2 High-Potential Trade Setups for the Japanese Yen This Week

2024.07.18 11:51

- Japanese authorities have not confirmed whether they have intervened in the market to support the Yen.

- USD/JPY broke a long-term descending trendline but found support near the 100-day MA and 155.00 level.

- Price Action outlook and potential setups on and GBP/JPY.

Fundamental Overview

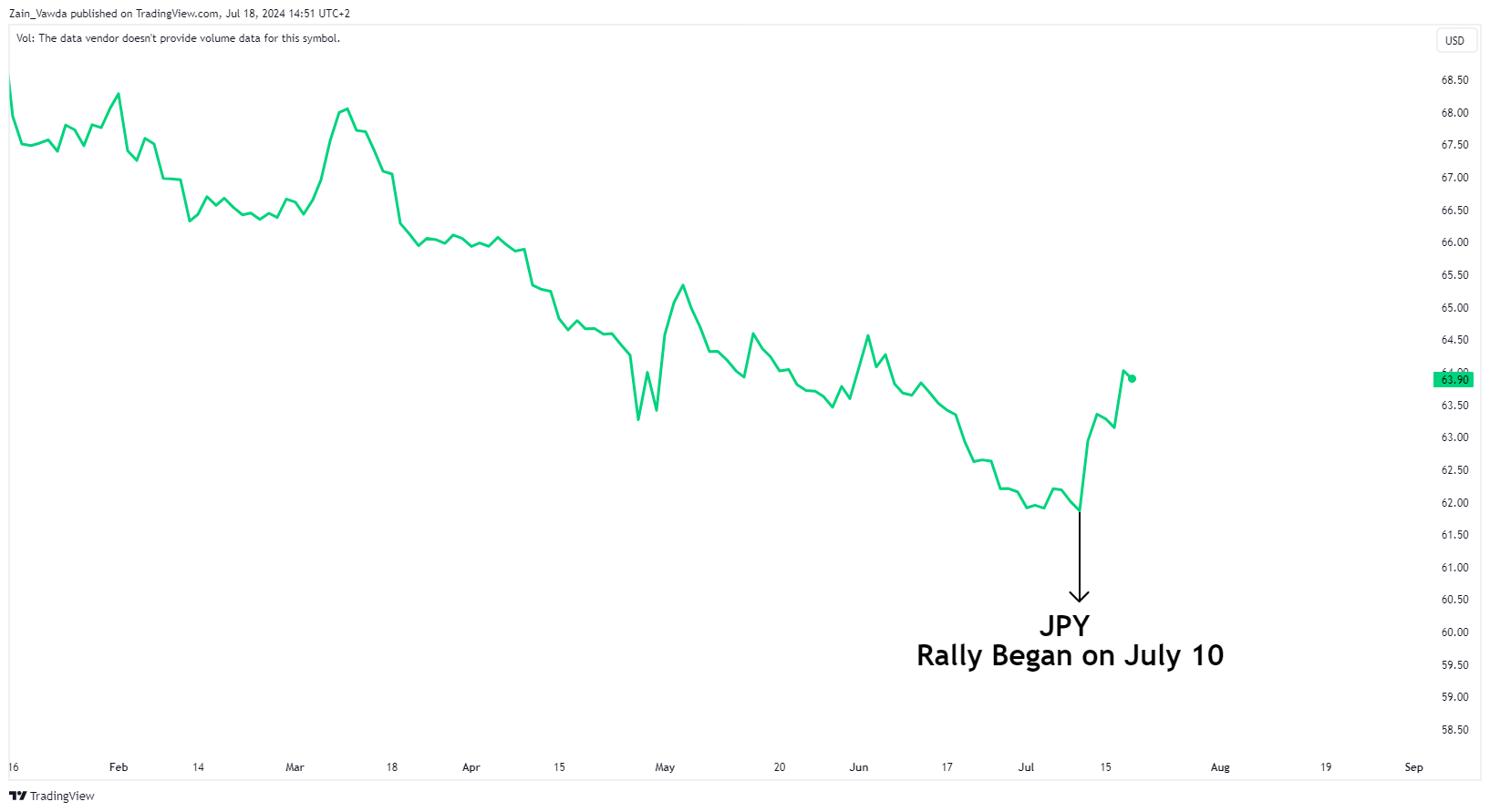

The Japanese Yen is enjoying a stellar week thanks in part to optimism around wage growth as well as rising rate cut optimism from the US Federal Reserve. The Yen rally has sparked talk of possible intervention for Japanese authorities who have refused to confirm whether intervention took place or not.

Earlier in the day, the release of the latest Bank of Japan (BoJ) did not show any immediate signs of intervention. According to Kazushige Kamiyama, a senior Bank of Japan (BoJ) official and the central bank’s Osaka branch manager, the BoJ would like to maintain an accommodative monetary environment as much as possible.

Money market data from last week did suggest that Authorities bought as much as 6 trillion Yen last week. This coupled with continued JPY strength has increased the belief of market participants that intervention has been ongoing during this week as well.

Japanese Yen Currency Index

Source:TradingView (click to enlarge)

Source:TradingView (click to enlarge)

Technical Analysis

USD/JPY

broke the long-term descending trendline which has been in play since December 2023. However, the pair does appear to have found support stopping just shy of the 100-day MA and key support area at the 155.00 handle.

Theoretically, breaking the trendline should result in further downside, especially with growing optimism around US rate cuts. However, historically, even when the Bank of Japan (BoJ) has intervened in the forex market, rapid gains by the Yen have often been quickly reversed.

Of course, past performance does not guarantee future results. Key resistance levels to watch include the 157.800 mark, which aligns closely with the trendline break. A retest and subsequent rejection of this level could signal further downside potential.

Alternatively a daily candle close above the 158.450 mark will see a shift in structure and likely put bulls back in the driving seat.

Support

- 155.00 (100-day MA)

- 153.59

- 152.00

Resistance

USD/JPY Daily Chart, July 18, 2024

Source: TradingView.com (click to enlarge)

Source: TradingView.com (click to enlarge)

GBP/JPY

Looking at and the daily chart almost mirrors USD/JPY. Not surprising given the overarching narratives has been JPY weakness rather than appreciation of other currencies.

Dropping down to an H4 timeframe and we have a descending trendline that comes into focus which could cap further gains. A break above this trendline may face the 100-day MA resting at 204.945 with the next area of focus being the 206.00 handle.

Alternatively a rejection of the 100-day MA or trendline will first need to clear the 200-day MA which came to the support of GBP/JPY pair overnight. A break of this support could finally facilitate a move down toward the 200.00 psychological level.

GBP/JPY Daily Chart, July 18, 2024

Source: TradingView.com (click to enlarge)

Source: TradingView.com (click to enlarge)

Support

Resistance

Follow Zain on Twitter/X for Additional Market News and Insights @zvawda