2 Dividend Stocks To Fuel Growth In Your Retirement Income

2022.10.13 13:49

[ad_1]

- This year’s bear market could represent an attractive long-term opportunity for those looking to start building a retirement portfolio

- Medtronic is a lesser-known pick, but with solid growth potential and chunky yields

- Lowe’s remains a dividend favorite, despite growing risks in the housing market

The best time to start building your retirement portfolio is when you’re young, have disposable income to spare, and when asset prices are down. So if you’re embarking on this journey just now, time is definitely on your side.

Since the start of this year, the persistent sell-off has pushed major indices into bear markets, making many stocks attractive for long-term, buy-and-hold investors.

There are many ways to benefit from this downturn. You can buy some top growth companies which command a defendable “economic moat,” a term coined by Warren Buffett to identify quality stocks with a vast competitive advantage.

If your ultimate goal is to generate consistent income through this portfolio, then another option is to buy dividend stocks that provide income through regular payouts.

A quality dividend stock is less likely to slash or suspend its dividend payments during market volatility, making it much easier to hold in your portfolio over the long run. Once you buy such assets, you keep them over the long run and focus on their income-generating capabilities.

With these factors in mind, below I’ve short-listed two large-cap dividend stocks that might suit your retirement goals in this bear market:

1. Medtronic

Healthcare stocks are considered relatively safe. Just like retailers, utilities, and garbage collectors, healthcare providers offer services that remain necessary even during a recession. Plus, economic swings don’t typically curb the roll-out of new drugs and devices.

Medtronic (NYSE:) is a lesser-known healthcare stock that I recommend to long-term investors due to its strong market position and hefty payouts. The world’s biggest medical device maker controls 50% of the global pacemaker market. It’s also a product leader assisting spinal surgeries and diabetes care.

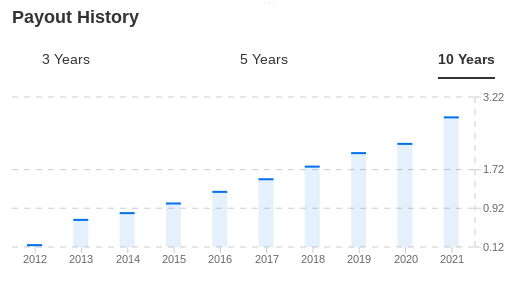

MDT Payout History

Source: InvestingPro

Regardless of how the economy fares, stocks like Medtronic will continue churning cash. The company has a long-term strategy to pay out 50% of its free cash flow to shareholders as dividends. With a 3.39% annual yield, the company pays a $0.68 a share quarterly dividend. That payout, on average, has increased by over 8% per year during the past five years.

The Dublin, Ireland-based medical device company is seeing the “best near term set up in years,” according to a recent note from Bank of America. Those positive catalysts include a robust rebound in surgical procedures as the coronavirus pandemic subsides.

BoA expects Medtronic to become only the second company behind Intuitive Surgical Inc (NASDAQ:) to apply for approval of a surgery-assisted robot.

After falling almost 20% this year, MDT traded on Thursday at $83.03.

2. Lowe’s

The home-improvement giant Lowe’s (NYSE:) is another dividend stock that fits nicely in any retirement portfolio.

The No. 2 home retailer in the U.S. experienced robust sales growth during the pandemic outbreak, which prompted stay-at-home workers to spend more money on their homes. While the peak of this growth is behind us as interest rates surge and the housing market cools, Lowe’s dividend isn’t under threat, in my opinion.

The company has a sustainable, low 26% payout ratio, leaving plenty of room for the retailer to distribute more cash to its shareholders. The company is optimistic about the outlook for home renovators despite the cooling U.S. housing market. Aging properties and higher real estate prices are trends that will underpin demand for Lowe’s products.

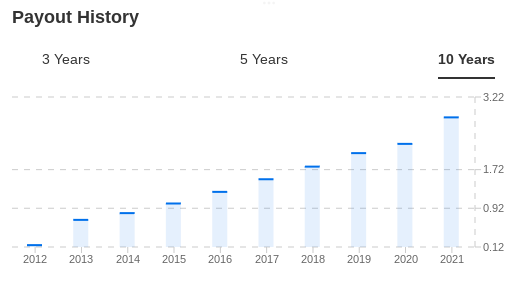

LOW Payout History

Source: InvestingPro

Lowe’s Chief Executive Officer Marvin Ellison said in a recent interview with Bloomberg that:

“What is bad for the home builder is not always bad for the home-improvement market.”

With a 2.17% annual yield, the company pays a $1.05 a share quarterly dividend. That payout, on average, has increased by over 16% per year during the past five years.

After falling more than 25% this year, Lowe’s traded at $192.32 at the time of writing.

Disclosure: At the time of writing, the author doesn’t own any shares mentioned in this report. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.

[ad_2]

Source link