10 Important Index Charts That Paint a Bearish Picture

2023.09.14 03:23

Now that the monthly is out of the way let’s take a look at 10 important index charts. I’ve got to say, these are collectively painting a rather exciting bearish picture.

1. All World Index

The index is still working on its miniature topping pattern, which is quite clean. if it can get below the low horizontal, the market as a whole is in serious trouble. I would also add that the also sports almost exactly the same pattern over the same time span.

2. Dow Jones Financials

The is particularly interesting since it features an inverted head and shoulders that terminated itself before it even launched. The stock, itself exceptionally clean, got to about the 98% completion point before it soured. It is now treading water at the dashed red horizontal.

Dow Jones Financial Chart

Dow Jones Financial Chart

3. Nasdaq

Fibonacci’s are dictating support/resistance for the . We are beneath a major Fib right now, leaving open the prospect of descending to the next major Fib level beneath.

4. Dow 30

The also had a very clean, bullish inverted H&S reversal pattern, and unlike the Financials, it actually completed it and shot higher. However, it had its own pee-wee-sized top (in pink) and is now in a state of tepid equilibrium at roughly the same horizontal as what constituted the neckline of the IHS bullish pattern.

5. Nasdaq 100

What I’m watching most closely on the is that sharply ascending trendline, It would only take a single strong down day to break it, which would be its full first for the entirety of the year 2023.

6. S&P 100

The has the easiest downside potential between present price levels and the dashed horizontal.

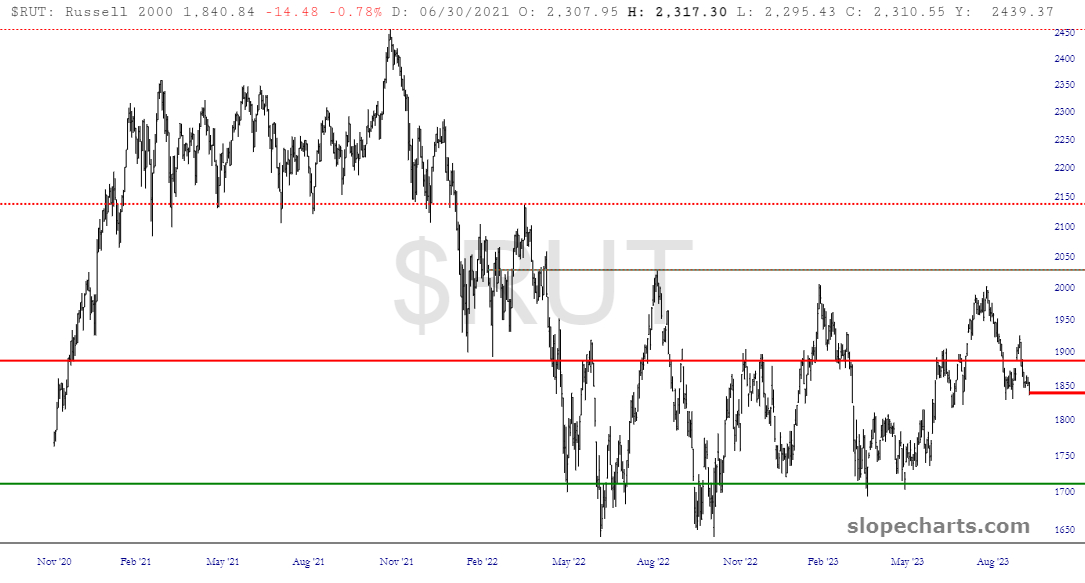

7. Russell 2000

The small caps () have been in a sinewave for nearly two years now, and we will hopefully match the lows witnessed last March once more.

8. Semiconductors

As mentioned at the top of this post, the semiconductor index has a small topping pattern which looks fantastic so long as (a) the price doesn’t push above the horizontal I’ve drawn within that topping pattern, (b) we slip below the low of August 18th. This could bring the whole market down.

9. Utilities

Of course, the Utilities (NYSE:) are always on my radar.

10. Major Market Index

Lastly, the has already busted its trendline, anchored all the way back to the Rolo Low, and seems poised, as the rest of these charts do, to affirm September’s well-established reputation for sell-offs. Next week could be one of the best of the year!