2 High-Potential, Fundamentally-Backed Trades for the Australian Dollar

2024.10.30 10:46

- Underlying inflation in Australia rose 0.8% in Q3, in line with expectations and RBA forecasts

- Services inflation remains above acceptable levels, goods inflation decelerates

- Labor market the sticking point preventing RBA rate cuts, not inflation

- First RBA rate cut not fully priced until May 2025

- US rates expectations, risk appetite, US election to drive AUD/USD, AUD/JPY direction

Overview

Underlying inflation remains uncomfortably high in Australia. With continued strength in hiring keeping labour market conditions tight, it means the prospect of rate cuts in 2024 is now remote. For and traders, external factors are likely to dictate direction from now until year-end, especially the Federal Reserve interest rate outlook and US election outcome.

Australia Q3 Inflation Report Overview

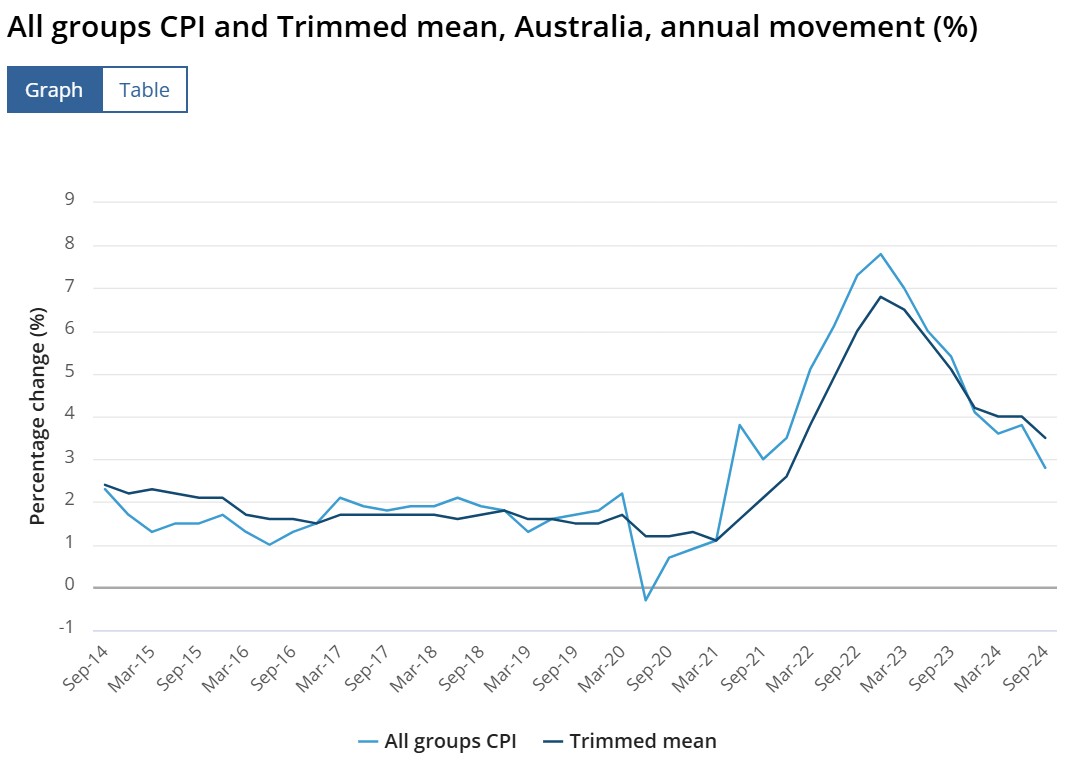

Australian consumer price inflation () rose 0.2% in the September quarter, bringing the rate down to 2.8%, the lowest since early 2021. The quarterly growth pace was the slowest since large swathes of the nation were in lockdown in mid-2020.

Source: ABS

Underlying inflation, as measured by the ABS trimmed mean series, increased 0.8% for the quarter, seeing the annual rate slow from 4.0% to 3.5%. The result was in line with expectations and what the RBA forecast in August. On a six-month annualized basis, it increased 3.3%, down from 3.8% in Q2 but still eight-tenths above the 2.5% midpoint of the RBA’s 2-3% inflation target.

The trimmed mean series strips out volatile price movements that can temporarily distort inflationary trends, providing a cleaner read on underlying price pressures. It is the RBA’s preferred inflation measure.

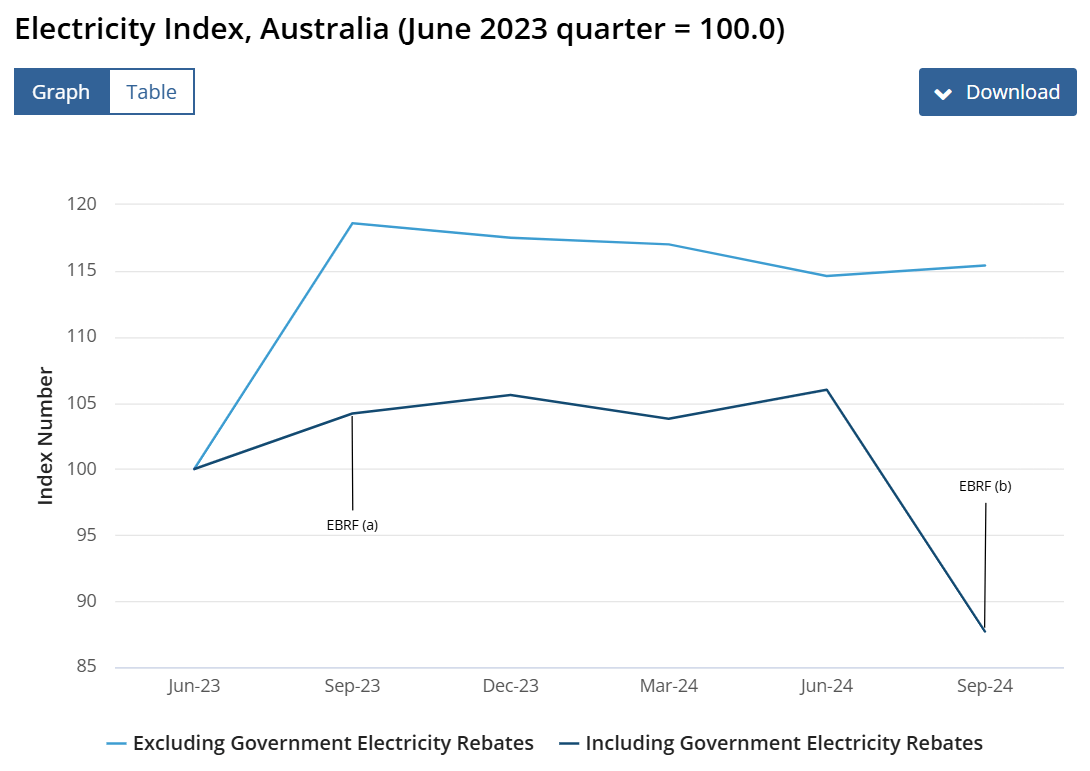

Electricity prices tumbled 17.3% over the quarter, primarily due to government rebates, while fuel prices fell 6.7%. On the flip side, domestic and international travel, along with rising food prices, prevented inflation from falling further.

Source: ABS

Other Notable Inflation Trends

Discretionary goods and services inflation (wants not needs) rose 0.7% over the quarter and 2.7% over the year. Non-discretionary goods and services inflation (needs not wants) fell 0.1% over the quarter but rose 2.9% over the year.

Non-tradable inflation (largely influenced by domestic factors) increased 0.5% over the quarter and 4.1% over the year. Tradable inflation (largely influenced by offshore factors) fell 0.2% for the quarter and rose 0.6% over the year.

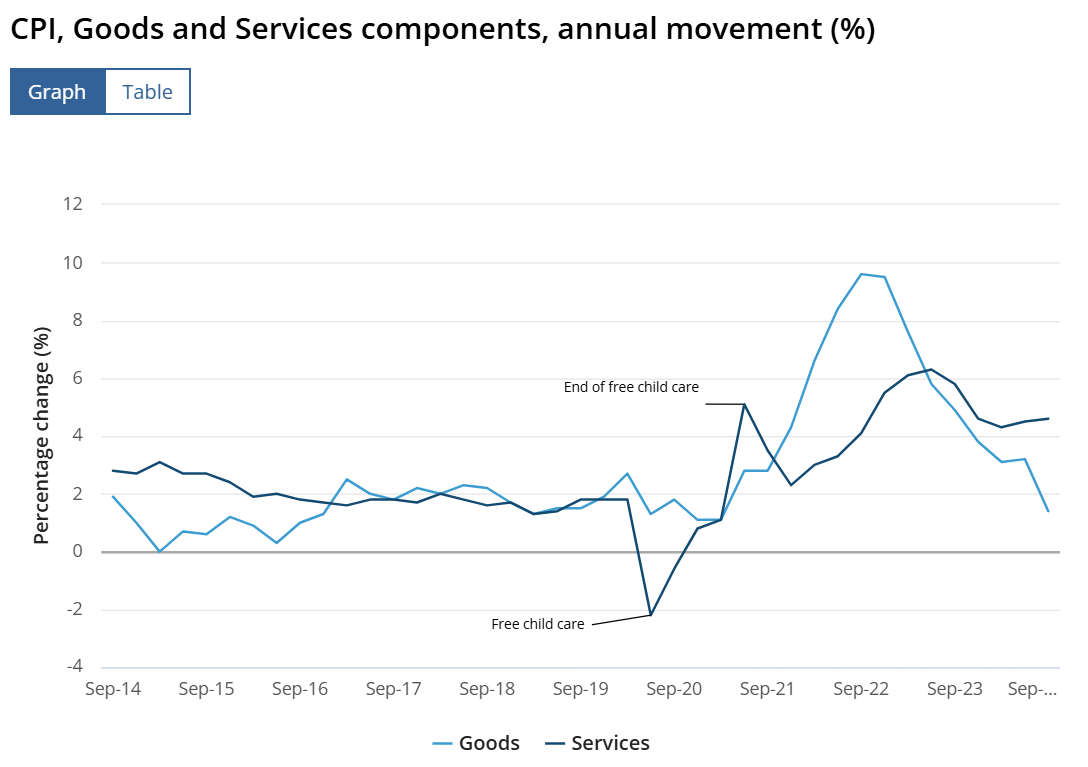

Services inflation rose 4.6% over the year, accelerating from 4.5% in the June quarter. Goods inflation decelerated sharply thanks to sharply lower automotive fuel and electricity prices, rising 1.4% over the year from 3.2% in Q2.

Market services ex volatile items increased 4.1% over the year, unchanged from Q2. This removes administrated (government and government-regulated) price movements, making it a useful guide on areas heavily influenced by labour market conditions.

Source: ABS

RBA Rates Outlook

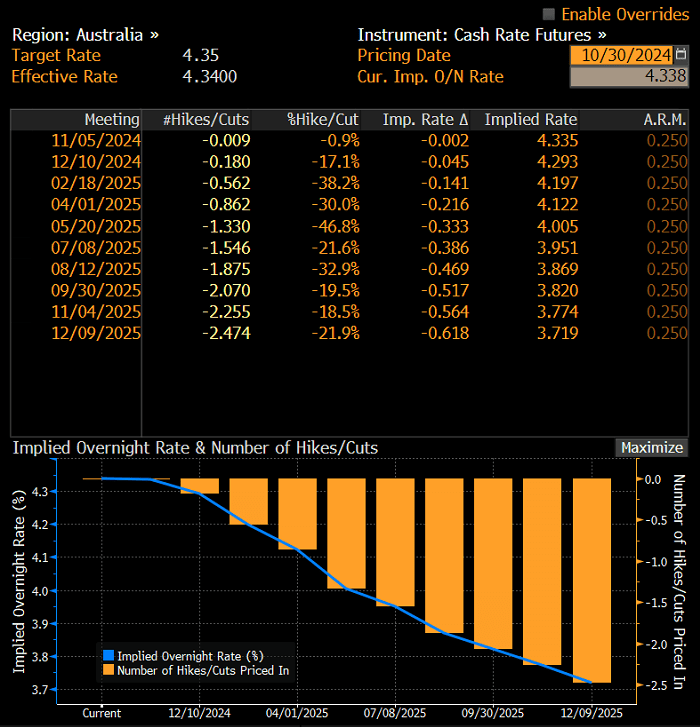

There was little change to the RBA cash rate outlook following the inflation report. The graphic below shows implied probabilities of rate moves for RBA meeting dates, as calculated by Australian overnight index swaps (OIS) pricing.

Source: Bloomberg

A rate cut by the end of 2024 is now deemed a less than one-in-five chance. A full 25 basis point cut is not priced until May with a second not seen until September.

As detailed in out inflation report primer released earlier this week, the RBA is far more interested in trimmed mean inflation when it comes to interest rate settings.

Jobs Market the Main Sticking Point Preventing Cuts, Not Inflation

Based on the RBA’s forecasts released in August, today’s underlying inflation result was in line with expectations, suggesting it’s on track to return to the 2.5% midpoint of its target band by the first half of 2026.

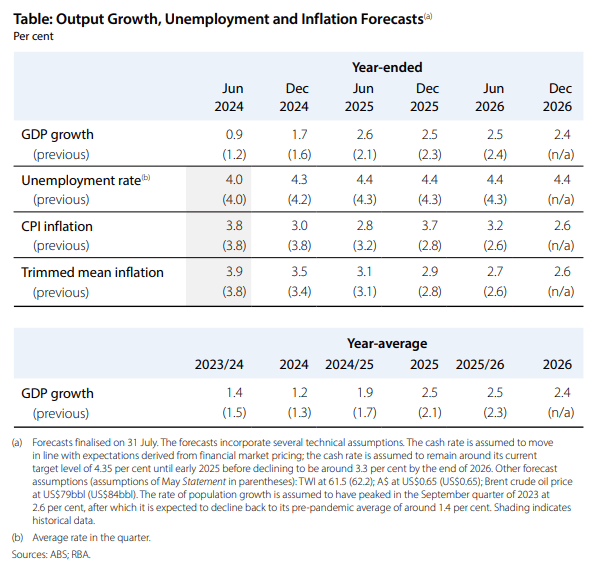

Source: RBA

Notably, its forecasts are premised on a shallow rate cutting cycle over the next two years, implying it could start to cut rates by the end of the year. But the sticking point preventing such a move is not inflation but the labour market. Continued strength in hiring is keeping labour market conditions tighter than what the RBA anticipated, with unemployment sitting at 4.1% compared to its end-2024 forecast of 4.3%.

With services inflation above the inflation target, it would be risky to cut rates prematurely given persistent strength in labour market conditions. Unless Australia can make meaningful progress in improving supply of goods and services (read productivity), the RBA cannot boost demand without the threat of inflation reaccelerating.

AUD/USD: US Rates Outlook Key

Source: TradingView

With Australia’s inflation report out of the way, and with no major change to the domestic rates outlook coming from it, the focus now returns to the US interest rate outlook. We wrote about it earlier this week in detail.

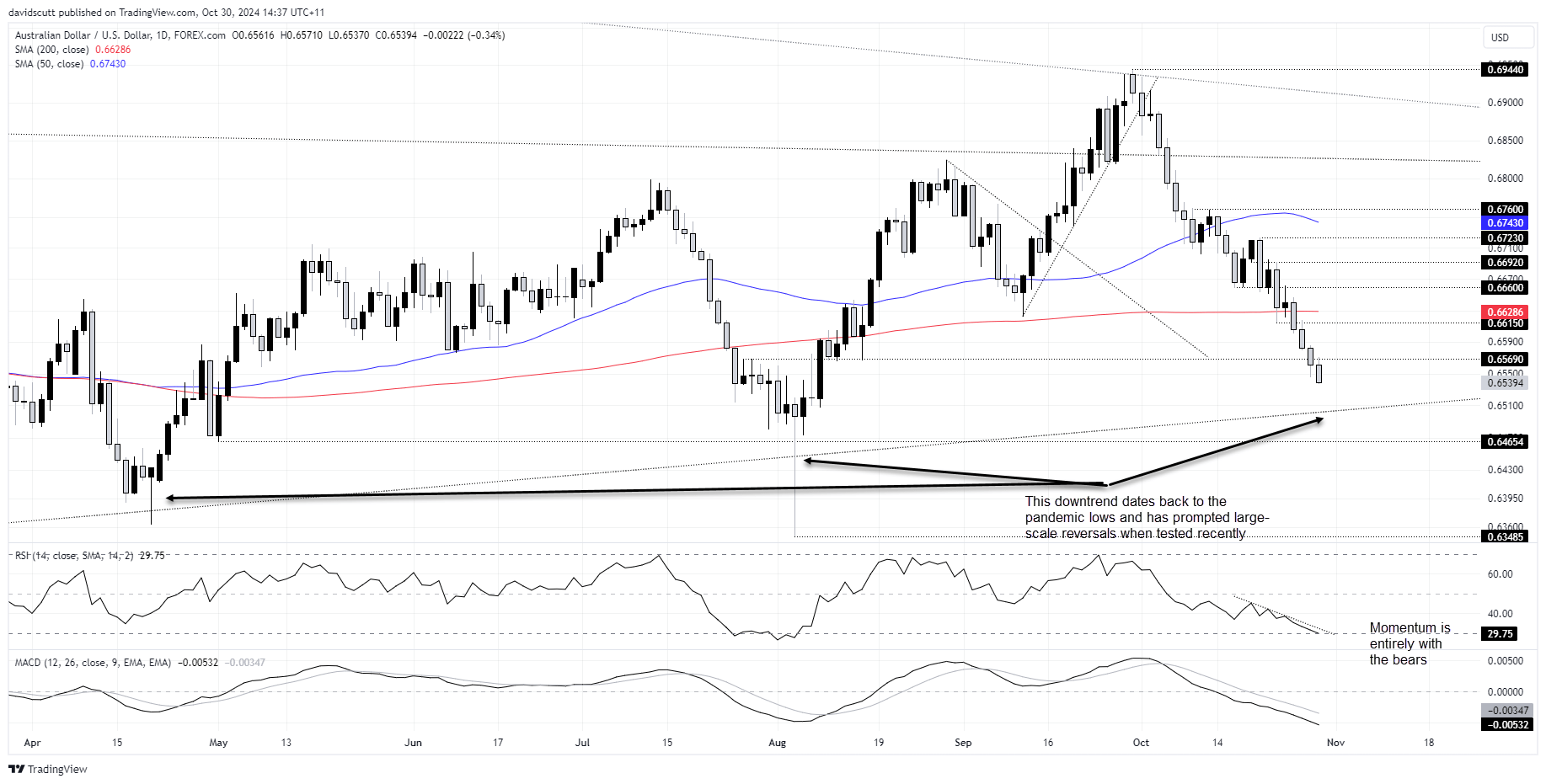

Looking at AUD/USD on the daily chart, the phrase one-way traffic comes to mind. It’s been hammered over the past month, largely because of the large reversal in longer-dated US bond yields. Unless we see a notable deterioration US economic data that forces to Fed to accelerate the pace of rate cuts, or a dramatic swing in the Presential election polls away from Donald Trump to Kamala Harris, AUD/USD will remain a sell-on-rallies prospect. The signals from RSI (14) and MACD reinforce this bearish view.

Resistance is located at .6569 and .6615. Below, there’s little visible support until the uptrend dating back to the pandemic lows in early 2020. It’s located around .6500 today.

AUD/JPY: Downside Risks Building

Source: TradingView

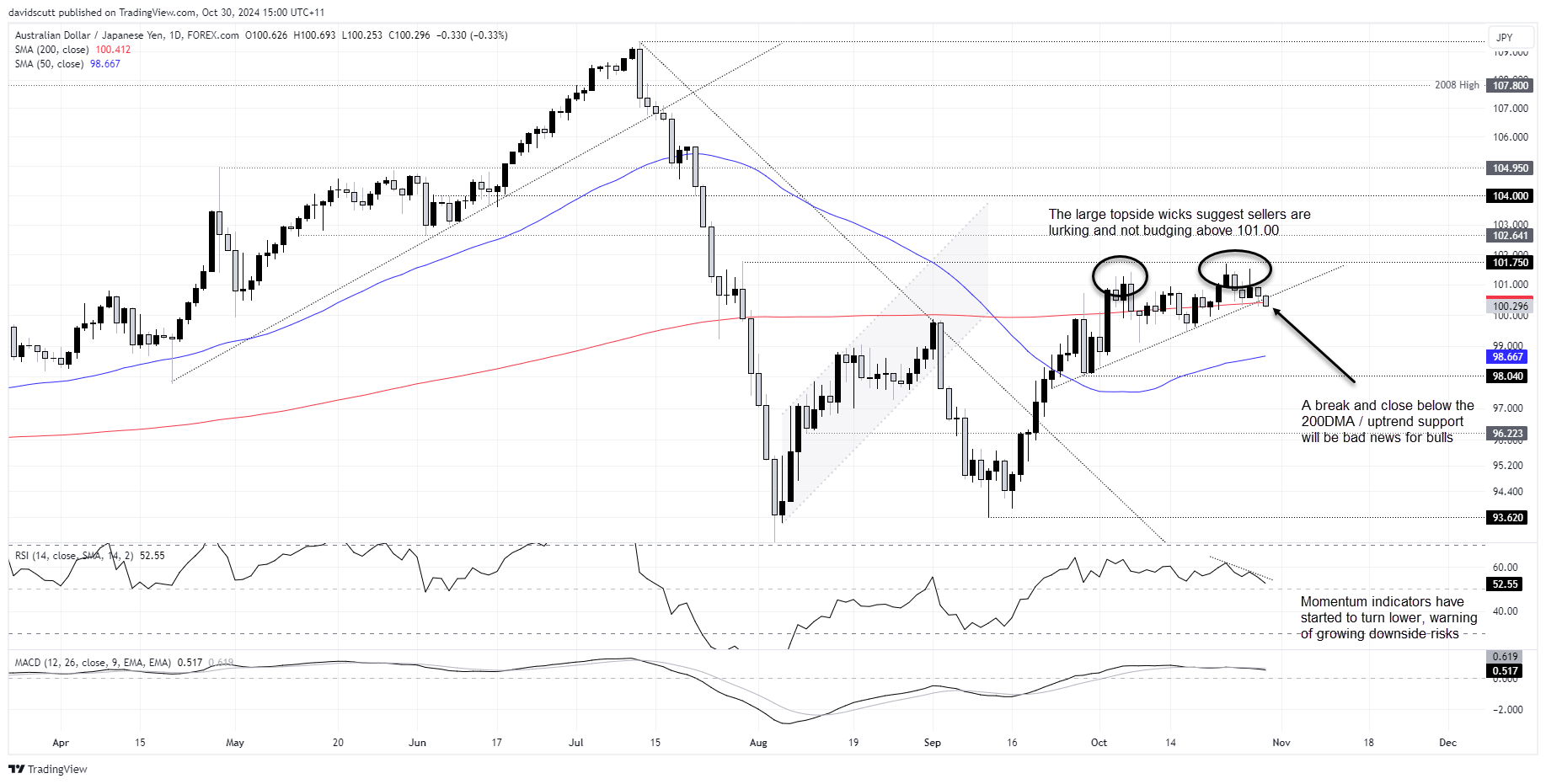

With and AUD/USD being driven by the US interest rate outlook, it comes as little surprise that AUD/JPY has been rangebound for much of the past month. The overall trend on the daily timeframe has been higher within an ascending triangle pattern, although the bearish break through both the 50-day moving average and uptrend support today warns of growing downside risks, especially with RSI (14) trending lower.

Bears may now target the October 16 low of 99.50, if the break sticks, with 99.10, 50-day moving average and 98.04 the next downside levels to watch. Above, the long topside wicks on the daily candles above 101 suggest a break above August high of 101.75 may prove to be tough in the near-term.

Original Post