1 Stock to Buy, 1 Stock to Sell This Week: Apple, Pfizer

2023.07.30 08:49

- U.S. jobs report, ISM PMI surveys, more earnings in focus.

- Apple shares are a buy with fiscal Q3 results due on Thursday.

- Pfizer’s stock is set to struggle amid shrinking profit and revenue.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

Stocks on Wall Street rallied on Friday to wrap up an action-packed week, as investors cheered data showing cooling inflation and stronger-than-expected earnings that supported the case that the U.S. economy can manage a soft-landing.

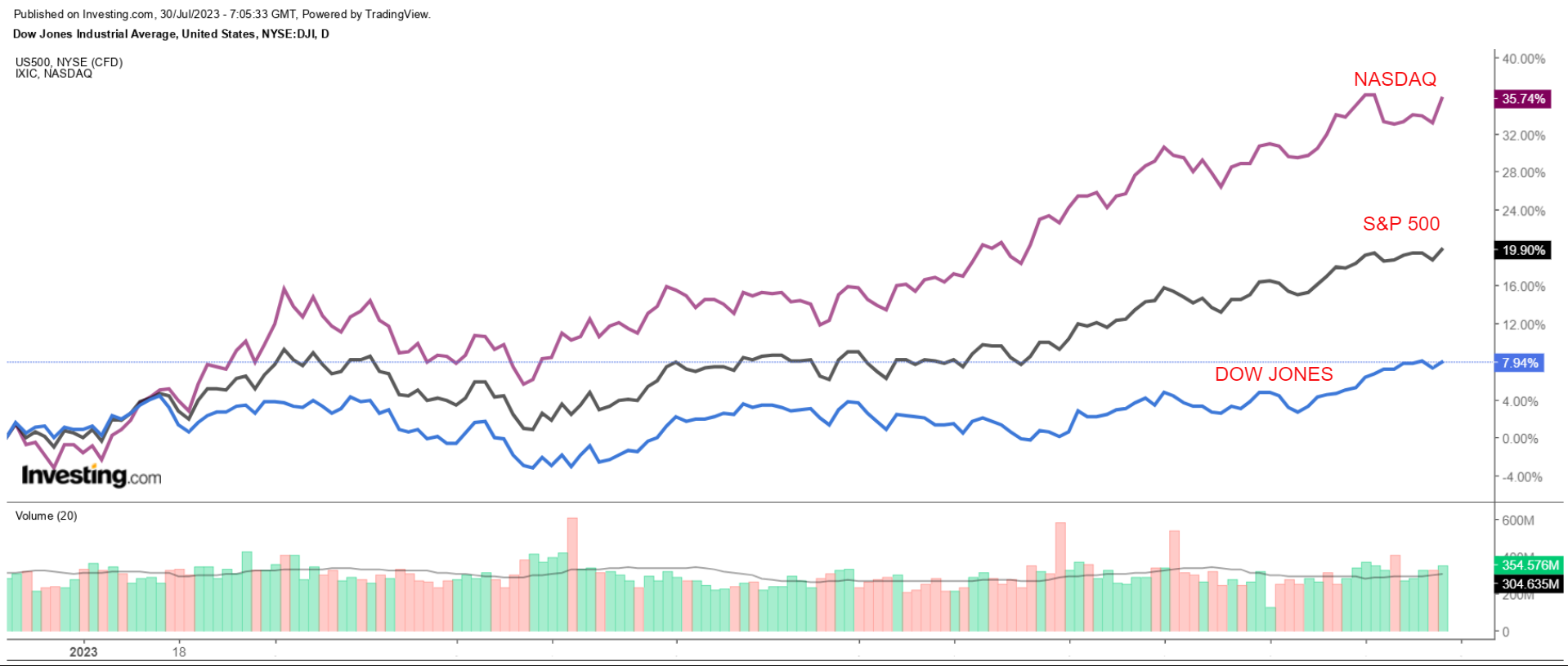

For the week, the blue-chip tacked on 0.7%, the benchmark rose 1%, while the tech-heavy advanced 2%.

S&P 500 vs. Nasdaq vs. Dow

S&P 500 vs. Nasdaq vs. Dow

The week ahead is expected to be another eventful one as the and investors continue to gauge the outlook for the economy, inflation, and interest rates.

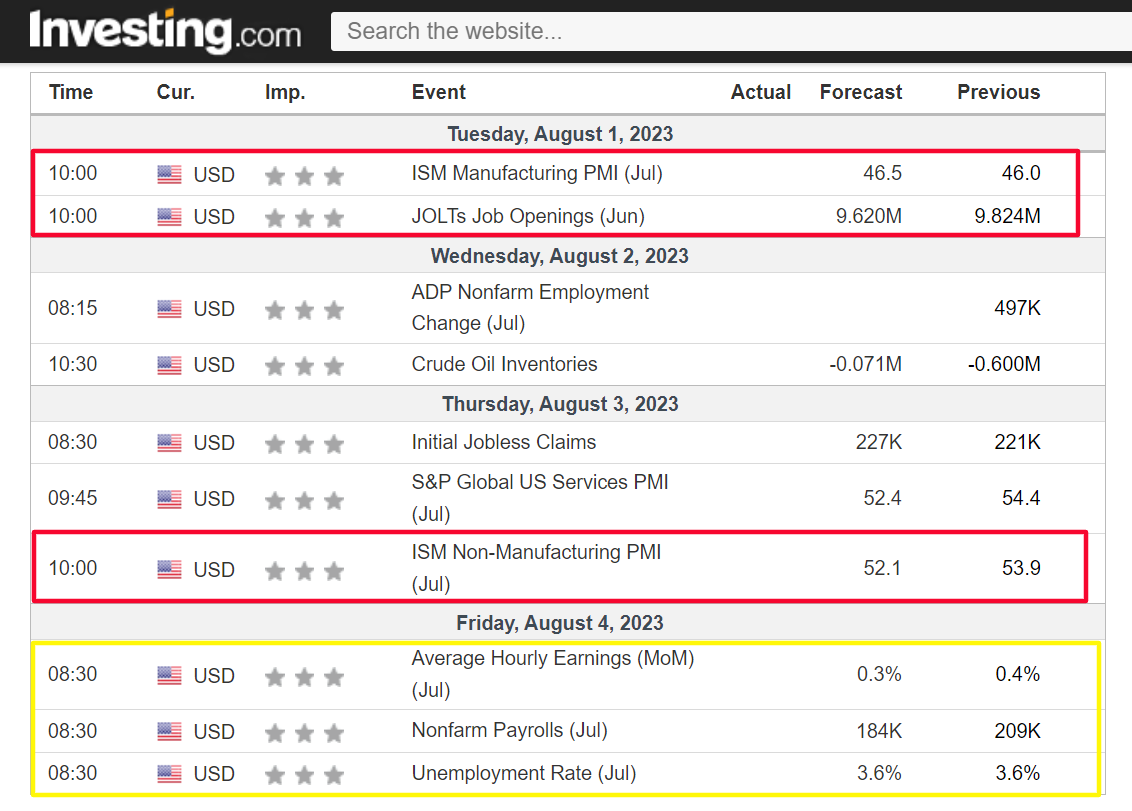

On the economic calendar, most important will be Friday’s U.S. jobs report. As per Investing.com, are forecast to rise by 184,000 in July, while the is seen holding steady at 3.6%.

Meanwhile, the Institute for Supply Management’s (ISM) is scheduled for Tuesday, followed by the ISM on Thursday.

The data will be key in determining the Federal Reserve’s next policy move. Currently, financial markets are pricing in just a 20% chance of another quarter-point increase at the next FOMC meeting in September, according to Investing.com’s

Elsewhere, the corporate earnings season continues in earnest with reports expected from high-profile companies, such as Amazon (NASDAQ:), Advanced Micro Devices Inc (NASDAQ:), Qualcomm (NASDAQ:), Coinbase (NASDAQ:), Robinhood (NASDAQ:), DraftKings (NASDAQ:), Shopify (NYSE:), PayPal (NASDAQ:), Block Inc (NYSE:), Pinterest (NYSE:), and Etsy (NASDAQ:).

Some of the other notable reporters include Caterpillar (NYSE:), Uber (NYSE:), Starbucks (NASDAQ:), Anheuser Busch Inbev (NYSE:), Kraft Heinz (NASDAQ:), Merck & Company Inc (NYSE:), Moderna (NASDAQ:), CVS Health (NYSE:), Airbnb Inc (NASDAQ:), Expedia (NASDAQ:), MGM Resorts (NYSE:), Norwegian Cruise Line (NYSE:), Devon Energy (NYSE:), ConocoPhillips (NYSE:), and Occidental Petroleum (NYSE:).

Regardless of which direction the market goes next week, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, July 31 – August 4.

Stock To Buy: Apple

After closing at a new record high on Friday, I expect Apple (NASDAQ:) shares to outperform in the week ahead as the consumer electronics giant’s latest financial results will easily top estimates in my view.

Following mostly bullish earnings reports from tech heavyweights like Alphabet (NASDAQ:), Meta Platforms (NASDAQ:), and Microsoft (NASDAQ:) last week, Apple will be the last ‘FAAMG’ company to report quarterly results when it releases its fiscal Q3 update after the market closes at 4:30PM ET on Thursday, August 3.

A call with CEO Tim Cook and CFO Luca Maestri is set for 5:00PM ET.

I believe the Cupertino, California-based tech conglomerate is poised to deliver a better-than-expected print as robust growth in its services unit and solid demand for its lineup of high-end iPhones will offset incremental weakness in other areas of the business.

According to the options market, traders are pricing in a swing of around 3% in either direction for AAPL stock following the update.

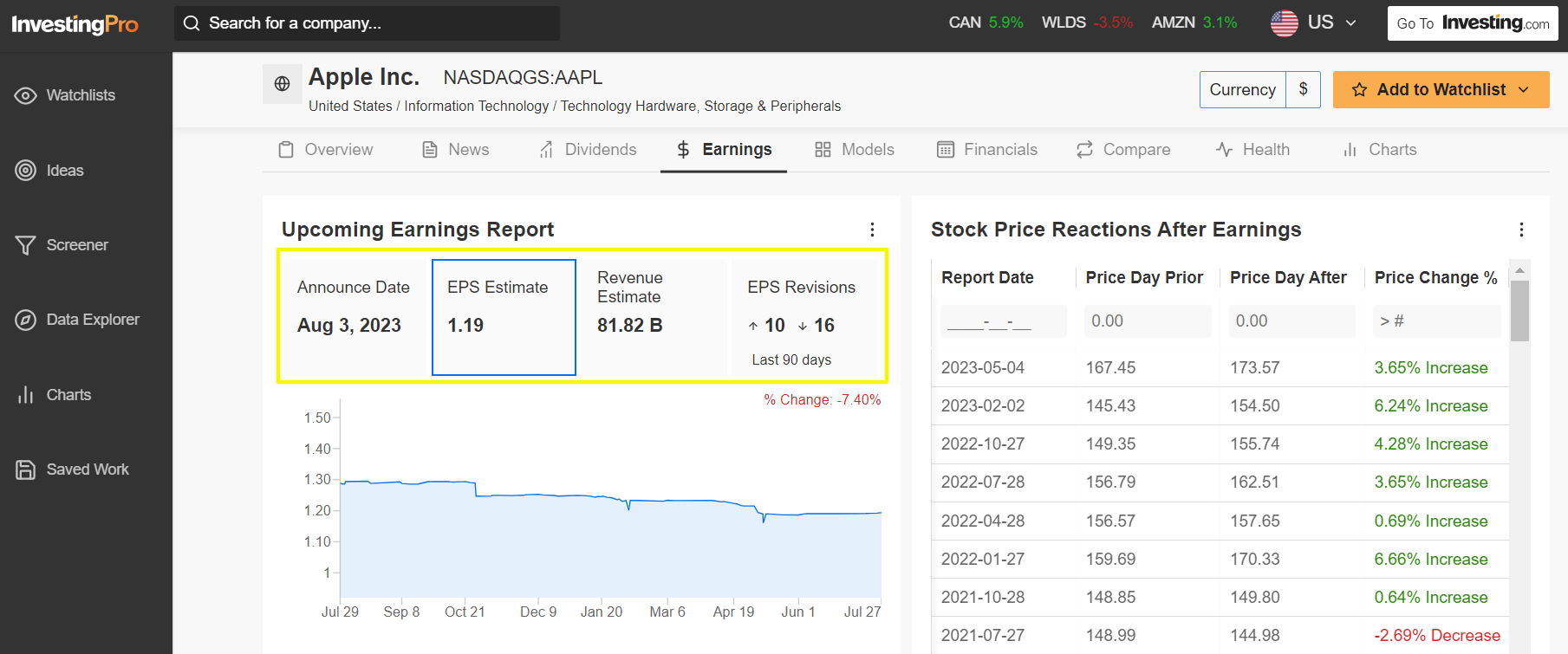

As per Investing.com consensus estimates, Apple’s fiscal Q3 earnings per share are expected to be $1.19, a decline of 0.8% from EPS of $1.20 in the year-ago period.

Meanwhile, revenue in the June quarter is forecast at $81.82 billion, or a 1.4% decrease annually, as Apple faces weak demand for its iPad tablets and Mac computers.

Analysts have raised their EPS estimates 10 times in the past 90 days, according to an InvestingPro survey, while 16 of the analysts surveyed downwardly revised their AAPL earnings forecast.

One bright spot is expected to be Apple’s services business, which was the fastest growing segment in fiscal Q2 with annualized revenue growth of 5.5%. The unit includes sales from the App Store, monthly subscriptions, payment fees, extended warranties, licensing fees, and search-licensing revenue.

Looking ahead, I believe the tech giant will provide strong profit and sales guidance for the rest of the year amid continued secular and cyclical tailwinds, including stable iPhone demand, and seasonal Mac strength.

In addition, Apple could also shake things up with an update on its AI strategy and further details on its upcoming Vision Pro mixed-reality headset which is scheduled to debut in early 2024.

AAPL stock closed Friday’s session at $195.83, just above the previous all-time peak of $195.10 reached on July 19.

At its current valuation, Apple has a market cap of $3.1 trillion, making it the most valuable company trading on the U.S. stock exchange, ahead of Microsoft, Alphabet, Amazon, Nvidia (NASDAQ:), and Tesla (NASDAQ:).

Shares are up 50.7% year-to-date, outperforming the broader market by a wide margin over the same period amid the ongoing rally in mega-cap tech stocks.

Stock To Sell: Pfizer

I believe Pfizer’s (NYSE:) stock will suffer a challenging week ahead, as the pharmaceutical giant’s latest earnings report will reveal a steep decline in both profit and revenue growth due to the negative impact of various headwinds on its business.

Pfizer’s financial results for the second quarter are due ahead of the opening bell on Tuesday, August 1 at 6:45AM ET and are likely to take a hit once again from a significant slowdown in sales of its Covid-related product portfolio.

Options trading implies a roughly 4% swing for PFE shares after the update drops.

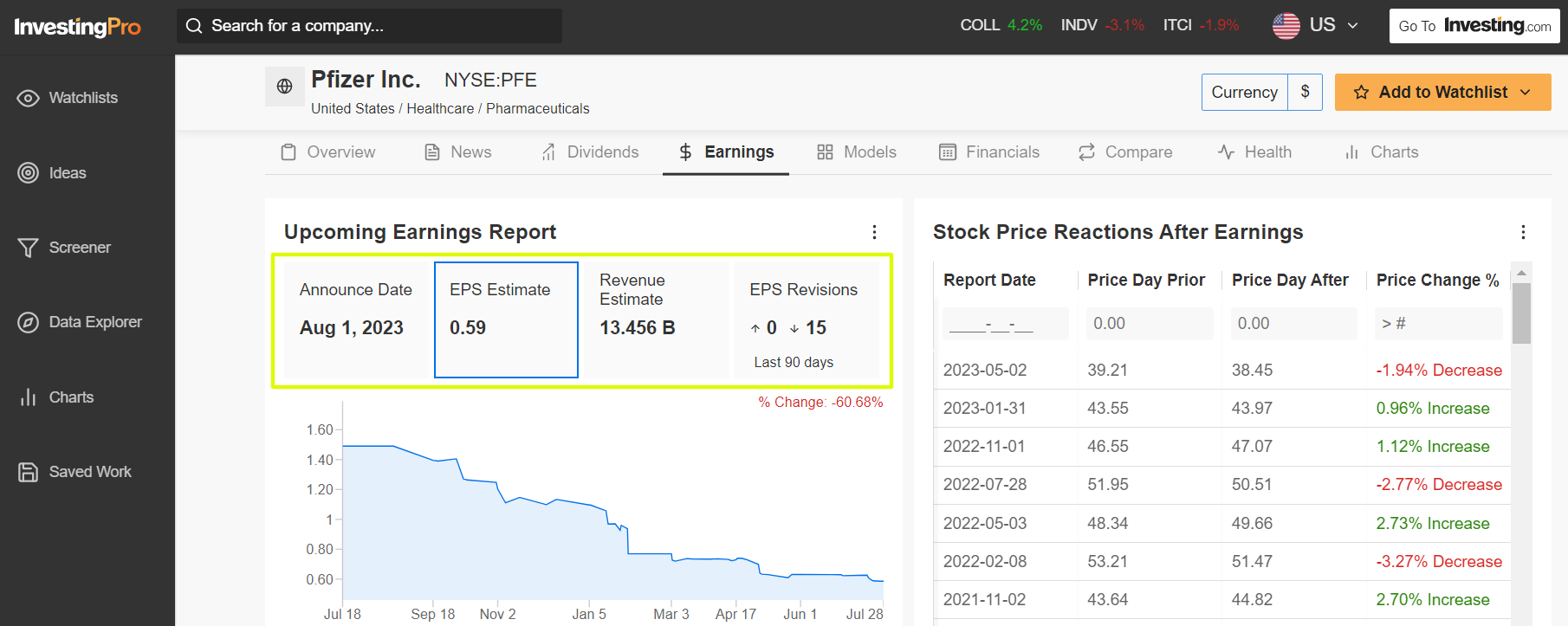

Underscoring several headwinds Pfizer faces amid the current backdrop, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the Q2 report, with all 15 analysts slashing their EPS estimates in the last three months, compared to zero upward revisions.

Wall Street sees Pfizer earning $0.59 per share, plunging 71% from a profit of $2.04 per share in the same period last year, as it grapples with higher operating costs and increased spending on research and development.

Revenue is expected to shrink 51.5% annually to $13.45 billion, amid dwindling demand for its COVID-19 vaccine and oral antiviral treatment due to built-up product inventories around the world, including in the countries that pay the most.

If those figures are confirmed, it would mark Pfizer’s smallest quarterly profit and lowest sales total since Q4 2020.

That leads me to believe that the drugmaker will strike a cautious tone in its forward guidance to reflect declining operating margins and higher cost pressures amid the current environment.

PFE stock – which fell to a two-and-a-half-year low of $35.35 on July 7 – ended at $36.07 on Friday. At current levels, the New York-based ‘Big Pharma’ company has a market cap of about $203 billion.

Shares have underperformed the broader market by a wide margin in 2023, falling 29.6% year-to-date.

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average, S&P 500, and the Nasdaq 100 via the SPDR Dow ETF (DIA), SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.