Oil prices recover on short-covering, U.S. debt ceiling fears weigh

2023.05.11 21:35

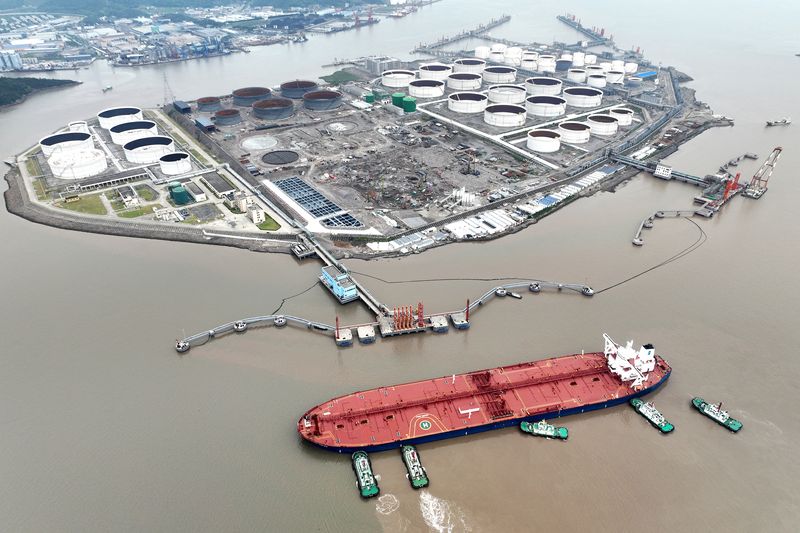

© Reuters. FILE PHOTO: An aerial view shows tugboats helping a crude oil tanker to berth at an oil terminal, off Waidiao Island in Zhoushan, Zhejiang province, China July 18, 2022. cnsphoto via REUTERS

By Yuka Obayashi

TOKYO (Reuters) – Oil markets regained some ground in early Asian trade on Friday with traders engaged in short-covering ahead of the weekend, but uncertainties regarding the U.S. debt ceiling and renewed fears over a U.S. regional banking crisis capped gains.

futures rose by 36 cents, or 0.5%, to $75.34 a barrel by 0051 GMT. futures gained 41 cents, or 0.6%, to $71.28. They recovered from losses of about 3%-4% over the past two sessions.

For the week, both benchmarks were on track for little change after three consecutive weeks of declines.

“Traders covered short positions ahead of the weekend, but concerns over a political standoff over the U.S. debt ceiling and increased worries about a U.S. regional banking crisis limited gains,” said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan (OTC:) Securities.

“Also with lingering fears over a slow recovery in China’s fuel demand, the market’s bearish mood will likely continue through next week,” he said.

However speculation that the U.S. could repurchase oil for the Strategic Petroleum Reserve (SPR) if WTI falls to around $70 a barrel will support prices, Kikukawa added.

The U.S. government has said it will buy oil when prices are consistently at or below $67 to $72 per barrel.

U.S. Treasury Secretary Janet Yellen on Thursday urged Congress to raise the $31.4 trillion federal debt limit and avert an unprecedented default that would trigger a global economic downturn.

Worries about a U.S. regional banking crisis grew after shares of PacWest Bancorp plunged 23% on Thursday. The Los-Angeles-based lender said its deposits declined and it had posted more collateral to the U.S. Federal Reserve to boost its liquidity.

Concerns about weak demand in China also kept investors cautious.

China’s April consumer price data rose at a slower pace and missed expectations, while factory gate deflation deepened, suggesting more stimulus may be needed to boost a patchy post-COVID-19 economic recovery.

The oil market largely ignored the Organization of the Petroleum Exporting Countries (OPEC) global oil demand forecast for 2023, which projected demand in China, the world’s biggest oil importer, would increase.