2 Solid Dividend-Growth Stocks

2022.11.25 10:55

[ad_1]

- Dividend-paying companies have built-in insurance to ride through downturns

- Blue-chip stocks return to their growth trajectory after an economic hurricane

- Energy stocks are among the largest dividend payers on Wall Street

If you’re planning to build your income portfolio, this is perhaps the most challenging time during the past decade. Markets are facing many disruptions, including rising interest rates, surging inflation, and war in East Europe.

These uncertainties make it quite hard for investors to stay focused on a bigger picture. If you’re in this boat, one way to start on your investment journey is to look for companies with a history of raising their dividends and a strong likelihood of continuing to do so.

As a risk-averse, buy-and-hold investor, I’ve been following this strategy for years and it has kept my income stream largely intact as I continue to receive cash in the shape of dividends without worrying what’ll happen tomorrow.

Though some investors view this type of investing as ‘boring,’ dividend-paying companies have a built-in insurance that helps us to ride through market downturns. So, if you invest in dividend growth stocks, you’re insured to get paid while you wait for better times or for economic conditions to improve.

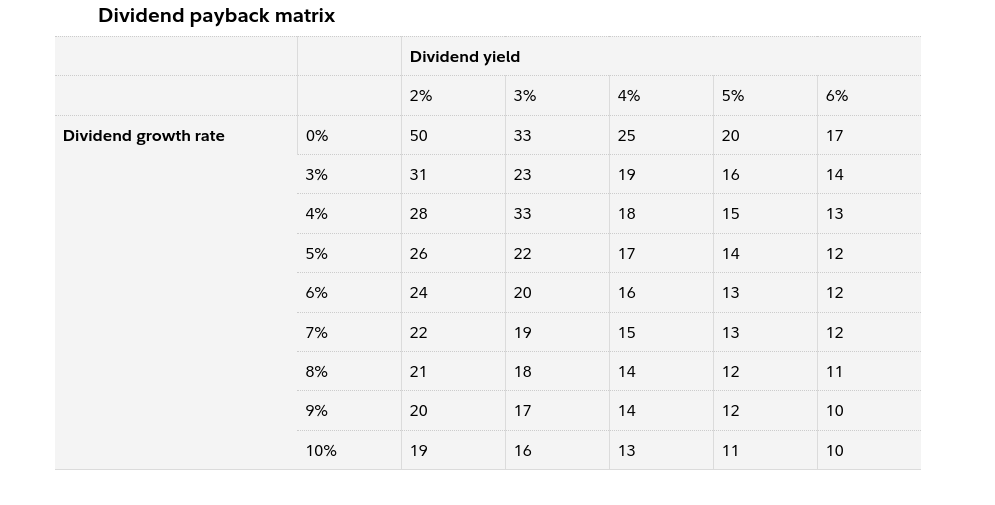

Fidelity Investments explained this concept through a dividend payback matrix chart below that helps determine payback times of a dividend stock (in years) based on dividend yields and dividend-growth assumptions.

Source: Fidelity Investments

In majority of the cases, solid dividend-paying stocks come back to their growth trajectory after the economic hurricane has passed and resume slow, steady growth.

Keeping this theme in mind, I’ve picked two dividend-growth stocks for you to consider:

1. Nike

The global sportswear giant Nike (NYSE:) doesn’t look an attractive buy these days due to various challenges. But the Oregon-based company has been an excellent income stock for long-term investors and the current bearish spell offers an opportunity to buy it cheap.

Its stock, trading at $106.65, has lost about a third of its value this year amid slowing sales in China, inventory build-up, and pressure on its margins. North American inventories surged 65% in the fiscal first quarter ended Aug. 31, and resulting markdowns caused gross margin to miss Wall Street’s expectations.

Will these challenges stick around forever for the sportswear giant? I don’t think so. The maker of Air Jordan and Air Force 1 sneakers has a strong brand following and a wide economic moat. Once these short-term issues are resolved, growth will come back and its stock will rebound.

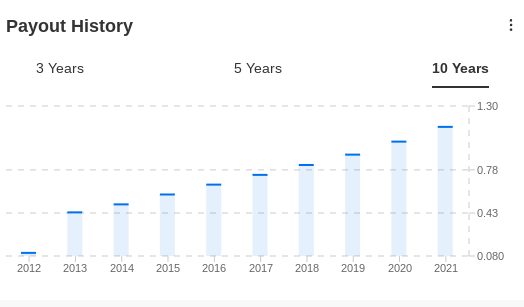

Nike Payout History

Source: InvestingPro

In addition to potential capital gains, you’ll also benefit from Nike’s dividend program. Its average dividend growth over the past five years has been more than 11%. With a low payout ratio of just under 30%, the company has more capacity to hike its dividend. The stock currently pays a dividend of $0.34 per share on a quarterly basis, which, at the current share price, translates to an annual dividend yield of 1.28%.

That may sound meager but percentage yield doesn’t convey the full story as to why this is a smart dividend play for buy-and-hold portfolios. When a company regularly hikes its dividend, the yield on the original cost basis also grows. And if you hold on to your investment, that 1% yield will grow to 3% or 5% over time.

Nike also uses its robust cash flows to support share buybacks. In June, Nike’s board authorized a new four-year, $18 billion stock buyback program. It will replace the company’s $15 billion share buyback program, which will end in the coming fiscal year.

2. Chevron

Having energy stocks in your portfolio is bound to create some volatility. It’s almost impossible to predict the future direction of markets due to multiple dynamics at play. But oil and gas producers are also some of the largest and more consistent dividend payers on Wall Street.

In this group, Chevron (NYSE:) is one of my favorites due to its solid cash position, diversified operations, and ability to sustain future price shocks. North America’s second-largest oil and producer has been adamant that shareholder rewards must be paid consistently through volatile commodity cycles and not pared back when energy prices dip.

Houston-based CVX $11.2 billion net profit last month for its previous quarter, its second-highest on record, helped by soaring international gas prices, strong oil-production growth in the Permian Basin and higher jet-fuel demand. These favorable conditions have also allowed it to pay more cash to investors in dividends and share buybacks.

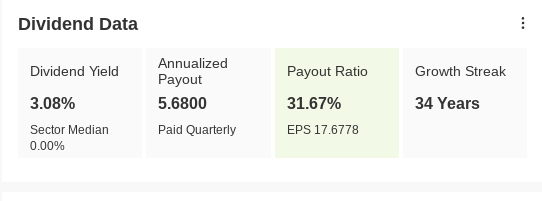

Dividend Data

Source: InvestingPro

Just months ago, the company raised dividends and share buybacks to a combined $25 billion a year. It pays $1.42 a share quarterly dividend which translates into 3.2% annual dividend yield. Chevron has raised its dividend for 34 years in a row, a track record very few companies can match.

Disclosure: As of the time of writing, the author is long on both Nike and Chevron. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

[ad_2]

Source link