Record demand pushes silver into new era of deficits, Silver Institute says

2023.04.19 08:54

2/2

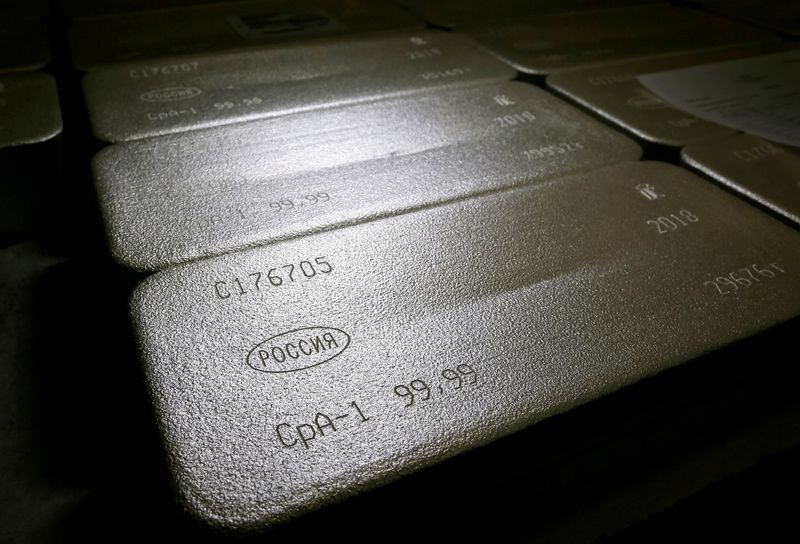

© Reuters. FILE PHOTO: ngots of 99.99 percent pure silver are seen at the Krastsvetmet non-ferrous metals plant, one of the world’s largest producers in the precious metals industry, in the Siberian city of Krasnoyarsk, Russia November 22, 2018. REUTERS/Ilya Naymush

2/2

LONDON (Reuters) – Global demand for silver rose by 18% last year to a record high of 1.24 billion ounces, creating a huge supply deficit, the Silver Institute said on Wednesday, predicting more shortages in the years to come.

The silver market was undersupplied by 237.7 million ounces in 2022, the institute said in its latest World Silver Survey, calling this “possibly the most significant deficit on record”.

It said 2022’s undersupply and a 51.1 million ounce shortfall in 2021 had wiped out cumulative surpluses from the previous decade and predicted further undersupply of 142.1 million ounces this year.

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at consultants Metals Focus, which prepared the Silver Institute’s data.

But he said this wouldn’t necessarily cause prices to shoot higher because while visible silver inventories are falling, huge amounts of metal held by individuals and investors can still fill supply gaps.

Silver prices have drifted mostly lower since 2020 as interest rates rose, discouraging investment in precious metals, which don’t offer interest.

Silver should average $21.30 an ounce this year, below last year’s average of $21.73, the institute said.

Demand for silver rose to record highs from all major users — jewellers, industry and buyers of silver bars and coins, according to the institute.

Silver is used in many industries including electronics and solar panels, and demand is expanding as the world moves away from fossil fuels.

India also imported huge amounts of silver last year, though demand there should cool somewhat in 2023, according to Newman.

Over the longer term, Newman said, “there is not a great deal of movement (in silver supply), whereas on the demand side we generally have that doing quite well … industrial demand in particular.”

SILVER DEMAND (MILLIONS OF OUNCES)

2021 2022 2023F 2022 2023F %

%change change

SUPPLY

Mine Production 827.6 822.4 842.1 -1% 2%

Recycling 175.3 180.6 181.1 3% 0%

Net Hedging Supply 0.0 0.0 0.0

Net Official Sector Sales 1.5 1.7 1.7 13% -1%

TOTAL SUPPLY 1,004.5 1,004.7 1,024.9 0% 2%

DEMAND

Total industrial 528.2 556.5 576.4 5% 4%

Photography 27.7 27.5 26.4 -1% -4%

Jewellery 181.5 234.1 199.5 29% -15%

Silverware 40.7 73.5 55.7 80% -24%

Bar & Coin Demand 274.0 332.9 309.0 22% -7%

Net Hedging Demand 3.5 17.9 0.0 409%

TOTAL DEMAND 1,055.6 1,242.4 1,167.0 18% -6%

Market Balance -51.1 -237.7 -142.1 365% -40%

Exchange traded products 64.9 -125.8 -30.0 -76%

Market Balance less ETPs -116.1 -111.9 -112.1 -4% 0%

Average prices ($/oz) 25.14 21.73 21.30 -14% -2%

*Source: The Silver Institute, Metals Focus