2 Small-Cap Stocks Poised for Rebound as Rate Cuts Drive Market Optimism

2024.09.25 12:42

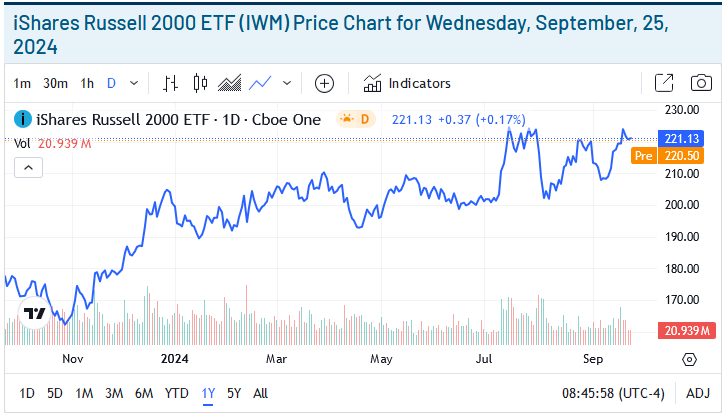

- Small-cap stocks, such as those in the iShares Russell 2000 ETF, often outperform larger peers after Federal Reserve rate cuts due to their reliance on external financing.

- The delayed rate cuts in 2024 led small caps to underperform large caps, but attractive valuations and seasonal strength in the fourth quarter could drive a rebound.

- The IWM has recently outperformed broader markets, gaining 4% this month and positioning itself for a potential breakout as we enter the year’s final quarter.

Like those represented by the iShares Russell 2000 ETF (NYSE:), small-cap stocks are especially sensitive to interest rate changes. Historically, after the implements rate cuts, all market cap sectors tend to rally, but small caps often outperform their larger-cap peers.

This outperformance is mainly because small-cap companies rely more heavily on external financing. When borrowing costs decline, as they do following a rate cut, small-cap companies see a significant tailwind, making it easier to secure the capital they need to fund growth and operations.

Earlier in 2024, small caps underperformed large caps because the expected rate cuts were delayed, resulting in a historically wide performance gap between the two. Small caps lagged, but now that rates have been cut by 50bps, the landscape could shift. Small-cap stocks’ valuation remains relatively attractive, allowing investors to capitalize on a potential rebound. Additionally, the fourth quarter has traditionally been a strong period for small-cap performance, providing a seasonally favorable environment for these stocks to play catch-up to the broader market.

The Performance of the IWM

The IWM, which tracks the performance of 2,000 small-cap U.S. stocks, has outperformed the broader market and the tech-heavy in recent weeks. This month alone, the IWM has gained nearly 4%, significantly outpacing the and . This strength follows the ETF’s break above a multi-year resistance level in July.

After briefly pulling back, the IWM successfully turned the previous $210 resistance area into a newfound support level. This shift suggests buyers are stepping in to support prices at higher levels, indicating a potential change in momentum.

With the recent 50bps rate cut boosting market sentiment, the IWM shows relative strength. The ETF is now trading just 3.4% below its 52-week high. Given its lagging year-to-date performance compared to larger-cap stocks, the IWM may be poised for a breakout as we move into the year’s final quarter, which is historically a period when small caps have performed well. This could be the perfect opportunity for small-cap stocks to play catch-up and deliver strong returns.

How to Gain Exposure to Small-Cap Stocks

The First and Obvious Choice: IWM

The iShares Russell 2000 ETF is the go-to option for investors seeking broad, diversified exposure to small-cap stocks. The fund tracks the , which includes approximately 2,000 small-cap companies from across the U.S. With a market cap of over $70 billion, IWM provides exposure to a wide range of industries, including (18.8% of the portfolio), (10.8%), and (10.6%). The ETF offers a dividend yield of 1.2% and has a low expense ratio of 0.19%. Analysts have assigned the ETF a Moderate Buy rating, with a consensus price target of $231.75, forecasting nearly 5% upside potential.

For Risk-Tolerant Investors: TNA

Direxion Daily Small Cap Bull 3X Shares (NYSE:) might be a compelling option for those looking to amplify their returns- and willing to accept elevated risk. This leveraged ETF seeks to deliver 300% of the daily performance of the Russell 2000 Index, meaning that for every 1% move in the index, TNA aims to provide a 3% return. However, with this higher reward potential comes increased risk. The ETF has a market cap of $2.74 billion, an expense ratio of 1.08%, and a small dividend yield of 0.23%. Year-to-date, TNA is up over 11%, consolidating below its 52-week high. A critical resistance level to watch is the $50 area, which has served as a significant inflection point for the ETF and could signal a breakout if breached.

Original Post