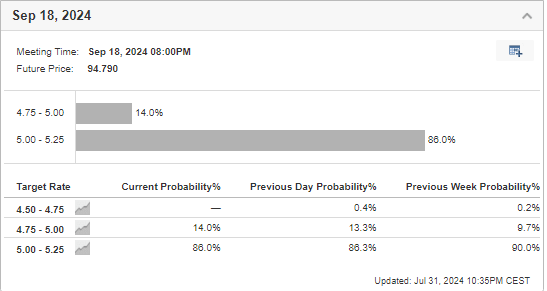

While the central bank maintained a cautious stance, citing recent economic data, market expectations for a September rate reduction remain strong, with at 87% at the time of writing.

Amid the Fed’s dovish tilt, the stock market rallied, buoyed by a generally positive earnings season thus far. Major indices climbed, with the posting a 1.58% gain.

While the Fed’s decision to maintain rates was unsurprising, the path forward remains uncertain. Upcoming and data for July and August will be crucial in determining the central bank’s next move.

However, current trends suggest at least two rate cuts before the end of the year.

As the Fed prepares to embark on a rate-cutting cycle, certain sectors and stocks are poised to benefit. Below, we’ll explore two stocks to prepare your portfolio for the changing economic landscape.

1. Qualcomm

Qualcomm’s (NASDAQ:) stock price surged over 8% yesterday after the company beat Q2 expectations.

Revenue climbed to $9.39 billion, surpassing forecasts by $180 million, while earnings per share reached $2.33, exceeding estimates by $0.08. This strong performance has halted a recent downtrend and presents a potential buying opportunity.

A 12% year-over-year increase in processor and smartphone modem sales further bolsters Qualcomm’s outlook. Technical analysis indicates a potential breakout from a resistance level near $200, which could propel the stock toward its historical high around $230.

2. Mastercard

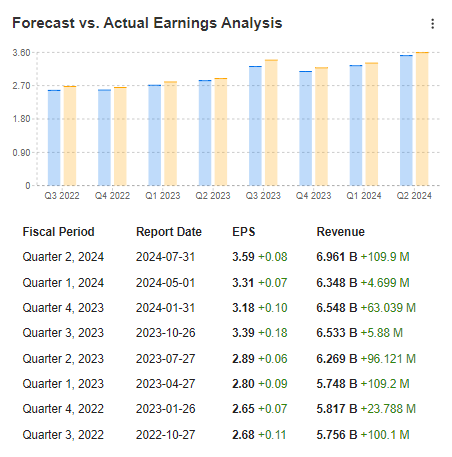

Mastercard (NYSE:), like Qualcomm, released its quarterly results yesterday, once again surpassing expectations in revenue and earnings per share. This continues its impressive streak of beating quarterly consensus.

With consistently rising revenues and robust net earnings, Mastercard remains an attractive and solid choice for stabilizing portfolios, especially if the Fed maintains its restrictive monetary policy.

Source: InvestingPro

The company’s continued positive trend is underpinned by an 11% quarter-on-quarter increase in payment transaction volume on the Mastercard platform.

CEO Michael Miebach expressed his satisfaction, stating,

“We achieved another strong quarter in all aspects of our business, posting double-digit growth in net revenues and profits.”

During yesterday’s session, Mastercard’s stock price surged by more than 3.6%, potentially marking the end of the correction and signaling a return to upward momentum.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.