13-Year Tech Support In Play, Will Results Be Different This Time?

2022.11.02 17:13

[ad_1]

The technology sector is a vibrant and important cog in today’s economy and stock market.

Tech represents both growth and leadership in global equities and has been under pressure due to rising interest rates.

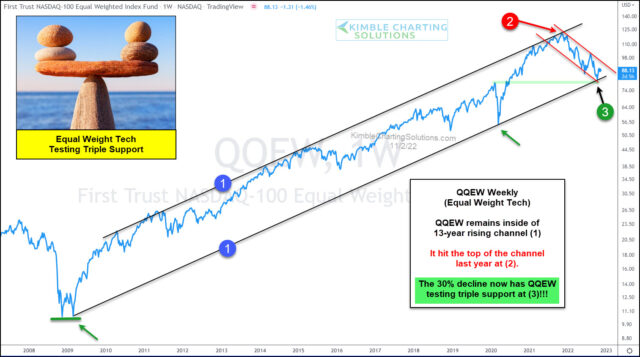

Today’s chart highlights this bearish development quite well. Below is a weekly chart of the First Trust NASDAQ 100 Equal Weighted Index Fund (NASDAQ:).

QQEW Weekly Chart

As you can see, tech has traded within a 13-year rising price channel marked by each (1). Price was bumping up against the top of that channel before turning lower last year at (2).

It Has Paid To Buy Tech Here. Will It Be Different This Time?

A short-term downtrend channel then formed as the 2022 bear market took shape. And just recently, QQEW tested the bottom of the long-term rising channel at (3). This area is very important and represents triple price support.

It will be bullish if the price continues to bounce from here and bearish if the price breaks down below triple support.

In my humble opinion, it would be good to keep an eye on QQEW. Stay tuned.

[ad_2]

Source link