2 Oil Funds to Sell Now

2022.12.22 07:12

[ad_1]

If you made money investing in this year, congratulations! But I have a warning: now is the time to take profits—especially if you hold the two oil funds we’ll discuss below.

Before we get to those, let’s talk a little more about oil’s big year. If you bought earlier in 2022, you managed to pick up on the only sector in the green this year—and well into the green, too: the Energy Select Sector SPDR ETF (NYSE:), a good benchmark for oil stocks, has climbed 55% so far in 2022, while the S&P 500 has headed the other way, dropping some 20%.

To be sure, there were lots of one-off events that fueled crude, like the Ukraine war, supply-chain bottlenecks, and China’s stubborn zero-COVID policy.

And while those events make for terrific short-term trades, unpredictable events like these also show why oil isn’t a good long-term buy, especially if you’re investing for income. To see what I mean, let’s stretch our timeframe out.

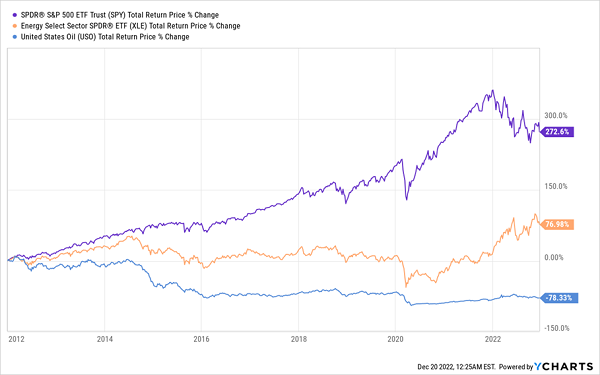

Oil Loses the Decade

XLE Total Return Price Change

As we can see above by the performance of XLE, in orange, and the United States Oil (NYSE:) ETF, a good proxy for oil prices, in blue, if you invested in oil in 2014, you would’ve seen a big drop in short order. But here’s the thing: holding oil for a five-year period at almost any point since 2010 would either mean losing money or underperforming the broader market.

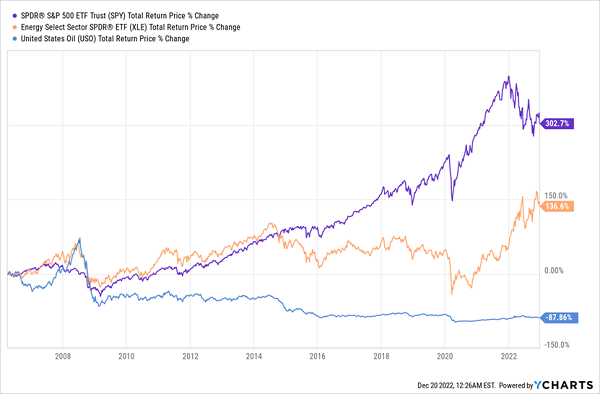

Oil Falls Short—and Often Loses Money—in the Long Run

XLE Total Return Price Change

This is why we’ve stayed out of oil in my CEF Insider service: we’re more focused on the long term. And the long term isn’t great for oil. Not only because history tells us so, but because oil prices have already come down, while shares of oil companies continue to levitate.

Oil Stocks Hit an Air Pocket

2022 Oil Price Chart

In other words, if you’ve seen oil profits in 2022, now is the time to consider getting out, because oil prices are back to where they were before the Ukraine conflict, and oil reserves are growing. According to Oil & Gas Journal, reserves are up 1.3% in 2022 from a year prior. Meantime, the Ukraine crisis has shown the world that fossil-fuel reliance is a geopolitical risk, prompting the European Union to shift away from and oil faster than it was already.

In short, you can make a lot of money in oil in the short term, but in the long term, the risks are high, especially after the recent jump in commodities.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”

[ad_2]