2 CEFs With Huge Yields

2023.06.26 06:13

Stop me if you’ve heard this one: “If you buy a high-yielding investment, your big yield won’t last because they’ll cut dividends.”

I hear it a lot, so let’s talk about two funds that haven’t cut distributions in the last decade. In fact, these closed-end funds (CEFs), yielding 9% and 10%, respectively, have done the opposite, growing payouts and dropping special dividends, too!

High-Yield CEF No. 1: A “One-Click” Way to Get a Growing 9% Payout From Tech

One of my favorite CEFs comes from the biggest fund manager on earth: BlackRock (NYSE:), with more than $10 trillion of assets under management. The 9%-yielding BlackRock Science & Technology (NYSE:) has been around for nine years, and it came out of the blocks on fire.

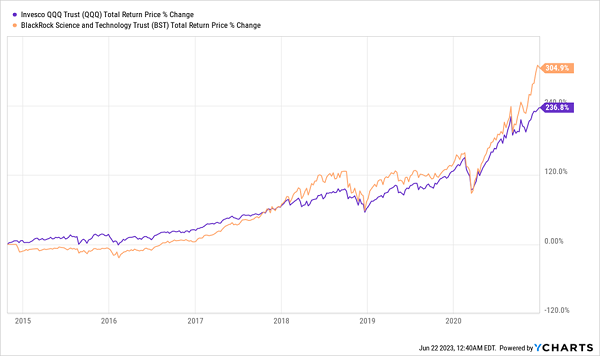

BST Quickly Soars, Overtakes the Market

BST-Outperforms

BlackRock’s size gives it considerable influence over the global economy. The firm also has tools and data individual investors simply can’t imagine. So it’s no surprise that those insights help a lot of BlackRock’s actively managed funds outperform.

What’s more impressive is how BlackRock used its edge to push BST past the NASDAQ 100, the tech-focused index that’s one of the most heavily traded, studied and analyzed.

And now we can buy BST at a 2% discount to net asset value (NAV, or the value of the assets in its portfolio). That may not sound like much of a deal, but the fund has traded at a premium for most of the last five years—and hasn’t been this cheap since late 2022. That’s particularly attractive when you consider its dividend growth:

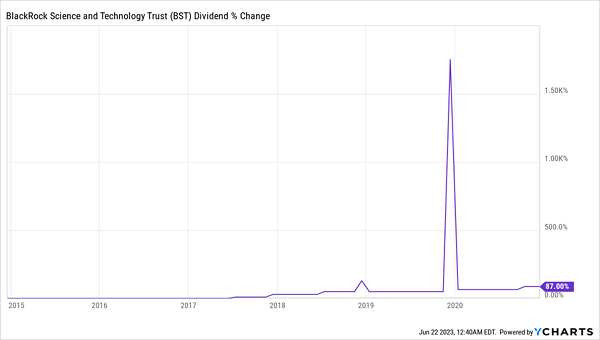

BST Tops Off Its High Yield With a Surging Payout

BST-Dividend-Growth

BST has always been a high-yield fund, but its high yield and an 87% dividend growth in less than a decade (plus a couple special dividends) put it in a league of its own.

The fund can do that because it buys stocks like Microsoft (NASDAQ:) and Alphabet (GOOG, NASDAQ:), then sells at a profit when the market gets overheated—and hands those profits to investors in the form of cash dividends. That’s the secret to its big gains and its big, and growing, income stream.

High-Yield Pick No. 2: A Bond/Stock Specialist With a 10% Payout

Then there’s the Virtus Equity & Convertible Income Fund (NYSE:), with a much lower profile than BST. Its investment strategy is beautifully boring, too: it buys solid stocks in firms with strong cash flows, like Mastercard (NYSE:) and NVIDIA (NASDAQ:), and adds convertible bonds boasting lower volatility and higher income.

Another nice aspect of convertible bonds? They give management the opportunity to convert their bonds to stocks under certain conditions—capturing more upside.

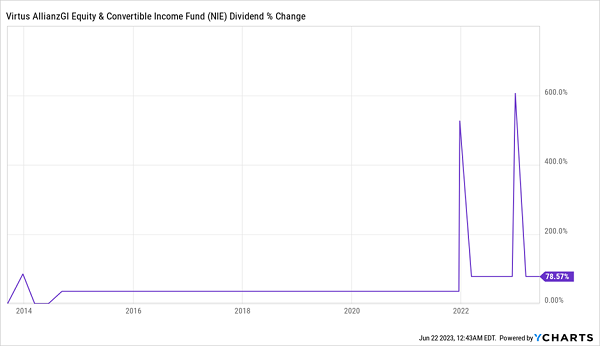

It’s a smart strategy that’s created a lot of excitement on the payout front: aside from its 10% yield, NIE pumps out dividend hikes and special payouts on the regular:

High Yield, Dividend Growth and Special Dividends: NIE Does It All

NIE-Dividend-Growth

After a decade of stable payouts, NIE paid big special dividends and grew its payouts in early 2022. The fund could very well offer more “specials,” but even if it doesn’t, its payout will likely grow as it further hikes ordinary dividends.

The 11% discount to NAV? Consider it a source of bonus upside, as the fund’s discount normally sits in the 8% to 10% range.

Conclusion

These are just two closed-end funds that have huge yields and long histories of stable or rising distributions. They also disprove one of the biggest myths about high yield—that payouts always get cut over the long term—that has kept a lot of people from profiting from CEFs.

That’s too bad for them but great for us, as there are still plenty of high-yielding CEFs out there with steady, and in some cases growing, dividends trading at some very nice discounts, thanks to the 2022 pullback.

I know that might sound a bit strange, given that we’re more than halfway through 2023, but it’s the nature of the CEF market: folks who buy CEFs—conservative income-seekers that they are—are often slow to respond to market changes. That’s something we can profit from—and use to add price upside to our high CEF dividends.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, “7 Great Dividend Growth Stocks for a Secure Retirement.”