1 Stock to Buy, 1 Stock to Sell This Week: McDonald’s, AMD

2023.10.29 08:01

- Fed decision, Powell comments, U.S. jobs report, and more earnings will drive sentiment this week.

- McDonald’s stock is a buy with earnings due on Monday morning.

- AMD shares are a sell amid expected weak Q3 sales, sluggish outlook.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

Stocks on Wall Street closed mostly lower on Friday to cap off another losing week as investors digested the latest round of corporate earnings results while continuing to focus on the Federal Reserve’s outlook for interest rates.

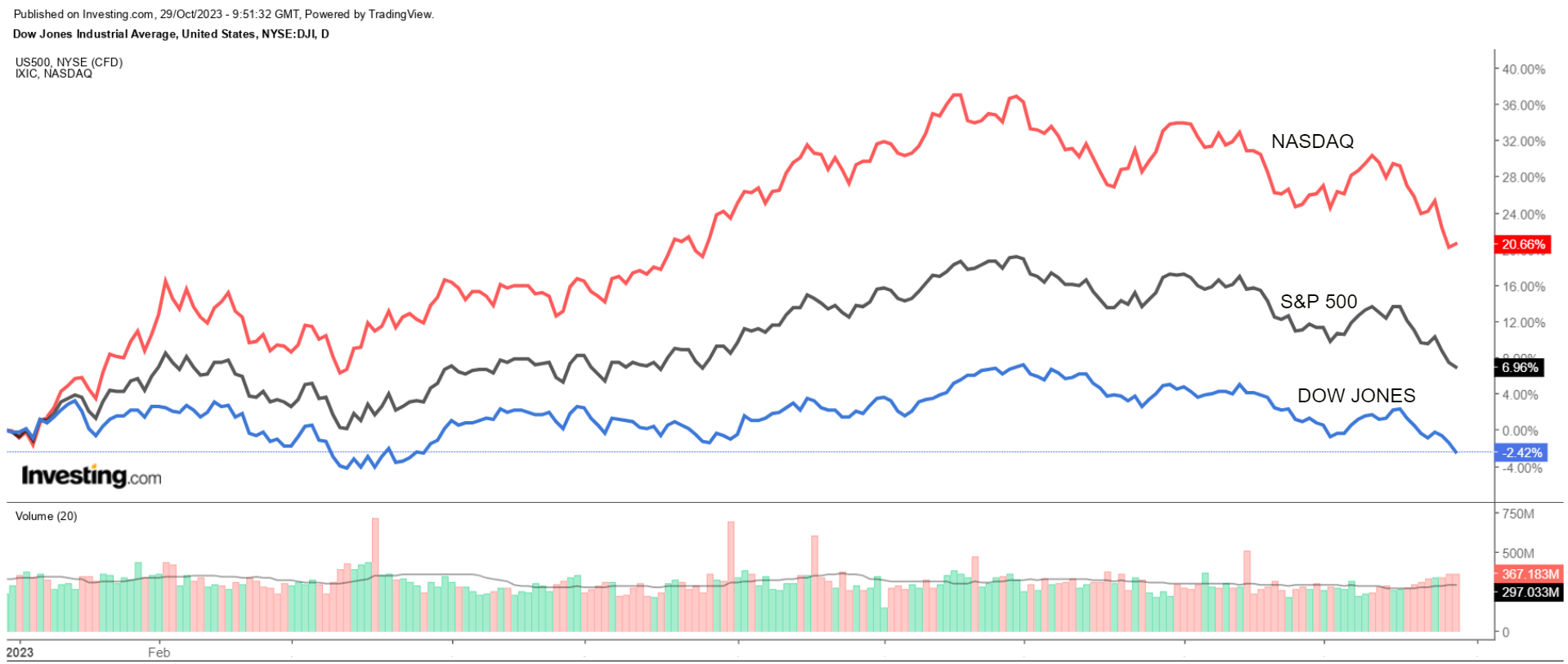

For the week, the blue-chip declined 2.1%, while the benchmark and the tech-heavy tumbled 2.5% and 2.6% respectively.

The recent selloff in the ‘Magnificent 7’ group of mega-cap tech stocks pushed both the S&P and the Nasdaq into correction territory, having both closed more than 10% below their highs in July.

S&P 500 vs. Nasdaq vs. Dow

S&P 500 vs. Nasdaq vs. Dow

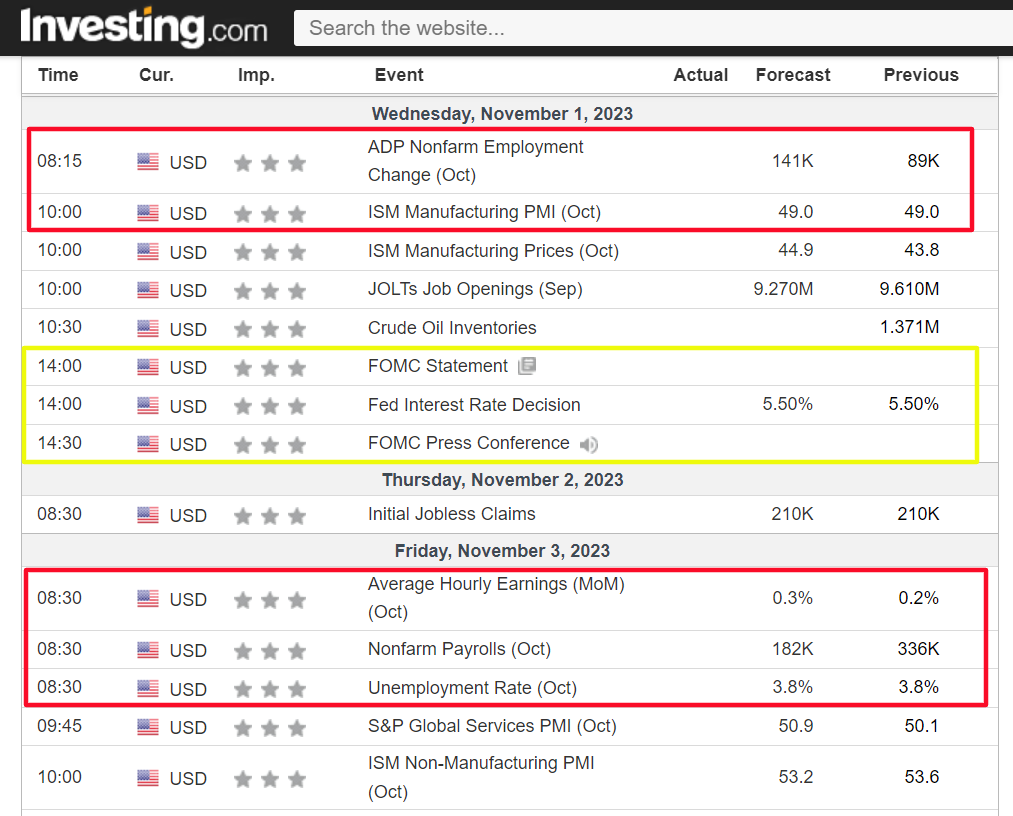

The blockbuster week ahead is expected to be action-packed with several key market-moving events as the , including the Fed’s latest policy decision, as well as a flurry of heavyweight economic data and earnings reports.

The U.S. central bank is almost certain to keep its in a range of 5.25%-5.50% at the conclusion of its two-day policy meeting on Wednesday, November 1.

Fed Chair Jerome Powell’s comments on the future direction of monetary policy will be in focus as investors ramp up bets that the Fed is all done raising rates.

Elsewhere, on the economic calendar, most important will be Friday’s U.S. employment report for October, which is forecast to show the economy added 182,000 positions, slowing from jobs growth of 336,000 in September. The unemployment rate is seen holding steady at 3.8%.

Meanwhile, the Q3 corporate earnings season continues in earnest with reports expected from high-profile companies, such as Apple (NASDAQ:), Qualcomm (NASDAQ:), PayPal (NASDAQ:), Block (NYSE:), Shopify (NYSE:), Coinbase (NASDAQ:), DraftKings (NASDAQ:), Palantir (NYSE:), Pinterest (NYSE:), and Roku (NASDAQ:).

Some of the other notable reporters include Airbnb (NASDAQ:), Caterpillar (NYSE:), Eli Lilly (NYSE:), Pfizer (NYSE:), Moderna (NASDAQ:), CVS Health (NYSE:), Kraft Heinz (NASDAQ:), Yum! Brands (NYSE:), Starbucks (NASDAQ:), and Anheuser Busch (NYSE:).

Regardless of which direction the market goes next week, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, Monday, October 30 – Friday, November 3.

Stock To Buy: McDonald’s

I expect McDonald’s (NYSE:) to outperform in the week ahead, as the fast-food giant’s latest earnings report will surprise to the upside, in my opinion, thanks to favorable consumer demand trends and a strong fundamental outlook.

McDonald’s is scheduled to deliver its third quarter results before the U.S. market open on Monday, October 30 at 7:00AM ET, and results are likely to benefit from higher menu prices as U.S. consumers flock to its restaurants amid the current economic climate.

Options trading implies a roughly 3.5% swing for MCD shares after the numbers drop.

Many Americans have cut back spending at traditional full-service restaurants in response to a slowing economy and persistently high inflation, boosting demand for McDonald’s iconic lineup of ‘Big Mac’ burgers and chicken ‘McNuggets’.

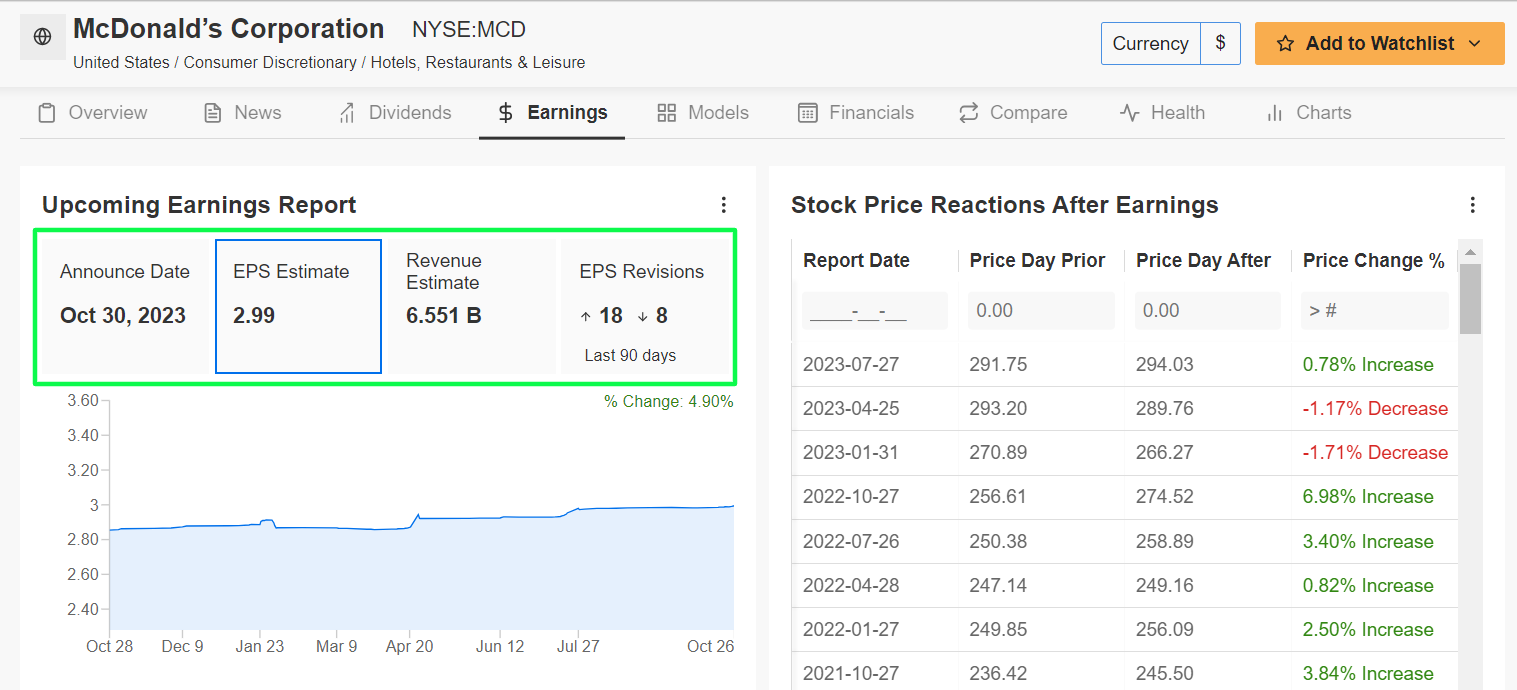

Not surprisingly, an InvestingPro survey of analyst earnings revisions points to mounting optimism ahead of the update, with analysts growing increasingly bullish on the fast-food chain.

Profit estimates have been revised upward 18 times in the past 90 days, while 29 analysts have a Buy-equivalent rating on the stock vs. eight Hold-equivalent ratings and zero Sell-equivalent ratings.

McDonald’s Earnings Estimates

McDonald’s Earnings Estimates

Consensus expectations call for McDonald’s to post third quarter earnings of $2.99 per share, rising 12% from EPS of $2.68 in the year-ago period. Revenue is also seen jumping double-digits, improving 11.7% year-over-year to $6.56 billion.

If that is in fact confirmed, it would mark McDonald’s largest quarterly sales total in eight years, dating back to Q3 2015, as the fast-food giant benefits from higher menu prices, unique marketing promotions, and a successful digital loyalty program.

U.S. same-store sales – which surged 10.3% in Q2 – will likely top estimates again as U.S. consumers flock to its stores amid the current economic backdrop of elevated inflation and lingering recession fears.

McDonald’s has missed Wall Street’s top line expectations only once in the past ten quarters, while trailing revenue estimates twice in that span, a testament to the resilience of its underlying business and strong execution across the company.

Looking ahead, I believe the burger chain will provide solid profit and sales guidance for the rest of the year as it remains well positioned to thrive despite an uncertain macro environment.

MCD stock ended Friday’s session at $255.76, not far from a recent 52-week low of $245.73 reached on October 6.

McDonald’s, which is one of the thirty components of the Dow Jones Industrial Average, has come under pressure in recent weeks amid the broader market selloff, which saw it wipe out its gains for the year.

With just two months left in 2023, MCD shares are down 3% year-to-date, and are nearly 15% below their July peak of $299.35.

The Chicago, Illinois-based fast-food company has a market cap of $186.4 billion at its current valuation, making it the world’s biggest quick-service restaurant chain.

Stock To Sell: Advanced Micro Devices

I believe Advanced Micro Devices (NASDAQ:) will suffer a challenging week ahead, as the semiconductor company’s upcoming earnings report will likely reveal a sharp slowdown in both profit and sales growth due to a weak PC market.

AMD is scheduled to deliver its third quarter update after the U.S. market close on Tuesday, October 31 at 4:15PM ET. A call with CEO Lisa Su is set for 5:00PM ET.

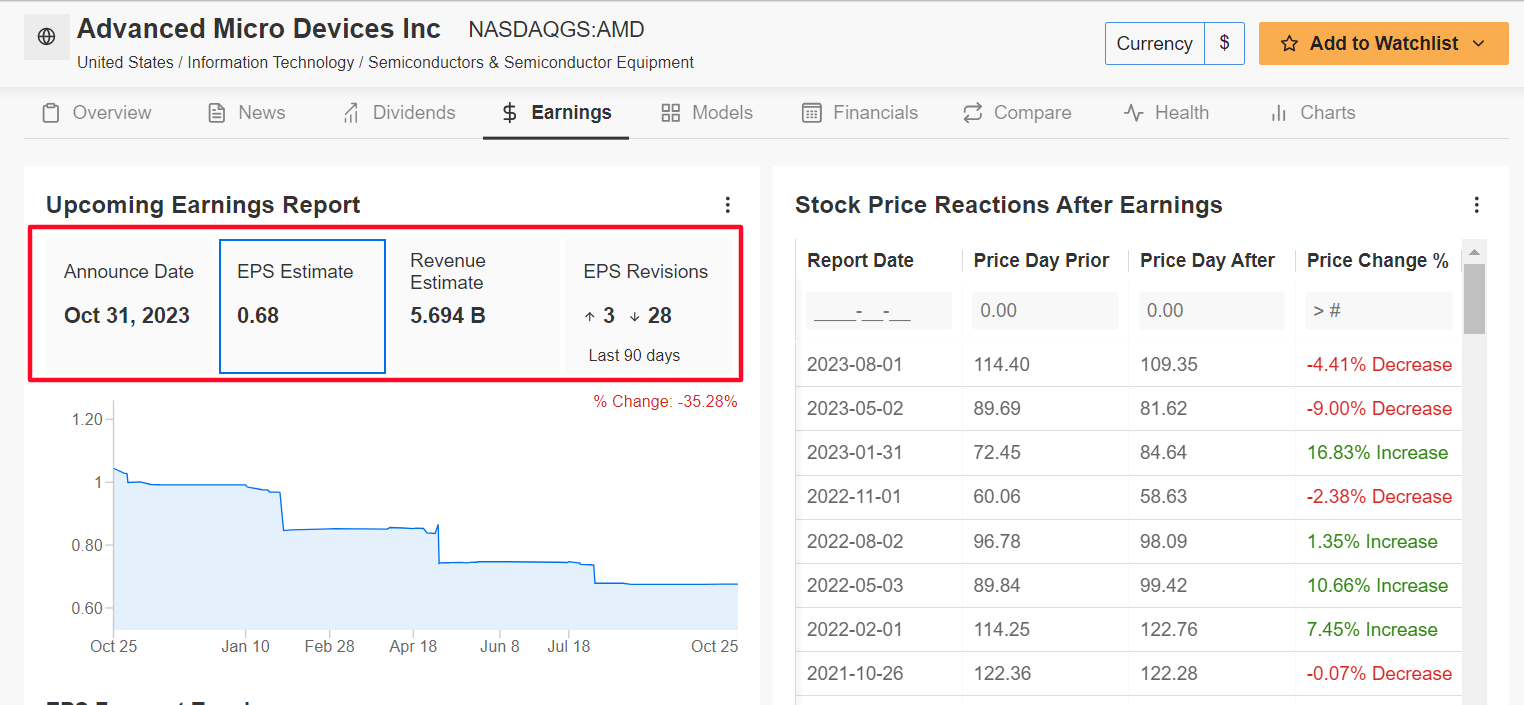

Market participants expect a sizable swing in AMD shares following the print, as per the options market, with a possible implied move of about 9% in either direction. Shares declined 4.4% after its last earnings report in early August.

Underscoring several near-term headwinds AMD faces amid the current environment, analysts have cut their EPS estimates 28 times in the three months leading up to the earnings update, compared to just three upward revisions, as per an Investing Pro survey.

Wall Street sees the Santa Clara, California-based chipmaker earning $0.68 a share in the third quarter, up a fraction from EPS of $0.67 in the year-ago period. If that is reality, it would mark AMD’s fifth consecutive quarter of declining earnings on a year-over-year basis.

Meanwhile, revenue is expected to inch up 2% annually to $5.69 billion, reflecting softening demand for PC and server chips.

Looking ahead, it is my belief that AMD’s management will strike a cautious tone in its forward guidance given the potential for slower near-term data center demand and a sluggish PC market.

AMD competes with Intel (NASDAQ:) in making central processing units (CPUs) for personal computers and servers. It also rivals Nvidia (NASDAQ:) in the market for graphics processing units (GPUs) for PCs, gaming consoles and data centers.

AMD stock sank to a near six-month low of $93.11 on Thursday, before closing the week at $96.43 on Friday. At its current valuation, AMD has a market cap of $155.8 billion.

Shares are down 27.4% from their 2023 high of $133 reached in mid-June, though still up nearly 49% on the year.

In comparison, Nvidia is up 177% year-to-date, Intel has gained 34.5%, while the Philadelphia SE Semiconductor Index has tacked on about 28%.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading decisions.

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.